For an investor exploring new ventures, Laos presents a compelling opportunity for solar manufacturing, thanks to its strategic location within ASEAN, competitive energy costs, and favorable government policies. However, transforming this vision into a viable business case requires a detailed blueprint: the financial model. This critical tool quantifies costs, projects revenues, and ultimately determines the feasibility of establishing a solar module factory in the country.

A generic financial model based on data from Europe or China is not just insufficient—it can lead to significant planning errors. This article provides a structured framework for building a realistic model tailored to the economic landscape of Laos, detailing the key local cost inputs and projection methods needed to accurately forecast capital requirements and long-term profitability.

Why a Localized Financial Model is Critical for Success

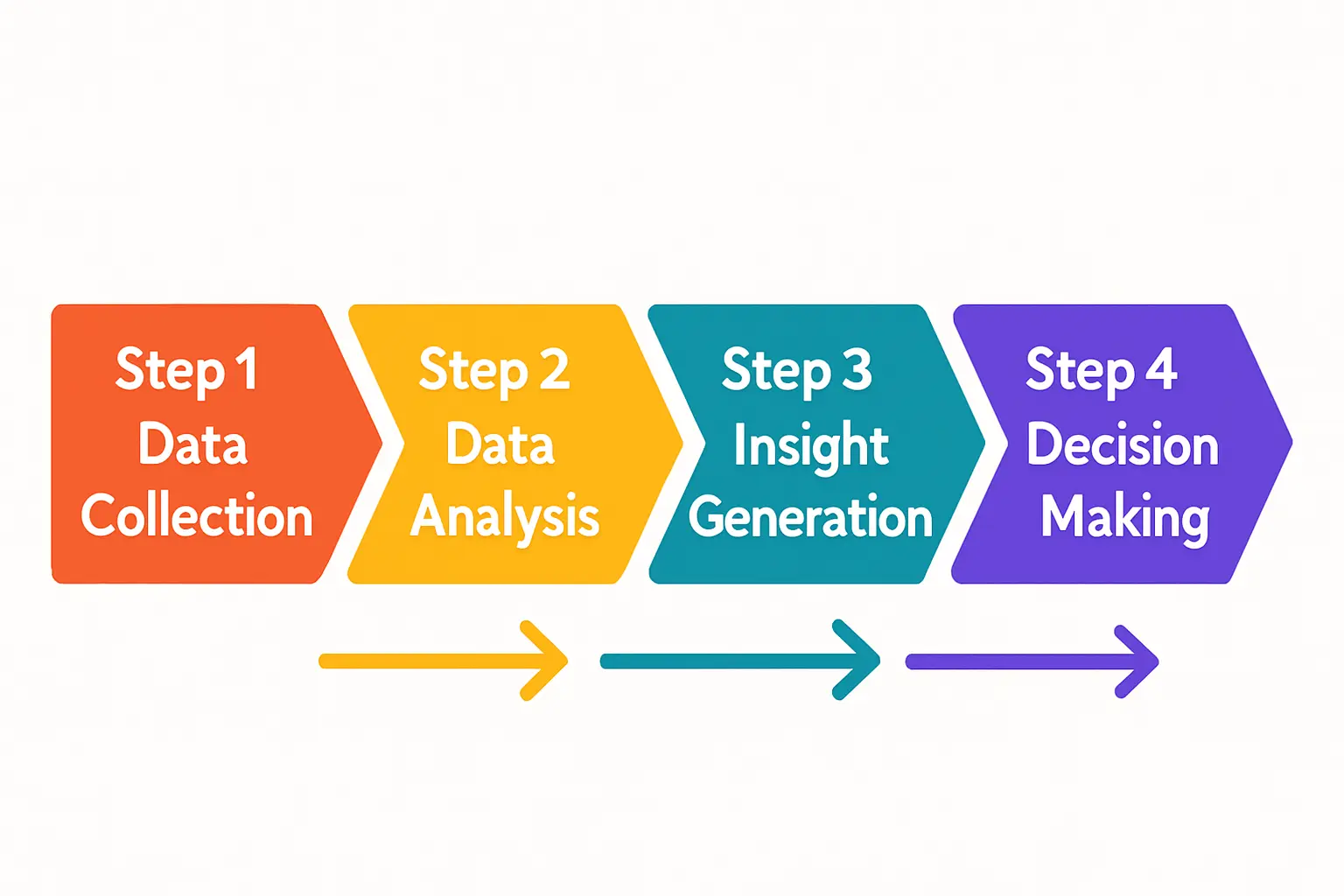

The difference between a successful launch and a stalled project often lies in the precision of its financial planning. A financial model serves as the operational and strategic guide for the business, influencing everything from capital fundraising to product pricing. Using inaccurate, non-localized data can create severe risks:

- Under-Capitalization: Misjudging setup costs or initial working capital can exhaust funds before the factory reaches stable, profitable production.

- Incorrect Pricing Strategy: An inaccurate understanding of production costs per module undermines the ability to set competitive yet profitable sales prices for domestic or export markets.

- Unrealistic Timelines: Failing to account for local logistics, customs, and ramp-up periods leads to missed deadlines and cost overruns.

Based on experience from J.v.G. turnkey projects, the most successful ventures are those built on a foundation of rigorous, localized financial planning. This process turns assumptions into calculated figures, providing the clarity needed to secure investment and steer the project effectively.

Core Components of a Solar Manufacturing Financial Model

A comprehensive financial model is built on three primary pillars, each requiring detailed, Laos-specific data for accuracy.

-

Capital Expenditures (CAPEX): These are the one-time costs required to establish the factory, including the purchase of all Solar Panel Manufacturing Machines, building construction or renovation, and initial setup fees.

-

Operating Expenditures (OPEX): These are the recurring costs associated with running the factory day-to-day. This category covers labor, raw materials, electricity, logistics, maintenance, and administrative overhead.

-

Revenue Projections: This involves forecasting the income generated from selling solar modules. Projections are based on production capacity, target market pricing, and sales volume over time.

Analyzing Key Cost Inputs Specific to Laos

Building an accurate model requires moving beyond general estimates and drilling down into the specific costs of doing business in Laos. The following sections explore the most significant variables.

Labor Costs

While Laos offers competitive labor costs, a financial model must differentiate between employee tiers. A typical 50 MW line might require 40–50 employees, from line operators to quality control managers and engineers.

- Unskilled and Semi-Skilled Labor: The majority of the workforce falls into this category. Wages for this group are based on the national minimum, with monthly salaries realistically ranging from $150 to $300 USD.

- Skilled Technicians and Engineers: These roles require higher compensation, typically ranging from $500 to $1,200+ USD per month, depending on experience. Budgeting for technical training is also a crucial line item, as specialized solar manufacturing expertise may need to be developed.

Electricity and Utilities

Laos’s significant hydropower resources provide a distinct competitive advantage: some of the lowest industrial electricity rates in Southeast Asia.

- Cost per kWh: Industrial users can typically expect electricity tariffs of approximately $0.06 to $0.08 per kilowatt-hour.

- Operational Advantage: This stable, low-cost power is a significant operational benefit, particularly for energy-intensive processes like solar cell stringing and module lamination. Reflecting these savings in the financial model is essential, as they directly impact the final cost per module.

Logistics and Supply Chain

Laos is a landlocked country, making logistics a central and complex component of the financial model. All raw materials and machinery must be imported, and finished goods must be transported for export.

- Primary Import Routes: The main corridors are through seaports in neighboring countries, primarily Laem Chabang in Thailand and the port of Da Nang in Vietnam.

- The China-Laos Railway: This modern railway provides a direct and increasingly efficient route for importing raw materials and equipment from China, a major supplier for the solar industry.

- Modeling Logistics: A robust model must account for sea freight costs to the port, customs duties (unless exempt), inland transportation fees from the port to the factory, and warehouse storage costs. These can add a significant percentage to the landed cost of raw materials.

Land and Building Costs

The factory’s location within Laos significantly impacts both initial and ongoing costs. Establishing the facility within a Special Economic Zone (SEZ) is often the most prudent strategy.

- SEZ Advantages: Zones such as the Savan-Seno SEZ or the Vientiane Industrial and Trade Area (VITA Park) offer streamlined administrative processes, existing infrastructure (roads, power, water), and significant financial incentives.

- Cost Estimates: Long-term land lease rates in these zones are highly competitive, often ranging from $2 to $4 USD per square meter per year—a rate substantially lower than comparable industrial land in neighboring countries.

Taxation and Incentives

Government incentives, particularly within SEZs, can dramatically improve a project’s financial viability.

- Corporate Income Tax: The standard rate is 20%, but companies in promoted sectors or located in SEZs can benefit from extended tax holidays, often paying 0% tax for the first several years of operation.

- Import Duty Exemptions: A critical incentive is the exemption from import duties and VAT on capital equipment, machinery, and the Key Raw Materials for Solar Modules. This significantly reduces the initial CAPEX investment.

Projecting Revenue and Profitability

With a clear picture of costs, the next step is to project revenue, which is driven by production volume and market price.

- Production Volume: A 50 MW semi-automated line, operating efficiently, can produce approximately 150,000 to 170,000 modules per year. The model should include a ramp-up phase, starting at 30-40% capacity and scaling to 80-90% over the first year.

- Market Pricing: Revenue depends on the target market. Selling modules domestically will have a different price point than exporting to the USA or Europe, where a Laotian origin can offer advantages by avoiding certain trade tariffs placed on other nations.

- Profitability Metrics: By subtracting the Cost of Goods Sold (COGS) from revenue, the model calculates the Gross Margin. Subtracting OPEX from this figure yields the EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization), a key indicator of operational profitability.

Common Pitfalls in Financial Modeling for New Ventures

Even with good data, certain strategic oversights can undermine a financial model’s reliability.

-

Underestimating Working Capital: Beyond the initial CAPEX, the business needs sufficient cash to fund raw material inventory and cover operating expenses for the first 6–9 months, until revenue streams stabilize.

-

Ignoring the Ramp-Up Phase: No factory operates at 100% capacity from day one. A realistic model must account for a gradual increase in production efficiency as the team is trained and processes are optimized.

-

Forgetting Contingency Funds: Unexpected costs are inevitable in any major industrial project. A prudent model includes a contingency buffer of 10–15% of the total CAPEX to cover unforeseen expenses during the Turnkey Solar Factory Setup process.

-

Overlooking Certification Costs: To sell modules in international markets, they must be certified. The costs for obtaining key Solar Module Certifications like IEC or UL can be substantial and must be included in the initial budget.

Frequently Asked Questions (FAQ)

What is the typical initial investment for a small-scale solar factory in Laos?

For a 20–50 MW semi-automated production line, the initial capital expenditure for machinery typically falls between $3 million and $7 million USD. This figure does not include the building, land lease, and necessary working capital, which must be budgeted separately.

How long does it take to become profitable?

Profitability depends heavily on operational efficiency, sales contracts, and raw material costs. With a solid business plan and effective management, a well-run factory can typically reach operational break-even within 12–18 months and achieve net profitability within 2–4 years.

Can a factory in Laos export to the US or Europe?

Yes, this is a primary strategic advantage. Products made in Laos are generally not subject to the same anti-dumping and countervailing duties (AD/CVD) that affect modules from other parts of Asia. This provides preferential access to key Western markets.

Do I need a local partner in Laos?

While it is legally possible to establish a 100% foreign-owned company, particularly within an SEZ, having a reputable local partner can be invaluable. A local partner can provide crucial assistance in navigating administrative procedures, understanding the business culture, and building relationships with government agencies and local suppliers.

Conclusion: From Financial Model to Investment-Ready Business Plan

A robust, localized financial model is the cornerstone of a successful solar manufacturing venture in Laos. It transforms an abstract opportunity into a concrete plan, providing the data-driven confidence needed to secure financing, guide strategic decisions, and manage resources effectively.

This model is not a static document but a dynamic tool that evolves with the project. Once complete, it serves as the financial engine of a comprehensive business plan. Developing such a detailed plan requires both financial acumen and deep industry knowledge. Resources like the pvknowhow.com How to Start a Solar Panel Factory guide can provide a comprehensive framework for this process, helping entrepreneurs navigate each step with clarity and purpose.