Powered almost entirely by the immense Itaipu hydroelectric dam, Paraguay presents a unique proposition for industrial investors. With an abundance of low-cost, clean energy and a government actively seeking to diversify its economy, the country offers fertile ground for manufacturing ventures.

For foreign entrepreneurs considering the solar panel production market, Paraguay’s legal and fiscal landscape—particularly Law 60/90—offers a clear and advantageous pathway. Translating this potential into an operational factory, however, requires a methodical approach to the country’s legal, environmental, and administrative procedures. This guide outlines the key steps a foreign investor must take to successfully register and permit a solar manufacturing facility in Paraguay, turning a strategic vision into a tangible industrial asset.

The Strategic Framework: Why Paraguay for Solar Manufacturing?

Before detailing the procedural steps, it’s worth understanding the business environment that makes Paraguay an attractive location. The country’s strategy for attracting foreign direct investment is built on several key pillars particularly relevant for capital-intensive industries like solar module manufacturing.

Law 60/90: The Cornerstone of Investment Incentives

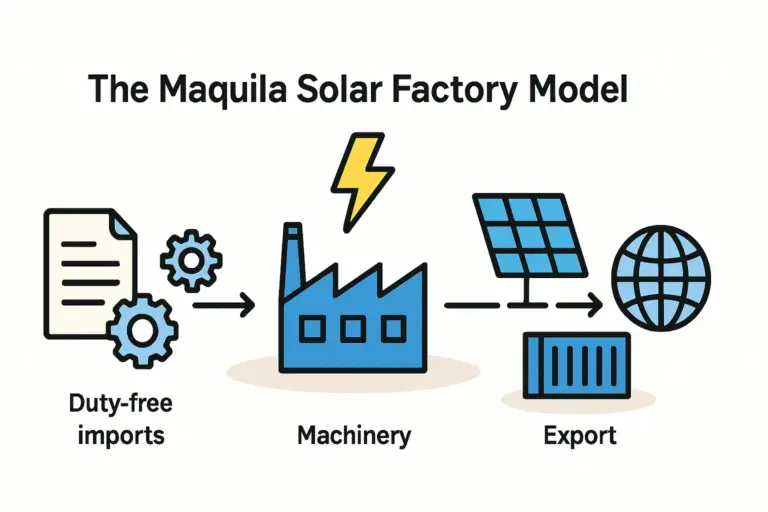

The most significant legislation for a foreign investor is Law 60/90, ‘For the Promotion of Investment for Economic and Social Development.’ This law provides substantial fiscal incentives for both foreign and national investors. For a solar factory, the benefits are compelling:

- Total exemption from customs duties on the importation of capital goods, such as laminators, stringers, and testing equipment.

- Value Added Tax (VAT) exemption on imported capital goods.

- Favorable tax treatment regarding the remittance and repatriation of capital and profits.

These incentives directly reduce the initial capital expenditure required to establish a production line, significantly improving the project’s financial viability from the outset.

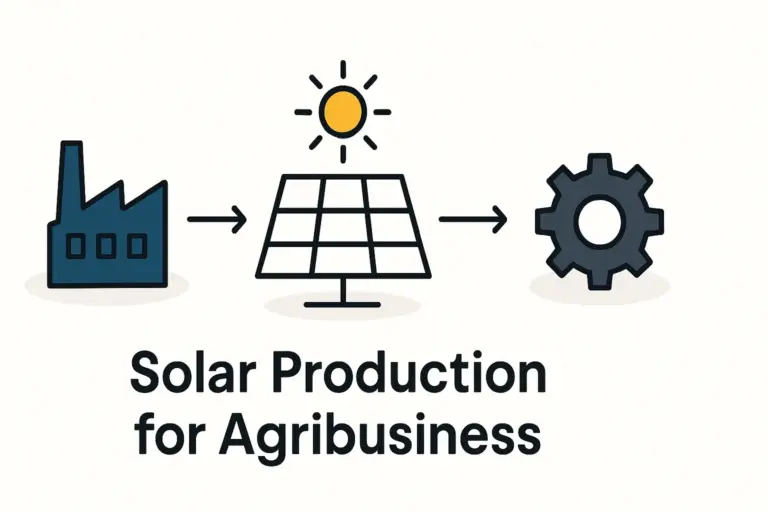

Energy Abundance and Cost Competitiveness

Paraguay’s energy matrix is dominated by hydroelectric power, which translates to one of the lowest electricity costs in the region. For an energy-intensive process like solar module manufacturing, this creates a sustainable, long-term operational cost advantage. This abundance of clean energy also aligns with the mission of a renewable energy enterprise.

Access to the Mercosur Market

As a full member of Mercosur (Southern Common Market), Paraguay offers preferential access to a trading bloc that includes Brazil, Argentina, and Uruguay. This positions a Paraguayan-based factory to serve not only the domestic market but also a regional market of over 260 million people with reduced trade barriers.

Step 1: Company Formation and Legal Establishment

The first formal step is establishing a legal entity in Paraguay. Foreign investors typically choose between two main corporate structures.

Choosing the Right Legal Structure

- Sociedad Anónima (S.A.): A joint-stock company, analogous to a corporation. This is the most common choice for medium- to large-scale foreign investments due to its flexible capital structure and clear separation of liability.

- Sociedad de Responsabilidad Limitada (S.R.L.): A limited liability company. While simpler to manage, it can have limitations on the transfer of shares and is often better suited for smaller enterprises.

For a solar manufacturing plant, an S.A. is generally the more appropriate and robust structure.

The Registration Process

The formation of a Paraguayan company involves a specific sequence of legal and administrative actions:

- Appointment of a Legal Representative: A foreign investor must appoint a local legal representative with a power of attorney to act on their behalf during the incorporation process.

- Drafting of Company Statutes: The company’s bylaws or statutes must be drafted by a Paraguayan notary public. These documents define the corporate purpose, capital structure, governance, and shareholder rights.

- Execution of a Public Deed: The statutes are formalized through a public deed of incorporation, signed before a notary.

- Registration with Public Registries: The public deed is then registered with several government bodies, a process often managed through the Unified System for the Opening and Closing of Companies (SUACE):

- Public Registry of Legal Entities and Associations.

- Public Registry of Commerce.

- Tax Registration: The company must obtain a tax identification number, known as the Registro Único de Contribuyentes (RUC), from the Undersecretariat of State for Taxation (SET).

This foundational legal work is critical. Experience from J.v.G. turnkey projects in emerging markets shows that engaging competent local legal counsel from the start is essential for avoiding delays and ensuring full compliance.

Step 2: Securing Investment Incentives Under Law 60/90

Once the company is legally constituted, the next step is to apply for the fiscal benefits offered by Law 60/90. This is not an automatic process and requires submitting a detailed investment project proposal.

The application is typically submitted to the Investment and Export Network (REDIEX), the national investment promotion agency. Central to this application is a comprehensive solar panel manufacturing business plan that outlines the project’s technical, economic, and social impact. This document must convincingly demonstrate:

- The total investment amount and its allocation.

- The number of jobs to be created.

- The technology and production processes to be used.

- Projected production capacity and target markets.

- The project’s contribution to the local economy.

The project is then evaluated by the Council of Investments. Upon approval, a resolution is issued by the Ministry of Industry and Commerce and the Ministry of Finance, formally granting the incentives.

Step 3: Environmental Licensing and Compliance

All industrial projects in Paraguay require an environmental license from the Ministry of the Environment and Sustainable Development (MADES). For a manufacturing facility, this process requires an Environmental Impact Assessment (EIA).

The EIA process is a systematic evaluation of the project’s potential environmental effects. It typically includes:

- Initial Consultation: A preliminary meeting with MADES to determine the scope and category of the environmental study required.

- Preparation of the EIA Report: An accredited environmental consultant prepares a detailed report analyzing potential impacts on air, water, and soil, as well as waste management plans and mitigation measures.

- Public Participation: Depending on the project’s scale, a public hearing may be required to present the findings to the local community.

- Technical Review and License Issuance: MADES reviews the EIA report. If the project complies with all national environmental regulations, an Environmental License is issued, which is a prerequisite for commencing construction and operations.

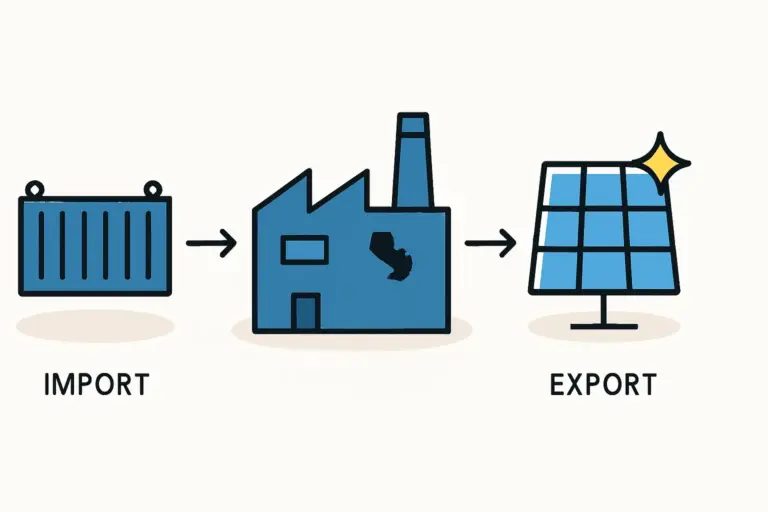

Step 4: Obtaining Operational Permits and Importing Equipment

With the legal, fiscal, and environmental frameworks in place, the final phase is securing the permits needed to build the factory and begin operations.

- Municipal Permits: This includes obtaining a building permit from the local municipality before construction can begin and, subsequently, a business license (Patente Comercial) to operate.

- Customs and Importation: The Law 60/90 framework significantly streamlines customs procedures for importing specialized solar manufacturing equipment. The resolution granting the investment incentives must be presented to customs authorities to claim the tax exemptions. Proper documentation and classification of all imported machinery are essential.

- Labor and Social Security: The company must be registered as an employer with the Social Security Institute (IPS), and all employment contracts must comply with Paraguayan labor law.

Frequently Asked Questions (FAQ)

Q: How long does the entire process of establishing a factory in Paraguay take?

A: A realistic timeline, from company incorporation to the start of operations, is typically 9 to 15 months. This can vary depending on the project’s complexity and the efficiency of administrative processes.

Q: Is a local Paraguayan partner required for a foreign investor?

A: No, Paraguay allows for 100% foreign ownership of companies. However, appointing a local legal representative is mandatory for the incorporation process, and engaging local legal and environmental consultants is highly advisable.

Q: What are the main challenges for foreign investors in Paraguay?

A: While the legal framework is favorable, navigating the bureaucracy can be challenging without experienced local guidance. The official language is Spanish, which can be a barrier for non-speakers. Patience and a methodical, step-by-step approach are key.

Q: Can profits and capital be repatriated from Paraguay?

A: Yes, Paraguay’s legal framework guarantees the right to remit profits and repatriate capital abroad. The process is straightforward, with taxes on dividends and remittances clearly defined.

The Path Forward

Establishing a solar factory in Paraguay is a multi-stage process, blending strategic legal planning with meticulous administrative execution. The country’s pro-investment policies, centered on Law 60/90, create a financially attractive environment, while its abundance of clean energy offers a unique operational advantage.

For the discerning entrepreneur, the journey from initial concept to a fully operational facility is complex but entirely achievable with structured planning and expert local guidance. The next logical step for a prospective investor is to conduct a deeper analysis of financial projections and develop the robust business plan required to engage with Paraguayan authorities.