An entrepreneur studying a map of global solar irradiation sees Somalia not as a place of challenges, but of immense, untapped potential. With some of the world’s highest and most consistent solar energy resources, the country presents a compelling case for local solar module manufacturing.

For any serious business professional, however, practical questions immediately come to mind: What is the legal and financial reality on the ground? Is foreign capital protected? Are there incentives to offset the risks?

This article provides a clear, business-focused overview of the legal and financial framework governing foreign investment in Somalia’s renewable energy sector. It is written for entrepreneurs and investors who see the opportunity but need a structured understanding of the rules of engagement. The aim is to outline the landscape so that you can begin your planning with confidence.

The Foundation: Somalia’s Foreign Investment Law

The cornerstone of Somalia’s approach to foreign capital is the Foreign Investment Law (No. 4 of 2015). This legislation aims to attract and protect foreign investors by creating a predictable and secure environment. Its most fundamental principle is the equal treatment of foreign and domestic investors, ensuring that foreign-owned enterprises are not at a disadvantage in the marketplace.

Key protections under this law include:

Guarantee Against Expropriation

The law explicitly protects against the nationalization or expropriation of foreign investments, except for legally defined public purposes and only with prompt, adequate, and effective compensation.

Full Repatriation Rights

Investors are guaranteed the right to repatriate profits, dividends, capital gains, and proceeds from the sale of their assets.

Dispute Resolution

The framework allows disputes to be settled through Somali courts or, crucially, through internationally recognized arbitration bodies like the International Centre for Settlement of Investment Disputes (ICSID).

This legal foundation is administered by the Foreign Investment Board (FIB), the central body responsible for facilitating, registering, and promoting foreign investment in the country.

Key Incentives for Solar Manufacturing Investors

To encourage investment in strategic sectors like renewable energy, the Somali government offers a range of compelling incentives. For a capital-intensive business like solar module manufacturing, these provisions can significantly improve a project’s financial viability.

Tax Exemptions and Concessions

One of the most powerful incentives is the exemption from customs duties and other taxes on the importation of essential capital goods. For a solar module factory, this applies directly to manufacturing machinery like stringers, laminators, and cell testers, as well as specialized equipment and initial stocks of raw materials.

This provision significantly lowers the initial investment required for a solar factory, as the substantial cost of importing sophisticated equipment is not inflated by import taxes. New investment projects may also be eligible for income tax holidays for an initial period, allowing the business to achieve profitability more quickly.

Guarantees and Financial Freedoms

Beyond tax benefits, the legal framework provides critical financial assurances. The unrestricted right to repatriate profits means that returns on investment can be transferred to the parent company or shareholders abroad in foreign currency without undue restriction. This is a vital consideration for any foreign investor and a clear signal of Somalia’s commitment to creating a pro-business climate.

Navigating the Business Registration Process

While the legal framework is welcoming, the administrative process requires careful navigation. A clear understanding of the steps involved is essential for a smooth market entry and helps avoid unnecessary delays.

Step 1: Application to the Foreign Investment Board (FIB)

The process begins with submitting a detailed investment application to the FIB. This application typically requires a comprehensive business plan, proof of financial capacity, and details about the proposed project’s scope, including job creation estimates and technology transfer benefits. The FIB reviews the proposal to ensure it aligns with national development priorities.

Step 2: Company Registration

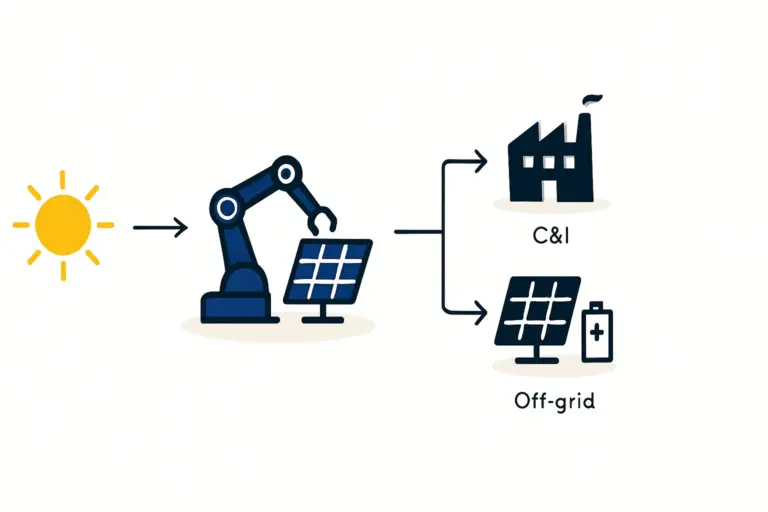

After securing an Investment Certificate from the FIB, the next step is to register the business entity with the Ministry of Commerce and Industry. Foreign investors can establish various legal entities, including a 100% foreign-owned Limited Liability Company (LLC), a common structure for manufacturing operations.

Step 3: Securing Licenses and Premises

Once the company is legally registered, the final phase involves obtaining any necessary sector-specific permits, such as those from the Ministry of Energy and Water Resources. Concurrently, securing a suitable location for the factory is critical. This step involves navigating regulations around land leasing or acquisition and requires a clear understanding of specific solar factory building requirements.

The Tax Structure for Foreign-Owned Businesses

Once operational, a foreign-owned solar manufacturing company in Somalia is subject to the national tax regime. The key components include:

- Corporate Income Tax (CIT): A standard rate is applied to the company’s net profits. As mentioned, new projects may benefit from an initial tax-free period.

- Value Added Tax (VAT): VAT is applicable on the sale of goods and services, though exports of solar modules may be zero-rated, providing a competitive advantage for regional distribution.

- Withholding Taxes: Taxes may be withheld on payments such as dividends and royalties, though rates can be influenced by Double Taxation Agreements (DTAs) if one exists with the investor’s home country.

A clear understanding of this structure is essential for accurate financial modeling and long-term compliance.

Practical Considerations for Investors

Beyond the letter of the law, successful investment often depends on practical, on-the-ground strategies.

- Local Partnerships: While not legally required, forming a joint venture or partnership with a reputable local business can be highly advantageous. A local partner can provide invaluable market insights, help navigate administrative hurdles, and facilitate relationships with suppliers and government bodies.

- Due Diligence: Thorough due diligence is non-negotiable. This includes verifying land titles, understanding local infrastructure limitations like port logistics and grid stability, and assessing the availability of a skilled or trainable workforce. A phased approach, starting with a smaller, scalable production line, can be a prudent strategy to manage risk while building operational experience and refining the manufacturing process in a new environment.

Frequently Asked Questions (FAQ)

-

Is there a minimum investment amount required for foreign investors in Somalia?

The Foreign Investment Law does not specify a universal minimum investment threshold. However, the project presented to the Foreign Investment Board should be commercially viable and demonstrate a serious commitment. -

How are investment disputes typically handled?

The law offers two paths for resolution. Disputes can be brought before the competent courts in Somalia or, as foreign investors often prefer, resolved through international arbitration forums like ICSID, provided there is an arbitration agreement. -

Can a foreign company own 100% of a business in Somalia?

Yes, the Foreign Investment Law permits 100% foreign ownership of companies in most sectors, including renewable energy manufacturing. -

What is the approximate timeline for receiving an investment license?

While timelines can vary, the government aims to process applications through the FIB within 60 to 90 days, assuming all documentation is complete and in order. -

Are there designated Special Economic Zones (SEZs) with additional incentives?

Somalia is in the process of developing SEZs. Investors should monitor these developments, as once established, these zones will likely offer enhanced incentives, such as more extended tax holidays and streamlined customs procedures, making them prime locations for manufacturing facilities.

Ultimately, while challenges exist, Somalia’s legal and financial framework demonstrates a clear intent to attract and protect foreign investment in high-potential sectors like solar energy. For the well-prepared entrepreneur, the country’s world-class solar resources, combined with a modern investment law, provide a compelling foundation for a successful and impactful manufacturing enterprise.