Mongolia, the ‘Land of the Eternal Blue Sky,’ boasts one of the world’s most significant untapped solar energy resources. With over 250 sunny days per year and vast, open plains in regions like the Gobi Desert, the potential for solar power generation is immense. For entrepreneurs, this presents a compelling opportunity. However, harnessing this potential requires navigating a landscape defined by more than geography; it hinges on mastering the logistics of a landlocked nation with unique infrastructural challenges.

This article offers a clear-eyed analysis of the primary logistical hurdles an investor faces when establishing a solar module manufacturing plant in Mongolia. Covering the importation of raw materials and the distribution of finished products, it provides strategic insights grounded in regional realities.

The Core Challenge: A Landlocked Nation with Global Ambitions

Mongolia’s fundamental logistical reality is its position as a vast, landlocked country bordered by only two neighbors: Russia to the north and China to the south. This geography means that nearly all international trade, particularly the import of specialized industrial goods, must transit through one of these nations.

For a solar manufacturing facility, this means raw materials sourced from global markets must first arrive at a seaport—most commonly Tianjin in China—before beginning a long overland journey. This multi-stage process adds complexities, costs, and potential delays that must be factored into any viable solar factory business plan.

Importing Raw Materials: The Journey to the Factory

The success of a solar manufacturing operation hinges on a reliable and predictable inflow of components. The journey these materials take from a global supplier to a factory in Ulaanbaatar is a process that requires careful understanding and management.

The Primary Supply Corridor: From Seaport to Factory Floor

The most common route for importing goods into Mongolia is by sea to the Port of Tianjin, followed by rail transport. This critical supply chain involves several key stages:

-

Ocean Freight: Raw materials, such as solar glass, EVA film, and junction boxes, are shipped in containers to Tianjin, a major port in northern China.

-

Port Handling & Customs: Upon arrival, the cargo undergoes Chinese customs clearance and is transferred from the port to the railway system.

-

Rail Transit: The goods are transported via the Trans-Mongolian Railway, a vital economic artery connecting China to Mongolia and onward to Russia.

-

Border Crossing: The most significant bottleneck occurs at the China-Mongolia border, specifically at the Erenhot (China) and Zamyn-Uud (Mongolia) crossing. Congestion here is common, and delays of several days or even weeks can occur due to high traffic volume, administrative processes, or infrastructure limitations.

-

Final Delivery: Once cleared, the train continues to Ulaanbaatar, where the materials are offloaded for final transport to the factory.

Understanding the fragility and specific handling needs of the different raw materials for solar panels is essential during this long transit. Improper handling or prolonged delays can compromise material quality and impact production yields.

The Climate Factor: Operating in Extreme Conditions

Mongolia’s continental climate poses a severe operational challenge. Winter temperatures regularly drop to -40°C, impacting every aspect of logistics:

-

Transportation: Extreme cold can lead to mechanical failures in trucks and locomotives. Roads may become impassable due to snow and ice, making rail the only viable, albeit slower, option.

-

Material Integrity: Certain polymers used in solar modules, like EVA encapsulant and backsheets, can become brittle at very low temperatures. Special considerations for packaging and climate-controlled storage may be necessary to prevent damage during transit and warehousing.

-

Labor and Operations: Loading and unloading activities are slower and more hazardous in extreme cold, requiring specific safety protocols.

Experience from J.v.G. turnkey projects in regions with harsh climates advises building a larger inventory of raw materials before the onset of winter to mitigate the risk of supply chain disruptions.

Distributing Finished Modules: Reaching a Dispersed Market

Once solar modules are manufactured, the next logistical challenge is delivering them to customers, both domestically and potentially for export.

Serving the Domestic Market

Mongolia is the most sparsely populated sovereign nation in the world. Its population of just over 3 million is spread across a territory of 1.56 million square kilometers. This creates a last-mile delivery problem on a massive scale.

Key distribution challenges include:

- Vast Distances: Projects may be located hundreds of kilometers from the manufacturing hub of Ulaanbaatar.

- Developing Infrastructure: While improving, many roads outside the capital are unpaved, making truck transport slow and increasing the risk of damage to finished modules.

- Seasonal Limitations: As with imports, winter conditions can severely restrict domestic transport options.

A successful distribution strategy relies on robust crating and packaging solutions, coupled with partnerships with local logistics providers experienced in navigating the country’s terrain and climate.

Exploring Export Opportunities

Mongolia’s strategic location offers potential export markets in Russia’s Siberian regions and Central Asia. The Trans-Mongolian Railway is the primary channel for this, allowing finished goods to be transported north. However, this means relying on the same infrastructure used for imports, with similar potential for bottlenecks and delays at border crossings.

Strategic Solutions for a Mongolian Solar Enterprise

While the challenges are significant, they can be overcome with careful planning and a strategic approach.

Building a Resilient Supply Chain

- Strategic Inventory Management: Maintain higher-than-average buffer stocks for critical components to absorb the impact of border delays or weather-related disruptions. A 60- to 90-day supply of key materials may be prudent, compared to a 30-day supply in a region with more stable logistics.

- Proactive Logistics Partnerships: Engage experienced freight forwarders who specialize in the China-Mongolia corridor. Their expertise in navigating customs and managing border procedures is invaluable.

- Thorough Supplier Vetting: Work with suppliers who can provide robust packaging suitable for long, arduous overland journeys and extreme temperature fluctuations.

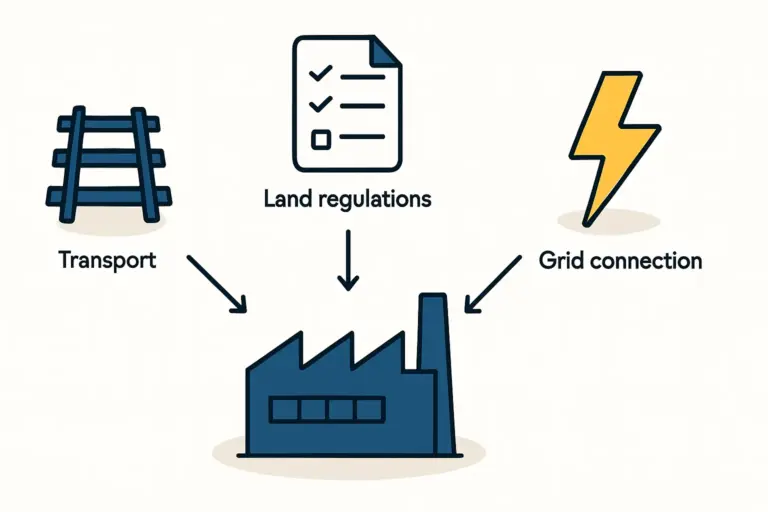

Optimizing Factory Location and Operations

The physical location of the manufacturing plant is a critical decision. Proximity to the main railway line near Ulaanbaatar is paramount, as this minimizes domestic transport legs for both incoming materials and outgoing products. This strategic choice is central to defining the solar factory building requirements and has long-term implications for operational efficiency and cost.

Adapting production schedules to align with seasonal realities—for instance, scheduling major shipments before the deep winter—can also significantly reduce logistical risk.

Frequently Asked Questions (FAQ)

What are the typical transit times for raw materials from China to Mongolia?

Assuming no major delays, the journey from the port of Tianjin to Ulaanbaatar typically takes 7 to 14 days. However, it is wise to budget for up to 30 days to account for potential congestion at the Erenhot/Zamyn-Uud border crossing.

How does the extreme cold affect solar panel components during transport?

Polymers like EVA and backsheets can lose flexibility and become brittle in sub-zero temperatures, making them susceptible to cracking if handled improperly. Solar glass is generally resilient, but condensation and thermal shock can be a concern. Climate-aware packaging and handling protocols are essential.

Is rail or road transport more reliable for distribution within Mongolia?

For long-distance transport along the main corridor, rail is generally more reliable, especially during winter. For final delivery to remote project sites off the main rail line, truck transport is necessary, but it is more susceptible to weather and poor road conditions. A multi-modal approach is often required.

What customs challenges should an investor anticipate at the China-Mongolia border?

The primary challenges are administrative delays and congestion. Ensuring all shipping documentation is perfectly accurate and complete is critical to avoid holds. Working with a customs broker who has a strong working relationship with officials at the border can help expedite the process.

Conclusion: A Strategic Approach to a High-Potential Market

Establishing a solar module factory in Mongolia is an ambitious venture and an opportunity to serve a nascent market with enormous growth potential. The logistical challenges—stemming from its landlocked geography, developing infrastructure, and extreme climate—are formidable but not insurmountable.

Success depends less on eliminating these challenges than on anticipating and managing them through intelligent planning. By building a resilient supply chain, selecting a strategic factory location, and forging strong local partnerships, an investor can build a robust and profitable manufacturing operation. For those prepared to navigate its unique landscape, Mongolia represents a clear and compelling frontier in the global solar industry.