An investor looking at a world map might notice a country like Laos and its most prominent geographical feature: it is landlocked. For any manufacturing venture, this can seem like a significant disadvantage, raising immediate questions about the cost and complexity of moving goods.

A closer look, however, reveals a different reality. Laos is not just landlocked; it is increasingly land-linked. Positioned at the heart of the Greater Mekong Subregion, the country is actively developing infrastructure that transforms its geography from a challenge into a strategic asset.

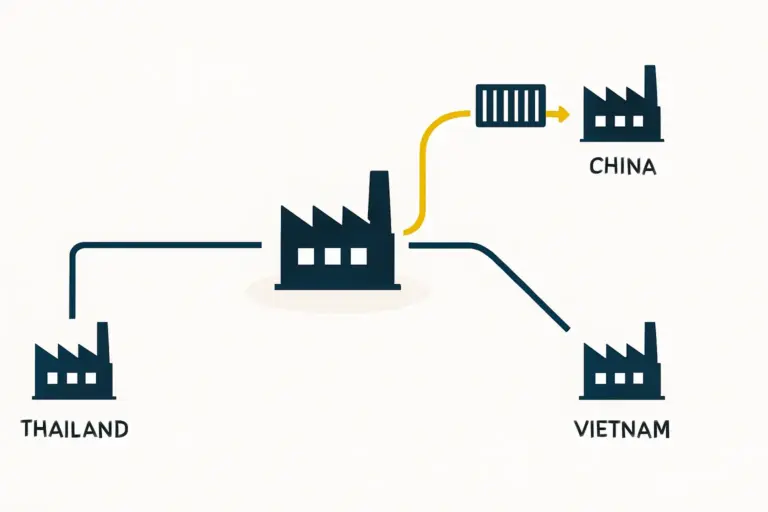

For an entrepreneur considering a solar module factory, understanding these logistical pathways is more than an operational detail—it is the cornerstone of a viable business model. This article explores the practical logistical strategies for importing raw materials and exporting finished solar modules from a factory in Laos, demonstrating how a business can navigate the supply chain through its neighbors, Thailand and Vietnam.

The Core Logistical Challenge: Sourcing and Distribution Without a Seaport

A solar module assembly plant depends on a constant flow of materials. It requires a reliable stream of imported containers carrying solar cells, tempered glass, and aluminum frames from global suppliers. At the same time, finished panels must be shipped efficiently to regional and international markets.

Without direct access to a seaport, a Laotian factory must rely on overland transport through neighboring countries. The success of the entire operation hinges on the efficiency, cost, and reliability of these corridors. The two most practical routes lead west through Thailand and east through Vietnam, each offering a distinct set of advantages that must be carefully weighed within the overall solar module manufacturing business plan.

These routes are not merely lines on a map; they are complex logistical systems involving roads, bridges, rail lines, dry ports, and seaports, all governed by international trade agreements.

Strategic Corridor 1: The Western Route via Thailand

The most established overland route connects Laos to the global shipping network through Thailand’s premier deep-sea port, Laem Chabang.

Key Infrastructure and Process

-

Laem Chabang Port: As one of Southeast Asia’s busiest container ports, it offers extensive global shipping connections where raw materials destined for Laos are offloaded.

-

Road Network: From Laem Chabang, containers travel by truck across Thailand to the border with Laos. The primary crossing is the First Thai-Lao Friendship Bridge, connecting Nong Khai, Thailand, with the Vientiane Prefecture in Laos.

-

Thanaleng Dry Port: Located near Vientiane, this modern inland container depot (ICD) acts as a crucial logistical hub. Containers can be cleared through customs here rather than at the congested border, significantly streamlining the process and reducing transit delays.

This western corridor benefits from mature infrastructure and well-defined customs procedures. Based on data from similar operations, road transit from Laem Chabang Port to Vientiane typically takes two to three days, depending on traffic and customs clearance. This reliability is a critical factor for production planning and inventory management.

Strategic Corridor 2: The Eastern Route via Vietnam

The eastern corridor through Vietnam provides a geographically shorter path to the sea, a compelling alternative with significant future potential.

Key Infrastructure and Process

-

Vung Ang Port: Located in Vietnam’s Ha Tinh province, Vung Ang Port is considerably closer to Vientiane than Laem Chabang. This proximity can reduce inland transportation costs and time.

-

Current Road Links: National Route 8 connects central Laos with Vietnam, serving as the current primary artery for truck transport to and from Vung Ang Port.

-

Future Rail Development: The planned Vientiane-Vung Ang railway is a transformative project. Once complete, this rail link will create a high-capacity, cost-effective corridor directly connecting Laos’s capital to a deep-sea port, dramatically enhancing the feasibility of large-scale manufacturing.

While the road infrastructure on this route continues to develop, the long-term potential of a direct rail connection makes it a vital part of any forward-looking logistical strategy.

The Impact of Modern Infrastructure Developments

Rapid infrastructure investment in Laos is directly improving manufacturing logistics. Beyond the specific corridors to Thailand and Vietnam, wider developments are changing the landscape.

The Laos-China Railway, for instance, offers an efficient link for sourcing raw materials and equipment from China, a major global supplier for the solar industry. Integrating this railway into the supply chain can significantly cut lead times and costs for key components.

The development of facilities like the Thanaleng Dry Port reflects a clear national strategy to overcome historical logistical hurdles. These hubs professionalize cross-border trade, reduce bottlenecks, and provide essential services like customs clearance, warehousing, and container maintenance—all vital for a smooth manufacturing operation. The efficiency of loading and unloading at the production site is also paramount and must be integrated into the initial factory layout.

Integrating Logistics into Your Business Plan

Investors must address these logistical considerations from the outset. They are not minor operational details but core components that influence cost, pricing, and profitability.

Key factors to analyze include:

-

Inland Freight Costs: Calculate the cost per container for both the Thai and Vietnamese routes.

-

Seaport and Customs Fees: Account for port handling charges, customs brokerage fees, and any transit duties. ASEAN Free Trade Area (AFTA) agreements can help mitigate some of these costs.

-

Lead Time Variability: Model the impact of potential delays on production schedules and working capital needs.

-

Equipment Sourcing: The logistics of transporting the manufacturing equipment itself—often handled as part of a turnkey solar production line package—must also be carefully planned.

Experience from J.v.G. Technology GmbH’s turnkey projects shows that a detailed logistical analysis and cost-benefit comparison of all available routes is an essential step in any new solar factory’s feasibility study.

Frequently Asked Questions (FAQ)

What are the main raw materials that need to be imported for a solar module factory?

The primary imported materials include solar cells, tempered front glass, backsheets or rear glass, aluminum frames, junction boxes, and encapsulants like EVA or POE. Most of these are sourced from international suppliers, primarily in Asia.

How do trade agreements like the AFTA affect logistics costs?

The ASEAN Free Trade Area (AFTA) aims to reduce tariffs on goods traded between member countries. For a factory in Laos, an ASEAN member, this can lower the cost of importing materials from other ASEAN nations (like Malaysia or Thailand) and make finished modules more competitive in markets within the bloc.

Is rail a viable alternative to road transport in Laos?

Yes, and its viability is growing rapidly. The Laos-China Railway is already a game-changer for trade with China, and the planned Vientiane-Vung Ang railway will do the same for the Vietnam corridor. For bulk, high-volume transport over long distances, rail is often more cost-effective and reliable than trucking.

How long does it typically take to ship a container from a port to a factory in Vientiane?

Via the Thailand route from Laem Chabang, inland transit usually takes two to three days. The Vietnam route from Vung Ang is geographically shorter, but current road conditions may lead to a similar transit time. These estimates exclude potential delays at the port or border for customs clearance.

Conclusion: From Landlocked to Land-Linked

The challenge of establishing a solar factory in a landlocked nation like Laos is a matter of strategic planning, not an insurmountable barrier. The country’s ongoing investment in modern rail lines, dry ports, and highway connections is transforming it into a competitive, land-linked manufacturing hub.

By carefully analyzing the logistical corridors through Thailand and Vietnam, leveraging favorable trade agreements, and designing a resilient supply chain, an investor can turn Laos’s central location into a distinct advantage for serving the rapidly growing Southeast Asian solar market. The key is to approach the project with a comprehensive understanding of the logistical landscape from day one.