An entrepreneur considering the solar manufacturing sector often begins with a familiar set of calculations: the cost of machinery, the price of raw materials, and projected revenue.

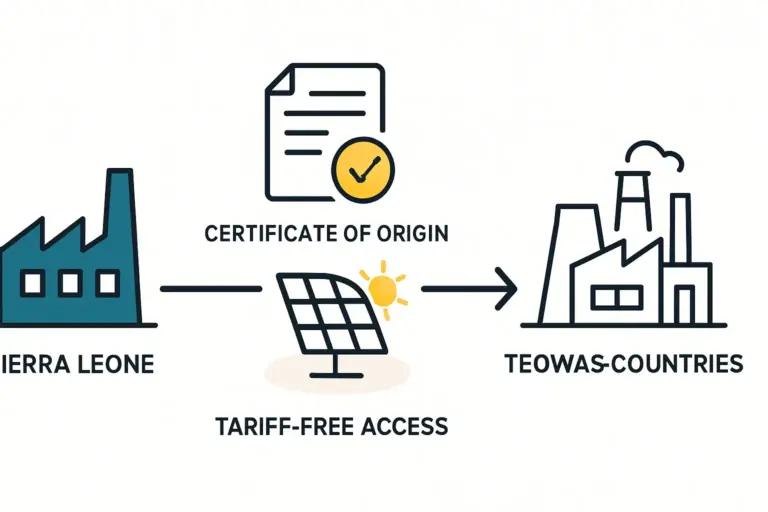

In certain markets, however, a standard financial model fails to capture a crucial variable—government incentives that can fundamentally alter a project’s viability. For a prospective solar module manufacturer in Sierra Leone, overlooking these policies would be like planning a journey without consulting the most important part of the map.

These incentives are not minor adjustments; they are powerful financial levers that can drastically reduce initial capital expenditure and accelerate profitability. This article breaks down two of the most impactful policies for solar investors in Sierra Leone: import duty exemptions and corporate income tax holidays. By understanding how to model these benefits, an entrepreneur can move from a speculative idea to a bankable business plan.

Understanding the Financial Landscape: Key Incentives for Solar Investors

Governments in emerging economies often use targeted financial incentives to attract investment in strategic sectors. For Sierra Leone, renewable energy manufacturing represents an opportunity to enhance energy security, create skilled jobs, and foster industrial development. To support these goals, the country has established a legal framework designed to de-risk and encourage such ventures.

For financial modeling purposes, two specific incentives stand out:

-

100% Import Duty Waiver: A complete exemption from duties and taxes on all imported plant, machinery, and equipment required for the project.

-

10-Year Corporate Income Tax Holiday: A full exemption from corporate income taxes for a decade, starting from the commencement of operations.

A closer look at each incentive reveals its profound impact on a project’s financial structure.

The Impact of Import Duty Exemptions on Initial Investment

The largest single cost in establishing a solar module factory is the capital equipment. A turnkey production line—comprising machines like stringers, laminators, and testers—represents a significant upfront investment. Under normal circumstances, importing this equipment would incur substantial taxes and duties, inflating the initial capital required.

Sierra Leone’s policy offers a 100% duty and tax waiver on such capital goods for renewable energy projects. This directly reduces the barrier to entry.

To illustrate the financial impact, consider a practical example:

Estimated Cost of Machinery: An investor plans to set up a 50 MW semi-automated production line. The Free on Board (FOB) cost for the required equipment is approximately $5,000,000.

Standard Import Costs (Hypothetical): Without an exemption, the project would be subject to various import levies. Assuming a cumulative rate of 20% (including tariffs and local taxes), the additional cost would be $5,000,000 x 20% = $1,000,000.

Savings with the Waiver: The 100% exemption eliminates this $1,000,000 cost entirely.

This is not merely a saving; it is a fundamental change to the project’s initial cash flow. The capital that would have been spent on taxes can now be redirected to other critical areas, such as working capital for raw materials, employee training, or facility upgrades. For investors seeking financing, a lower initial capital requirement makes the project far more attractive to lenders and equity partners.

Analyzing the Long-Term Benefits of a Corporate Income Tax Holiday

While import duty waivers provide immediate, upfront relief, a corporate income tax holiday delivers substantial value over the long term. This incentive allows a new enterprise to retain 100% of its profits for a defined period, enabling it to build a strong financial foundation.

Sierra Leone offers a 10-year tax holiday for qualifying renewable energy projects. This tax-free period significantly accelerates the return on investment and enhances the project’s overall profitability.

Here’s how the incentive affects a factory’s finances:

Projected Annual Profit: After the initial ramp-up phase, the solar module factory is projected to generate an annual profit before tax of $800,000.

Standard Corporate Tax Rate: The standard corporate income tax rate in Sierra Leone is 25%. Without the holiday, the annual tax liability would be $800,000 x 25% = $200,000.

Total Savings Over the Holiday Period: The 10-year holiday translates into a total tax saving of $200,000 per year x 10 years = $2,000,000.

This $2 million in retained earnings over the first decade is transformative. It allows the business to self-fund expansion, invest in next-generation technology, pay down debt ahead of schedule, or build substantial cash reserves. The direct impact on the timeline to profitability becomes even clearer when an investor understands the complete investment requirements for a solar factory.

Integrating These Incentives into Your Financial Model

A professional financial model must accurately reflect these government policies. The best practice is to build scenarios that compare the project’s performance with and without the incentives.

This approach serves several key functions:

-

Demonstrates Value: It clearly quantifies the financial benefit of locating the project in Sierra Leone, which is essential for securing board approval or attracting investors.

-

Risk Assessment: It highlights the project’s sensitivity to these policies, reinforcing the importance of ensuring all qualification criteria are met.

-

Strategic Planning: It provides a clear picture of the cash flow available for reinvestment during the 10-year tax holiday, enabling better long-term strategic planning.

Based on experience from J.v.G. turnkey projects, creating a detailed financial model that accounts for local incentives is a critical early step. It forms the foundation of a robust business plan for solar manufacturing, turning government policy into a tangible financial asset.

Frequently Asked Questions (FAQ)

Are these incentives guaranteed for any solar project in Sierra Leone?

No, they are not automatic. Projects must typically meet specific criteria related to investment size, technology, and local employment. An investor must submit a detailed proposal and secure an investment certificate from the Sierra Leone Investment and Export Promotion Agency (SLIEPA) to qualify. Proper legal and administrative due diligence is essential.

What happens after the 10-year tax holiday ends?

Once the 10-year period concludes, the business becomes subject to the standard corporate income tax regulations and rates applicable at that time. A comprehensive financial model must account for this transition, showing the shift in net profitability and cash flow after year 10.

Do these waivers cover raw materials as well, or only capital equipment?

The 100% waiver is specifically targeted at capital equipment—the plant and machinery used to establish the factory. Raw materials, such as solar cells, EVA, and glass, are typically governed by different import regulations. These operational costs must be modeled separately.

How does one apply for these incentives?

The process begins with formal engagement with SLIEPA. This usually involves presenting a detailed business plan, a financial model, and evidence of technical and financial capacity. Working with a local legal advisor familiar with the investment laws of Sierra Leone is highly recommended to navigate the application process successfully.

Conclusion: From Theoretical Benefit to Actionable Strategy

The financial incentives offered in Sierra Leone are among the most compelling in the region for aspiring solar manufacturers. They transform the risk-reward calculation for investors, lowering the upfront capital barrier and creating a decade-long runway for growth and profitability.

However, these benefits can only be realized if they are understood, quantified, and properly integrated into a project’s financial planning from the outset. For entrepreneurs exploring this sector, turning financial theory into operational reality means understanding the full scope of how to start a solar module factory.