Entrepreneurs considering new markets often look for a convergence of factors: growing demand, clear government support, and tangible financial advantages. Sri Lanka’s ambitious goal to source 70% of its electricity from renewable sources by 2030 creates just such a convergence.

For investors planning to enter the solar module manufacturing sector, this national strategy is more than a policy statement—it is a significant business opportunity. However, transforming this opportunity into a viable enterprise requires navigating the local regulatory landscape. In Sri Lanka, the primary gateway for foreign investors is the Board of Investment (BOI).

Understanding its processes and the incentives it offers is critical to establishing a successful manufacturing operation in the country. This guide provides a clear overview of the BOI framework, its benefits, and the practical steps involved.

What is the Board of Investment (BOI) of Sri Lanka?

The Board of Investment of Sri Lanka is the central government agency tasked with promoting and facilitating foreign direct investment (FDI). It serves as a single point of contact designed to streamline the complex procedures associated with setting up a business.

For an international investor, the BOI is not merely a regulatory body but a strategic partner. Its mandate is to simplify approvals, provide guidance, and grant a range of powerful fiscal incentives to projects that align with the nation’s economic development goals. Renewable energy manufacturing is a key priority sector.

Key Incentives for Solar Manufacturing Investors

Securing BOI approval unlocks a suite of financial incentives designed to reduce initial capital outlay and improve long-term profitability. These benefits are legally binding, established through a formal agreement between the investor and the BOI.

Corporate Income Tax Holidays

One of the most significant advantages is a corporate income tax holiday. Depending on the scale and strategic importance of the investment, a new solar manufacturing venture can be exempted from corporate income tax for up to 12 years. This extended tax-free period directly improves a project’s financial viability, allowing for a faster return on investment and enabling profits to be reinvested into expansion or technology upgrades.

Duty-Free Import Concessions

Setting up a solar module factory requires substantial specialized machinery and equipment. The BOI provides duty-free concessions for the import of all capital goods, including components for a complete turnkey solar manufacturing line. Furthermore, these concessions often extend to the import of raw materials required for production. This exemption from customs duties and other levies significantly lowers the initial setup cost, a critical factor when calculating the total investment required for a solar panel factory.

The BOI Approval Process: A Step-by-Step Overview

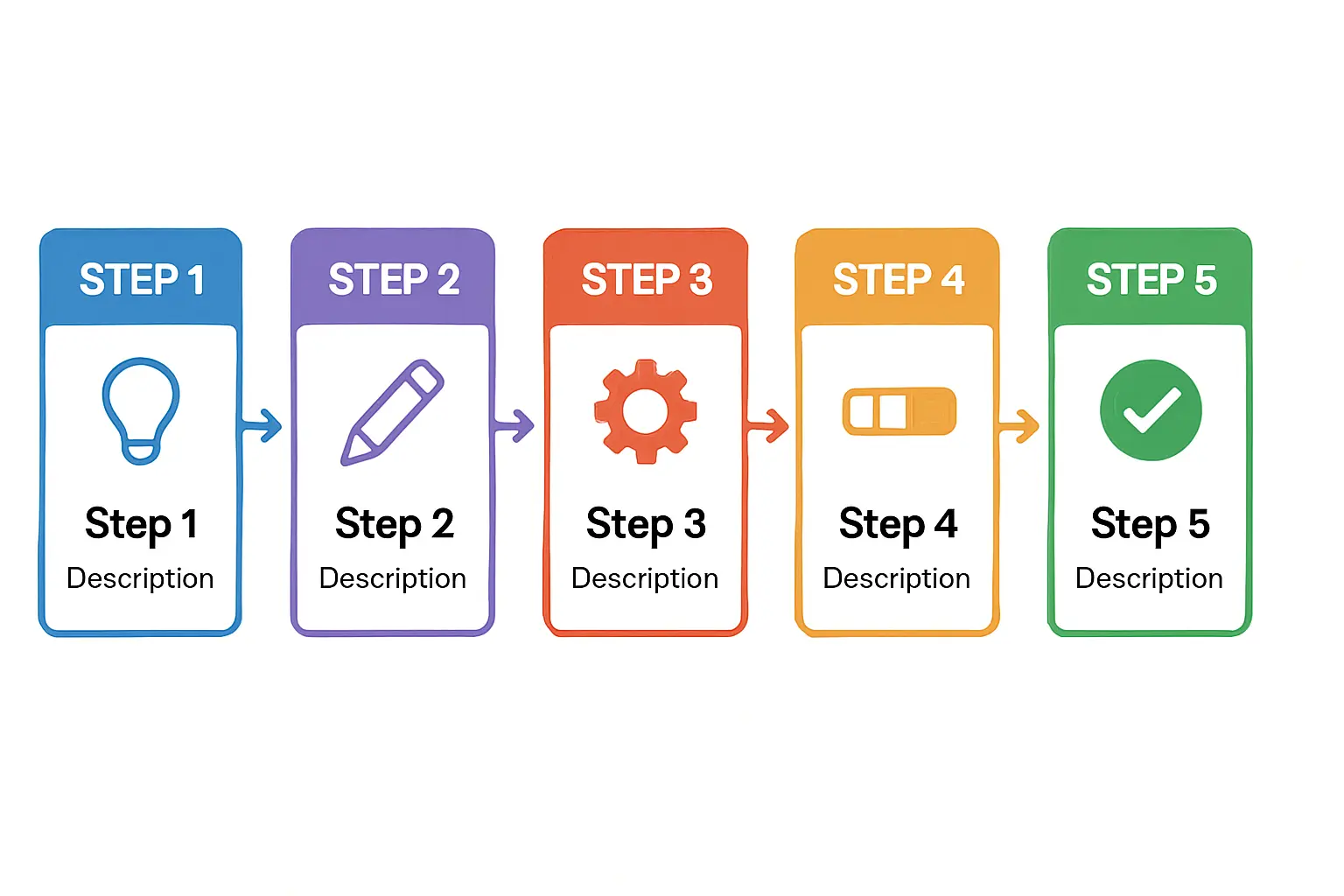

While the BOI aims to simplify the investment journey, the approval process is rigorous and requires meticulous preparation. The process generally follows a structured sequence of evaluation and agreement.

Step 1: Application and Documentation

The process begins with submitting a formal application to the BOI. This must be accompanied by comprehensive documentation, most crucially a detailed feasibility study and business plan. The plan must clearly outline the project’s scope, financial projections, technology, and market strategy. A well-structured solar factory business plan is essential for a successful application. Other required documents include proof of financial capacity and the company’s articles of association.

Step 2: BOI Appraisal and Negotiation

Once the application is submitted, the BOI conducts a thorough appraisal. Officials evaluate the project’s economic and technical viability, its potential for job creation, and its alignment with Sri Lanka’s renewable energy targets. This stage may involve meetings and negotiations to clarify aspects of the business plan and finalize the specific incentive package.

Step 3: Approval and Agreement

Upon successful appraisal, the BOI issues a letter of approval, followed by the signing of a formal agreement between the investing company and the BOI. This legal document details the project’s obligations and officially grants the agreed tax holidays, duty-free concessions, and other benefits.

Navigating Common Challenges

Based on experience from J.v.G. turnkey projects in emerging markets, investors should be aware of several potential challenges. Proactive planning can mitigate these risks effectively.

Bureaucratic Timelines

Although the BOI acts as a single window, the process involves coordination with multiple government ministries and agencies, which can sometimes lead to administrative delays. Submitting a complete, accurate, and professionally prepared application is the best way to minimize potential delays.

Regulatory Consistency

Government policies and regulations can evolve. While a BOI agreement provides a strong legal foundation, investors should maintain an open line of communication with the BOI and stay informed about any changes in the broader regulatory environment that might affect their operations.

The Importance of Local Expertise

Navigating local regulations, labor laws, and business customs can be complex. Engaging reputable local legal and financial consultants is invaluable. A local partner or advisor can help address issues before they arise and ensure the project remains compliant with all national and provincial requirements.

Planning Your Investment: Key Considerations

Beyond the BOI process, several strategic factors must be considered when planning a solar manufacturing plant in Sri Lanka.

Meeting the Investment Threshold

BOI incentives are often tied to a minimum investment value. For many projects, this threshold is around USD 250,000, though it can be higher for large-scale manufacturing. The proposed investment must be clearly justified and substantiated in the application.

Location and Infrastructure

Sri Lanka offers several Export Processing Zones (EPZs) that provide streamlined access to high-quality infrastructure, including reliable power, water, and logistics. Locating a factory within an EPZ can simplify setup and operational management, as these zones are specifically designed to support industrial and export-oriented businesses.

Aligning with International Standards

While BOI incentives provide a strong competitive advantage, the long-term success of the venture will depend on the quality of the final product. The manufacturing facility must be designed to produce modules that meet internationally recognized solar panel quality standards, such as those from IEC and UL. This ensures the products are suitable for both the domestic market and potential export opportunities.

Frequently Asked Questions (FAQ)

What is the typical timeframe for BOI approval?

The timeframe can vary depending on the project’s complexity and the application’s completeness. A well-prepared application can often receive approval within 4-6 weeks, but it is wise to allow for a longer period.

Can BOI incentives be revoked?

Yes, incentives are granted based on the commitments made in the BOI agreement. Failure to meet key obligations, such as the agreed investment level or project implementation timeline, can lead to the suspension or revocation of benefits.

Is 100% foreign ownership guaranteed for solar manufacturing projects?

In most cases, the BOI framework permits 100% foreign ownership for projects in priority sectors like renewable energy manufacturing. This is a key attraction for international investors.

Do duty-free concessions on raw materials last indefinitely?

The duration of duty-free concessions for raw materials is specified in the BOI agreement. They are typically granted for a set number of years, aligned with the project’s initial operational phase.

What happens after the tax holiday period ends?

Once the tax holiday period concludes, the company becomes subject to the standard corporate income tax rates applicable in Sri Lanka at that time.

Conclusion: The Strategic Advantage of BOI Status in Sri Lanka

For an entrepreneur looking to enter the solar manufacturing industry, Sri Lanka presents a compelling case. The government’s clear commitment to renewable energy, combined with the powerful financial incentives offered through the BOI, creates a highly favorable investment climate.

The BOI framework is designed to lower entry barriers, reduce initial risk, and accelerate the path to profitability. While the process requires diligent planning and a thorough understanding of the requirements, securing BOI status provides a solid foundation for building a competitive and sustainable solar manufacturing enterprise. For prospective investors, the next step is clear: conduct a detailed feasibility study and begin drafting a comprehensive business plan to capitalize on this promising market.