For entrepreneurs looking to enter the solar manufacturing sector, the initial capital outlay is often the most significant hurdle. To address this challenge, the Malaysian government—committed to advancing its green technology—has established a specific financial instrument. Understanding this mechanism is not just an advantage; it is a critical part of a strategic market entry.

The Green Technology Financing Scheme (GTFS) is Malaysia’s primary initiative to encourage private investment in green technology. It’s not merely a loan; it’s a comprehensive support system designed to reduce investment risks for both the entrepreneur and the financing institution.

This article provides a clear overview of the GTFS, its eligibility criteria, and the application process for those looking to establish solar module manufacturing operations in Malaysia.

Understanding the GTFS: A Strategic Overview

First launched as GTFS 1.0, the scheme has evolved through versions 2.0 and 3.0 and is currently operating as GTFS 4.0. This evolution highlights the Malaysian government’s long-term commitment to fostering a sustainable green economy. The core purpose of the GTFS is to accelerate the adoption of green technology by making financing more accessible and affordable.

The scheme achieves this through two key mechanisms:

-

Government Guarantee: The government provides a 60% guarantee on the approved financing amount. This significantly reduces the risk for Participating Financial Institutions (PFIs), making them more willing to lend to new ventures in the green sector.

-

Interest/Profit Rate Subsidy: The government offers a 2.0% per annum rebate on the interest or profit rate charged by the bank. This directly lowers the cost of capital for the investor, improving the financial viability and profitability of the project from day one.

This government backing transforms a potentially high-risk venture into a bankable project, aligning private investment with national energy objectives.

Who is Eligible for the GTFS? Key Criteria for Solar Manufacturers

To access the scheme, applicants must meet specific criteria for their company and project. For a prospective solar module manufacturer, understanding these requirements is the first step toward a successful application.

Company and Project Certification

Obtaining a Green Project Certificate from the Malaysian Green Technology and Climate Change Corporation (MGTC) is a key requirement for any GTFS application. This certification validates that the proposed project aligns with the country’s green technology definitions and standards. For a solar module assembly line, this involves demonstrating how the manufacturing process and the final product contribute to renewable energy generation.

Applicant Categories

The GTFS clarifies eligibility by grouping applicants into categories. A solar module manufacturing enterprise falls under the Producer category: companies that produce green technology equipment or assets, such as solar photovoltaic modules. The other categories, Users and Service Providers, are less relevant for this specific investment type.

Financial Requirements

Under GTFS 4.0, the scheme is designed to support significant investments. The financing limit for Producers is up to RM100 million. The 60% government guarantee and 2.0% interest rebate are standard across all eligible projects, providing a predictable financial advantage for business planning. This structure is particularly beneficial for projects requiring substantial investment in machinery and facilities, a typical scenario for starting a new factory. An overview of solar manufacturing incentives in Malaysia provides broader context on the full range of government support available.

Project Scope

The GTFS is flexible and can be used to finance new projects, the expansion of existing facilities, or the retrofitting of old ones with green technology. This allows both new market entrants and established players to leverage the scheme for growth.

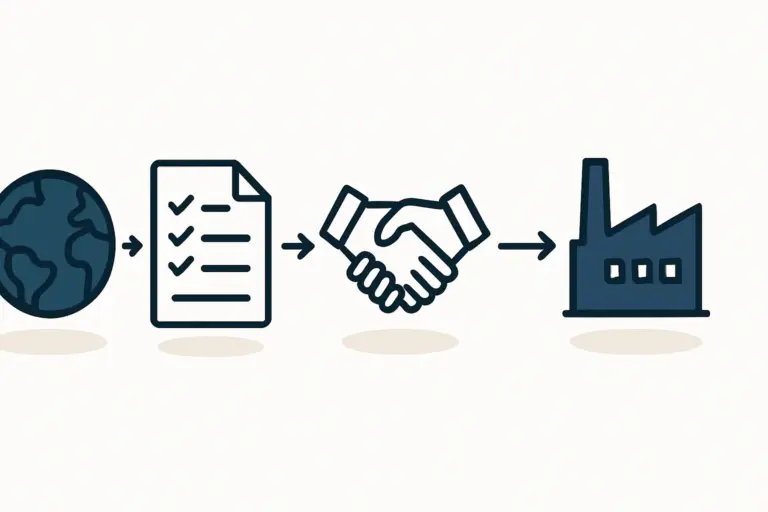

The GTFS Application Process: A Step-by-Step Guide

Navigating the application process requires a methodical approach. While it involves multiple agencies, the path is clearly defined.

Step 1: Project Certification with MGTC

Before approaching any bank, the project must be certified by MGTC. This involves submitting a detailed project proposal that outlines the technical specifications, environmental benefits, and commercial viability of the solar manufacturing plant. A successful certification is the key that unlocks the financing process.

Step 2: Selecting a Participating Financial Institution (PFI)

Once the project is certified, the applicant can approach any of the PFIs. These are commercial banks, Islamic banks, and development financial institutions that have partnered with the government to offer the GTFS. Major PFIs in Malaysia include CIMB Bank, AmBank, and Bank Islam. It’s advisable to engage with several PFIs to find the best fit for the project’s needs.

Step 3: Submitting the Application

The application to the PFI must be comprehensive. It typically includes the MGTC Green Project Certificate, detailed financial projections, and a robust business plan. The quality of the solar panel manufacturing business plan is paramount, as it serves as the primary document for the bank’s credit assessment.

Step 4: Credit Assessment and Approval

The PFI conducts its standard credit evaluation. Simultaneously, the application for the government guarantee is assessed by the Credit Guarantee Corporation Malaysia Berhad (CGC) or Danajamin Nasional Berhad. Following a successful evaluation by both parties, the financing is approved and disbursed according to the project timeline.

Strategic Considerations for Solar Investors

Securing GTFS financing is not just about meeting the criteria; it also involves aligning the project with Malaysia’s broader strategic goals. The country’s National Energy Transition Roadmap (NETR) heavily emphasizes solar power as a key pillar of its future energy mix.

By positioning a solar manufacturing project as a direct contributor to the NETR, an investor can strengthen their application. This demonstrates not only commercial intent but also a commitment to supporting national policy, a factor that can be viewed favorably by both MGTC and the PFIs. Experience shows that framing the investment within this national strategic context helps clarify its long-term value to stakeholders.

Frequently Asked Questions (FAQ)

What is the typical timeline for a GTFS application?

The entire process, from applying for MGTC certification to securing financing, can take between six and nine months. The timeline is highly dependent on the completeness and quality of the submitted documentation.

Can a foreign-owned company apply for the GTFS?

Yes, a foreign-owned company can apply, provided it is incorporated in Malaysia and operates within the country. The key is that the company must be a Malaysian-registered legal entity.

Is the GTFS only for large-scale projects?

While the scheme supports financing up to RM100 million for producers, it is accessible for a range of project sizes. The critical factor is the project’s viability and its certification as a green project, not just its scale.

What are common reasons an application might be rejected?

The most common reasons for rejection include an incomplete or unconvincing business plan, failure to obtain the MGTC Green Project Certificate, or a poor credit assessment by the PFI. Thorough preparation is essential.

Securing financing is a crucial first step in establishing a solar manufacturing facility. The GTFS in Malaysia offers a structured and highly advantageous path for investors. By understanding its requirements and strategically aligning a project with national objectives, entrepreneurs can significantly lower financial barriers and position their ventures for success in one of Southeast Asia’s most promising solar markets.