An investor has finalized quotations for state-of-the-art solar manufacturing equipment from a supplier in Germany. The machinery cost is calculated, the business plan looks solid, and the project is poised to move forward.

However, when the equipment lands at the Port of Durban, the final invoice from the clearing agent is nearly 20% higher than anticipated. This unexpected cost increase puts immediate pressure on cash flow and project timelines.

This scenario is all too common for entrepreneurs entering the manufacturing sector in South Africa. The landed cost of imported machinery is rarely just the supplier’s price plus shipping. A critical, and often underestimated, component of any accurate financial model is a thorough understanding of South Africa’s import duties, tariff codes, and available rebate programs.

This article breaks down how these factors impact capital investment and offers a framework for integrating them into your financial forecast.

THE FOUNDATION OF IMPORT COSTS: UNDERSTANDING TARIFF (HS) CODES

Before you can calculate any potential duties, the first step is to understand how goods are classified. Every piece of equipment imported into South Africa, from a simple screw to a complex solar cell stringer machine, is assigned a Harmonized System (HS) Code.

Think of an HS Code as an international passport for a product. This standardized numerical code, used by customs authorities worldwide, dictates the specific import regulations and duty rates that apply. A minor error in classification can lead to significant financial penalties or delays.

For example, an automatic solar cell stringer and a module laminator are both essential for production, but they fall under different tariff classifications. Their respective duty rates can vary based on their specific function and country of origin. Getting this classification correct from the beginning is the bedrock of an accurate cost projection.

CALCULATING POTENTIAL IMPORT DUTIES: A PRACTICAL APPROACH

The basic formula for calculating customs duty is straightforward:

Duty Payable = Customs Value x Duty Rate (%)

However, the complexity lies in determining the ‘Customs Value.’ This is typically the price paid for the goods (the Free on Board or FOB price), plus the cost of shipping and insurance to bring them to South Africa (Cost, Insurance, and Freight or CIF).

While duty rates are subject to change, here is an illustrative example of potential tariff codes and general duty rates for common solar production machinery:

Machines for semiconductor device manufacturing, like those under HS Code Chapter 8486, often have a 0% general duty rate.

Automatic Cell Stringers or Tabbers and Module Laminators, often classified under Chapter 8479, can have duty rates ranging from 0% to 20%.

Solar Simulators (Flash Testers), under Chapter 9030, typically have a 0% duty rate.

Electroluminescence (EL) Testers, under Chapter 9031, also generally have a 0% duty rate.

Note: These figures are for educational purposes only and must be verified with a licensed customs clearing agent based on the exact equipment specifications and country of origin.

Past projects analyzed by J.v.G. Technology GmbH show that neglecting a detailed tariff code analysis at the planning stage can lead to budget overruns exceeding 15% of the total equipment cost. The first step to avoiding this is to create a comprehensive list of all required machinery for a solar module production line, as this list forms the basis for your customs declarations.

STRATEGIC SAVINGS: LEVERAGING SOUTH AFRICA’S REBATE AND INCENTIVE PROGRAMS

While import duties can represent a substantial cost, the South African government offers several rebate provisions to encourage industrial development and local manufacturing. These programs, administered by the International Trade Administration Commission (ITAC), can allow capital equipment to be imported at a reduced or even zero-percent duty rate.

The most relevant provision for a new solar factory is often a rebate for machinery and equipment that is not manufactured locally.

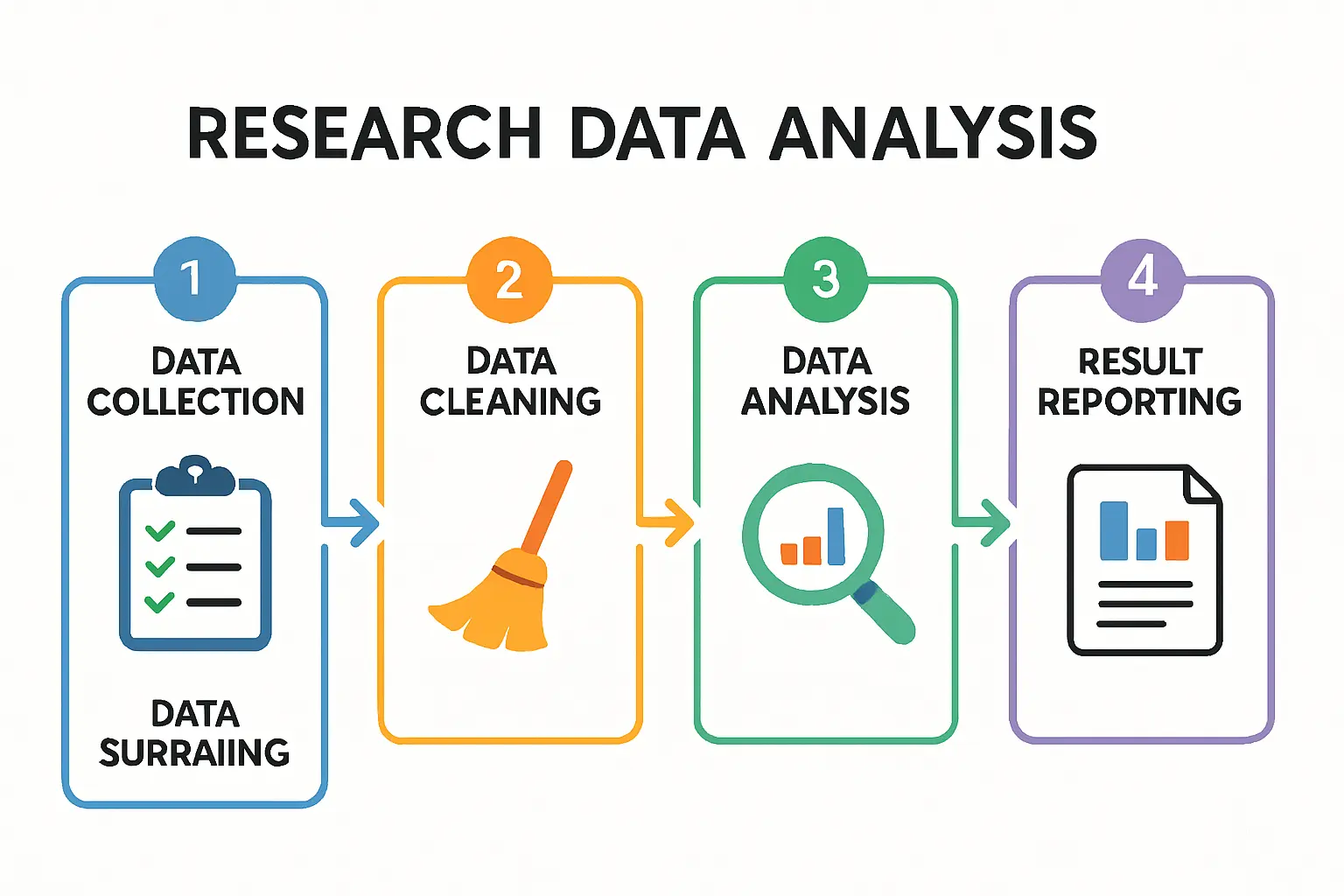

The process to secure such a rebate generally follows these steps:

- Project Registration: The investment project is registered with the relevant authorities.

- Equipment Identification: A detailed list of all required capital equipment for the production line is compiled.

- Local Market Research: The investor must provide evidence that the specified machinery is not produced in South Africa.

- ITAC Application: A formal application for a rebate permit is submitted to ITAC. This must be done before the equipment is shipped.

- Permit Issuance: If approved, ITAC issues a specific permit for the goods. This permit is presented to customs during the clearing process to waive the applicable duties.

A project developer in the Eastern Cape, for instance, successfully applied for a rebate on their laminator and stringer machines. This strategic move saved an estimated ZAR 3 million in import duties, which was then reallocated to operator training and international certification efforts. The success of such applications often hinges on a professionally prepared and defensible business plan for your solar factory.

INTEGRATING DUTIES AND REBATES INTO YOUR FINANCIAL MODEL

A dynamic financial model should not treat import duties as a single, fixed percentage. Instead, it should allow for a line-by-line analysis of each major piece of equipment. This approach provides a much clearer view of potential costs and savings.

Consider this simplified structure for your capital expenditure forecast:

Automatic Stringer: With a supplier cost of €500,000 and an estimated duty rate of 15%, the potential duty is €75,000. If a rebate is applicable and a permit is secured, the final landed cost (excluding VAT) is just the supplier cost plus shipping.

Module Laminator: For a cost of €400,000, a 15% duty would add €60,000. Again, a successful rebate application would bring this potential cost down to zero, with a final landed cost of €400,000 plus shipping.

Framing Machine: At a cost of €150,000 and a 0% duty rate, no duty is payable, and a rebate is not applicable. The landed cost is the supplier price plus shipping.

Forklift (Local): A locally sourced forklift for ZAR 400,000 would not be subject to import duties, so its cost remains as quoted.

For a typical 50 MW semi-automated production line, the total equipment investment can range from €4 to €6 million. A 15% import duty on this sum represents a significant capital outlay of €600,000 to €900,000—an amount that could be substantially reduced through proper planning and ITAC applications. After all, these industrial policies are specifically designed to align new manufacturing projects with South Africa’s national development goals.

COMMON PITFALLS AND HOW TO AVOID THEM

Navigating the customs landscape can be complex. Here are four common mistakes to avoid:

-

Applying for Rebates Too Late: A rebate permit from ITAC must be secured before the goods arrive at a South African port. It cannot be applied for retroactively.

-

Incorrect HS Code Classification: Relying solely on the supplier’s declared HS code can be risky, as interpretations vary. It is prudent to have the codes verified by a local clearing agent.

-

Underestimating Clearing Fees: The fees charged by customs brokers and clearing agents are separate from the duties themselves and should be budgeted for.

-

Forgetting about VAT: In addition to duties, a 15% Value-Added Tax (VAT) is payable on the customs value plus any non-rebated duties. While this import VAT can typically be claimed back by a registered business, it represents a significant initial cash flow requirement.

Frequently Asked Questions (FAQ)

Q1: What is the difference between a duty and a tax like VAT?

A customs duty is a tariff levied specifically on imported goods to protect local industries or generate revenue. VAT, on the other hand, is a general consumption tax applied to most goods and services sold in South Africa, including imports.

Q2: Can I apply for a rebate after my equipment has arrived in South Africa?

No. Applications for duty rebates must be submitted and approved by ITAC before the goods are cleared through customs. Planning is essential.

Q3: How long does the ITAC permit application process take?

Timelines can vary, but it is advisable to budget several months for the application and approval process. Starting early is critical to avoid project delays.

Q4: Do I need to hire a specialist customs broker?

Yes. Engaging a reputable, licensed customs clearing agent is not only recommended but practically essential. They have the expertise to manage documentation, verify tariff codes, and process declarations correctly.

Q5: Are duties different if I set up in a Special Economic Zone (SEZ)?

Yes, establishing a factory within a designated SEZ in South Africa can offer additional benefits, including specific customs-controlled area incentives that may provide relief from import duties and VAT. This requires separate investigation based on the chosen location.

Conclusion

Import duties and rebates are not minor details in a financial plan; they are strategic variables that can significantly influence the capital requirements and overall viability of a solar manufacturing project in South Africa. By moving beyond simple percentage estimates and adopting a detailed, line-item approach, investors can create a far more accurate and resilient financial model.

Proactively managing these complexities is a core part of the planning phase. The structured guidance available through resources like the pvknowhow.com e-course can help investors build a robust financial forecast that accounts for these crucial local variables from the outset. A well-planned project is one that anticipates these costs and leverages available incentives to its full advantage.