Libya boasts one of the world’s most significant solar resources, with an average solar irradiation of nearly 2,900 kWh/m² per year. Despite this vast potential, the nation’s energy infrastructure faces persistent challenges, including a supply deficit estimated at 5 GW by the General Electricity Company of Libya (GECOL). Establishing a national solar module factory near a strategic hub like Tripoli offers a powerful path toward energy independence, economic diversification, and technological advancement.

Yet such a large-scale industrial project requires a sophisticated structure, one that balances public interests with private-sector efficiency. A Public-Private Partnership (PPP) offers the most robust framework to achieve this. This article outlines the key legal, financial, and operational components for structuring a successful PPP for a national solar module manufacturing facility in Libya.

Why a Public-Private Partnership is the Optimal Model for Libya

A PPP is a long-term contractual agreement between a government entity and a private company to deliver a public asset or service. For this project, the model allows the Libyan government to achieve its strategic objectives—including sourcing 22% of its electricity from renewables by 2030—without shouldering the full financial and operational burden.

The partnership fosters a symbiotic relationship:

The Public Partner (Government): Provides the mandate, land, and regulatory support, along with potential long-term offtake agreements. These contributions de-risk the project for private investors and align it with national development goals.

The Private Partner (Investor/Operator): Contributes capital, commercial discipline, operational expertise, and access to international markets, ensuring the factory runs efficiently and remains technologically competitive.

For Libya, this model can accelerate industrialization, create hundreds of skilled jobs, and establish a domestic supply chain for its ambitious renewable energy projects. For a private investor, it offers a secure, government-backed entry into one of North Africa’s most promising solar markets.

Key Components of a Successful PPP Framework

A durable PPP rests on three pillars: a clear legal structure, a sound financial model, and a precise definition of operational roles.

Legal and Regulatory Structure

The foundation of the partnership is a transparent and enforceable legal agreement. While Libya has a foundational PPP law, a project of this scale requires a bespoke concession agreement, typically managed through a Special Purpose Vehicle (SPV)—an entity created specifically for the project.

The SPV, often a joint venture between private investors and a state-affiliated entity like the Renewable Energy Authority of Libya (REAOL), serves to:

- Isolate project-specific finances and risks from the parent companies.

- Act as the contractual counterparty for all agreements, including financing, construction, supply, and offtake.

- Provide a clear governance structure with defined roles for the board and management.

The legal framework must explicitly address tenure, performance standards, dispute resolution mechanisms, and exit strategies.

Financial Structuring and Investment ROI

Financing for a national solar factory typically involves a blend of equity and debt. The private partner provides the majority of the equity, demonstrating commitment and assuming commercial risk. The government might contribute through a sovereign wealth fund or by providing the land and infrastructure as equity-in-kind.

The capital required for an initial 50-100 MW facility can be significant, with substantial outlays for machinery, construction, and initial working capital.

To attract this level of private investment, the financial model must offer a clear path to a viable return on investment (ROI). Key drivers include:

- Government Incentives: Tax holidays, exemptions from import duties on capital equipment, and streamlined permitting.

- Guaranteed Offtake: A long-term Power Purchase Agreement (PPA) or a Module Supply Agreement with GECOL for national projects provides the predictable revenue stream crucial for securing debt financing from development banks and international lenders.

- Export Potential: The facility’s strategic location near Tripoli provides access to European and other African markets, creating additional revenue streams.

Operational Roles and Responsibilities

A clear demarcation of responsibilities is critical to prevent operational friction.

The Public Partner is responsible for creating an enabling environment. This includes securing a suitable industrial site, ensuring access to reliable utilities like power and water, and facilitating all necessary permits and licenses.

The Private Partner holds responsibility for the overall management and commercial success of the factory, including corporate governance, sales and marketing, supply chain management, and financial performance.

The Technical Partner is responsible for the physical realization of the factory. This specialist firm, often engaged on a turnkey basis, manages everything from the initial feasibility study to the final handover. Its responsibilities include factory design, sourcing and commissioning the production line, implementing quality control systems for IEC certification, and training the local workforce. This role—as experience from J.v.G. turnkey projects demonstrates—is fundamental to ensuring the plant meets international standards of quality and efficiency from day one.

Mitigating Risks: A Balanced Allocation Strategy

Every large infrastructure project carries risks. A well-designed PPP allocates these risks to the party best equipped to manage them.

Political & Regulatory Risk

Primary Risk Holder: Public Partner

Mitigation Strategy: Sovereign guarantees, stable long-term concession agreements, and transparent legal frameworks.

Construction & Technical Risk

Primary Risk Holder: Technical Partner

Mitigation Strategy: A fixed-price, date-certain turnkey engineering, procurement, and construction (EPC) contract with performance guarantees.

Market & Revenue Risk

Primary Risk Holder: Shared

Mitigation Strategy: The government provides a baseline of demand through offtake agreements, while the private partner manages commercial and export sales to diversify revenue.

Operational Risk

Primary Risk Holder: Private Partner

Mitigation Strategy: The private operator is incentivized through its equity stake to maximize efficiency, control costs, and maintain high production quality, which relies on a skilled workforce.

The Role of the Technical Turnkey Partner

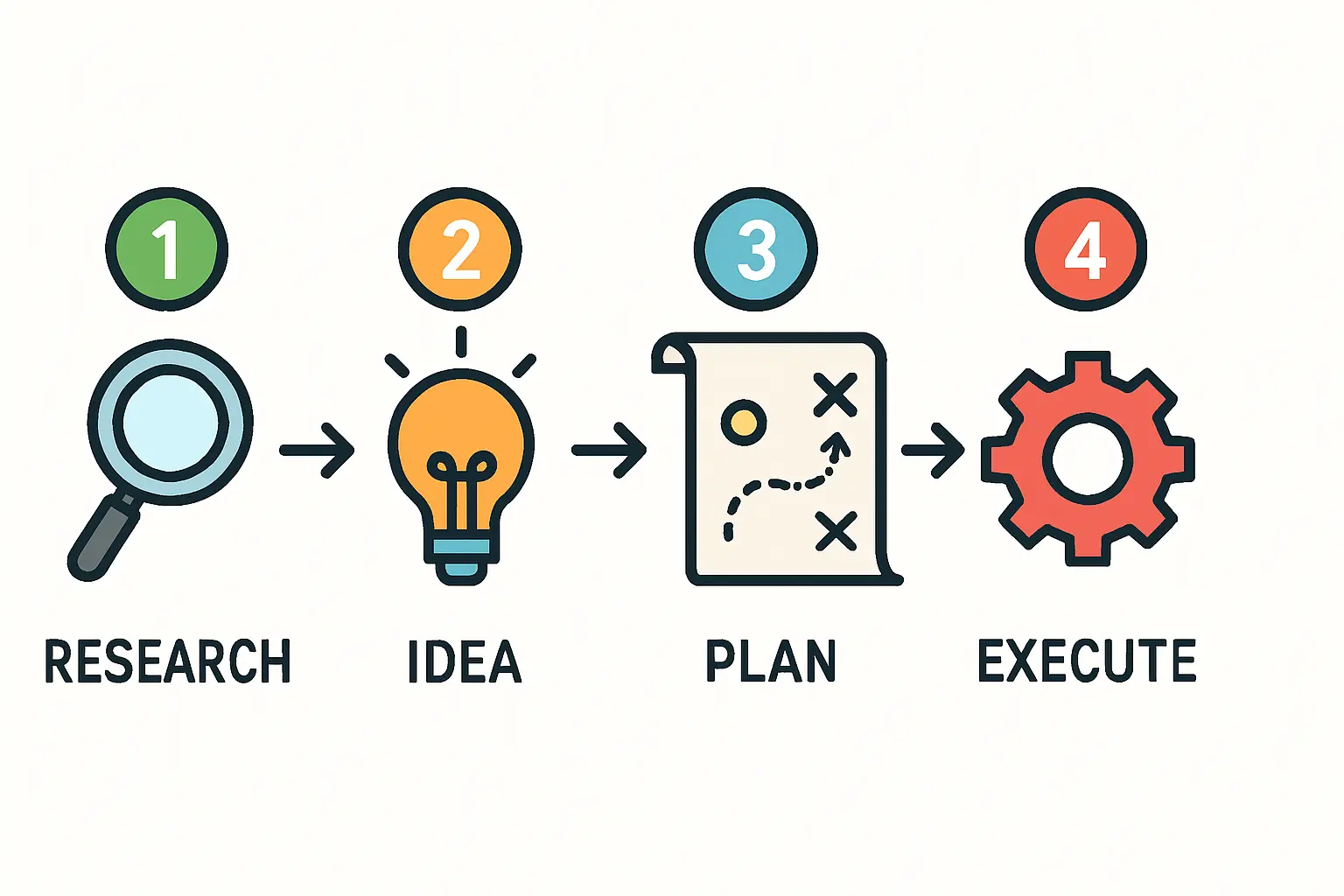

The choice of a technical partner is paramount for any government or investor group without prior experience in photovoltaic manufacturing. An experienced turnkey provider can transform the project from a concept into a fully operational industrial asset.

This partner’s scope goes far beyond supplying machines, encompassing a comprehensive suite of services:

- Feasibility and Business Planning: Conducting detailed analysis to validate the project’s financial and technical viability.

- Factory Design: Creating an efficient layout that optimizes material flow and allows for future expansion.

- Equipment Specification: Selecting manufacturing equipment suited to the target products and local environmental conditions.

- Process Integration: Ensuring all machines work together seamlessly as a cohesive production line.

- Quality Assurance: Implementing the systems required to achieve internationally recognized certifications (e.g., IEC 61215, IEC 61730), which are non-negotiable for bankability and export.

- Training and Handover: Equipping local engineers and technicians to operate and maintain the factory independently.

This integrated approach significantly reduces project risk and accelerates the timeline from groundbreaking to the production of the first certified solar module.

Frequently Asked Questions (FAQ)

What is the typical timeline for establishing such a factory under a PPP?

Once the final concession agreement is signed, a typical timeline is 12 to 18 months until the first module is produced. This period covers factory construction, equipment installation, and commissioning.

How many jobs can a factory of this scale create?

A semi-automated 100 MW solar module assembly factory typically creates 100 to 150 direct skilled and semi-skilled jobs, while also generating significant indirect employment in logistics, maintenance, and material supply.

What are the primary challenges in the Libyan context?

Key considerations include ensuring long-term political and regulatory stability to maintain investor confidence, securing financing from international institutions, and developing a skilled local workforce through targeted training programs.

Is it better to import solar cells or manufacture them locally?

The most pragmatic and capital-efficient approach for a new national factory is to begin with module assembly, importing solar cells from the established global market. Cell manufacturing is significantly more capital-intensive and can be considered a second phase of vertical integration once the module factory has established a stable market position.

What government incentives are most critical for the project’s success?

The most impactful incentives are a combination of financial and structural support: long-term tax exemptions, a waiver of import duties on capital goods, the provision of land at a favorable rate, and a guaranteed offtake agreement for a portion of the factory’s output.

Conclusion

Structuring a national solar module factory as a PPP provides a resilient and effective path for Libya to capitalize on its abundant solar resources by bringing together public vision, private capital, and specialized technical expertise. For investors, entrepreneurs, and public institutions ready to explore this opportunity, the crucial first step is to commission a comprehensive feasibility study and a bankable business plan. This foundational work transforms a national ambition into a viable, world-class industrial project.