An investor reviewing a business plan for a new solar module factory sees promising figures for market demand and production costs. But a separate analysis, focused on the plant’s location, reveals an opportunity that could fundamentally alter the project’s financial trajectory.

By situating the factory within a Special Economic Zone (ZEE), the projected return on investment increases dramatically—not through higher sales, but through significant fiscal optimization. This scenario highlights a critical strategic advantage for any entrepreneur considering entry into the solar manufacturing sector in Southern Africa.

With its strategic location and growing commitment to renewable energy, Mozambique offers a compelling case for investment. The government’s Special Economic Zones provide a powerful framework of incentives designed to attract foreign capital, particularly for export-oriented industries like solar panel manufacturing. Understanding these benefits isn’t just an accounting exercise; it’s a core component of strategic business planning.

Understanding the Special Economic Zone (ZEE) Framework

A Special Economic Zone is a geographically designated area within a country that operates under different economic regulations than the rest of the nation. The primary goal of a ZEE is to stimulate economic growth by attracting foreign direct investment, boosting exports, and creating jobs.

For a prospective solar module manufacturer, these zones are designed to reduce the financial friction of starting and operating a new enterprise. They are specifically structured for businesses that serve international markets, requiring a significant portion of production—typically at least 85% of annual output—to be exported. This aligns perfectly with a business model aimed at supplying solar modules to the broader Southern African Development Community (SADC) region and beyond.

Core Fiscal Incentives for Solar Manufacturers in Mozambique’s ZEEs

The financial advantages offered within a ZEE are substantial and multi-faceted, directly impacting a project’s capital expenditure (CapEx), operational expenditure (OpEx), and profitability.

1. Corporate Income Tax (CIT) Exemption

One of the most significant incentives is extensive relief from Corporate Income Tax, which provides a crucial long-term advantage for a new manufacturing venture.

-

Initial Period (Years 1-10): A complete exemption (0% rate) from CIT is granted for the first ten years of operation. For a capital-intensive business like solar manufacturing, this allows for rapid capital recovery and reinvestment of profits into business expansion or technology upgrades.

-

Subsequent Period (Years 11-15): Following the initial decade, the benefits continue with a 50% reduction in the standard CIT rate for an additional five years.

-

Long-Term Benefit: After year 15, the CIT rate is reduced by 25% for the life of the project.

This phased tax structure provides a predictable and highly favorable environment, enabling a business to build a strong financial foundation during its most critical early years.

2. Exemption from Customs Duties

Setting up a solar module factory requires importing specialized machinery, equipment, and components—items that often represent the largest portion of the initial investment. A key advantage of operating within a ZEE is the full exemption from customs duties on these necessary imports.

This applies to:

- Production Machinery: Equipment that forms the core of a turnkey solar production line, such as stringers, laminators, and testers.

- Essential Equipment: This includes laboratory instruments for quality control, material handling systems, and other ancillary hardware.

- Raw Materials: All components required for manufacturing solar modules, including solar cells, glass, EVA film, backsheets, and aluminum frames.

This exemption substantially reduces the upfront capital required to launch the factory, directly improving the project’s initial financial viability.

3. Value-Added Tax (VAT) Exemption

Similar to customs duties, VAT on imported goods can add a significant cost during the setup phase. Within a ZEE, manufacturers benefit from a VAT exemption on the importation of all the machinery, equipment, and raw materials mentioned above. This further reduces the initial cash outlay and simplifies procurement, preserving working capital for operational needs.

4. Freedom of Profit and Capital Repatriation

For any international investor, the ability to repatriate profits and capital is a fundamental concern. The ZEE framework in Mozambique explicitly addresses this by guaranteeing the freedom to transfer funds abroad, including:

- Repatriation of profits generated by the enterprise.

- Repatriation of the initial invested capital.

This provision offers investors security and confidence, assuring them that returns can be realized in their home currency without unnecessary restrictions.

What This Means for Your Business Model

These incentives create a powerful financial case for establishing a solar factory in a Mozambican ZEE. The benefits move beyond simple tax savings, becoming integral to the business strategy:

-

Reduced Startup Costs: Exemptions on customs and VAT for a complete production line can significantly lower the initial investment barrier. Experience from J.v.G. turnkey projects indicates these savings can substantially alter the capital requirements outlined in a preliminary business plan.

-

Accelerated Path to Profitability: The 10-year CIT holiday allows all operational profits to be retained, enabling faster debt repayment, funding for expansion, or distribution to shareholders.

-

Enhanced Competitiveness: Lower operational tax burdens and reduced import costs for raw materials allow a manufacturer to price its solar modules more competitively in the regional export market—a critical advantage when competing with established international suppliers.

An entrepreneur can use these factors to build a more robust and attractive financial model, making the project more appealing to lenders and equity partners. A comprehensive understanding of these fiscal tools is a prerequisite for anyone considering the process of setting up a solar module factory.

Frequently Asked Questions (FAQ)

Q1: What are the main eligibility criteria for setting up a business in a Mozambican ZEE?

The primary requirement is that the business must be export-oriented. This generally means a minimum of 85% of annual production must be sold to markets outside Mozambique. There are also specific application and approval processes managed by the Agency for the Promotion of Investment and Exports (APIEX).

Q2: Do these benefits apply to a business anywhere in Mozambique?

No, these fiscal incentives are specific to companies approved to operate within a designated Special Economic Zone or an Industrial Free Zone, making the factory’s location a critical strategic decision.

Q3: Are there minimum investment thresholds to qualify for ZEE status?

While specific thresholds can vary, ZEEs are typically designed to attract substantial investments. A proposal for a solar module factory, which requires significant capital for machinery and infrastructure, would generally meet the scale required for consideration.

Q4: How does this framework compare to incentives in other SADC countries?

Many countries in the region offer investment incentives, but Mozambique’s ZEE package—particularly the long-duration CIT exemption and comprehensive customs relief—is considered highly competitive for export-focused manufacturing ventures.

Q5: What is the process for applying for ZEE status?

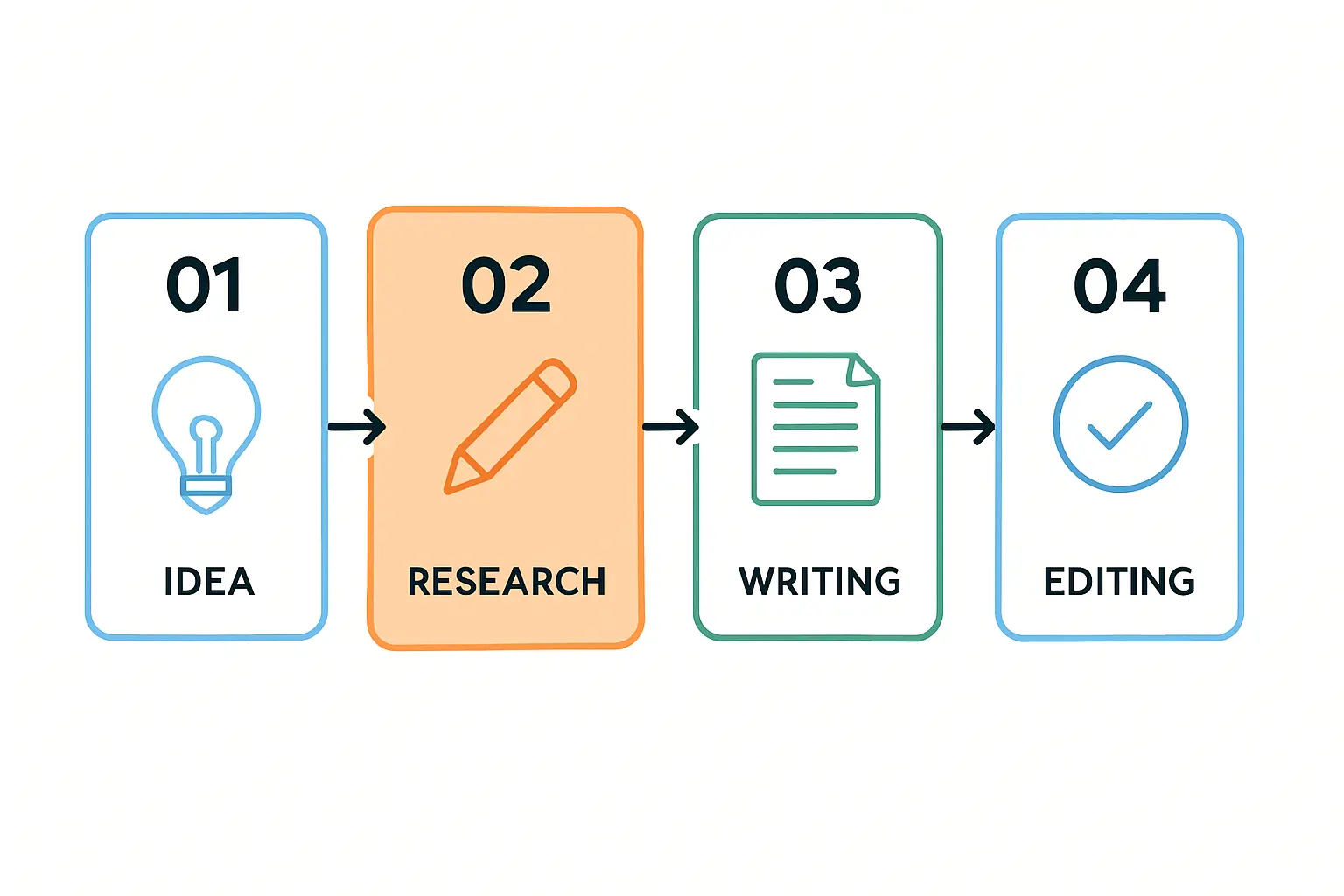

The process typically involves submitting a detailed project proposal and business plan to APIEX. The proposal must demonstrate the project’s economic viability, export potential, and compliance with national regulations. Seeking expert guidance on this application process is highly recommended.

Next Steps for Exploration

The fiscal benefits available within Mozambique’s Special Economic Zones offer a compelling opportunity for investors in the solar manufacturing sector. By strategically leveraging this framework, an entrepreneur can significantly de-risk a project, improve its financial returns, and establish a competitive foothold in Southern Africa’s rapidly growing market for renewable energy.

To develop a comprehensive business plan, the next logical step is to analyze the specific investment requirements for a solar factory, including machinery costs, building specifications, and initial working capital.