An investor exploring the UAE’s industrial sector might naturally gravitate toward established industries like aluminum or logistics. Yet, a less obvious but strategically powerful opportunity is emerging: solar module manufacturing.

With the UAE targeting 50% of its energy from clean sources by 2050, demand for locally produced solar panels is poised for substantial growth. National initiatives like the Mohammed bin Rashid Al Maktoum Solar Park bolster this trend, creating a consistent, long-term market.

But what does it actually cost to establish and run a solar module factory in the Emirates? The question is more than academic—a precise understanding of the financial requirements can be the difference between a viable business plan and a speculative venture.

This article offers a structured overview of the investment and operational costs for a small- to medium-scale (e.g., 50 MW) solar module assembly plant in the UAE. We’ll break down the key financial components an entrepreneur must consider, from initial machinery procurement to daily running expenses.

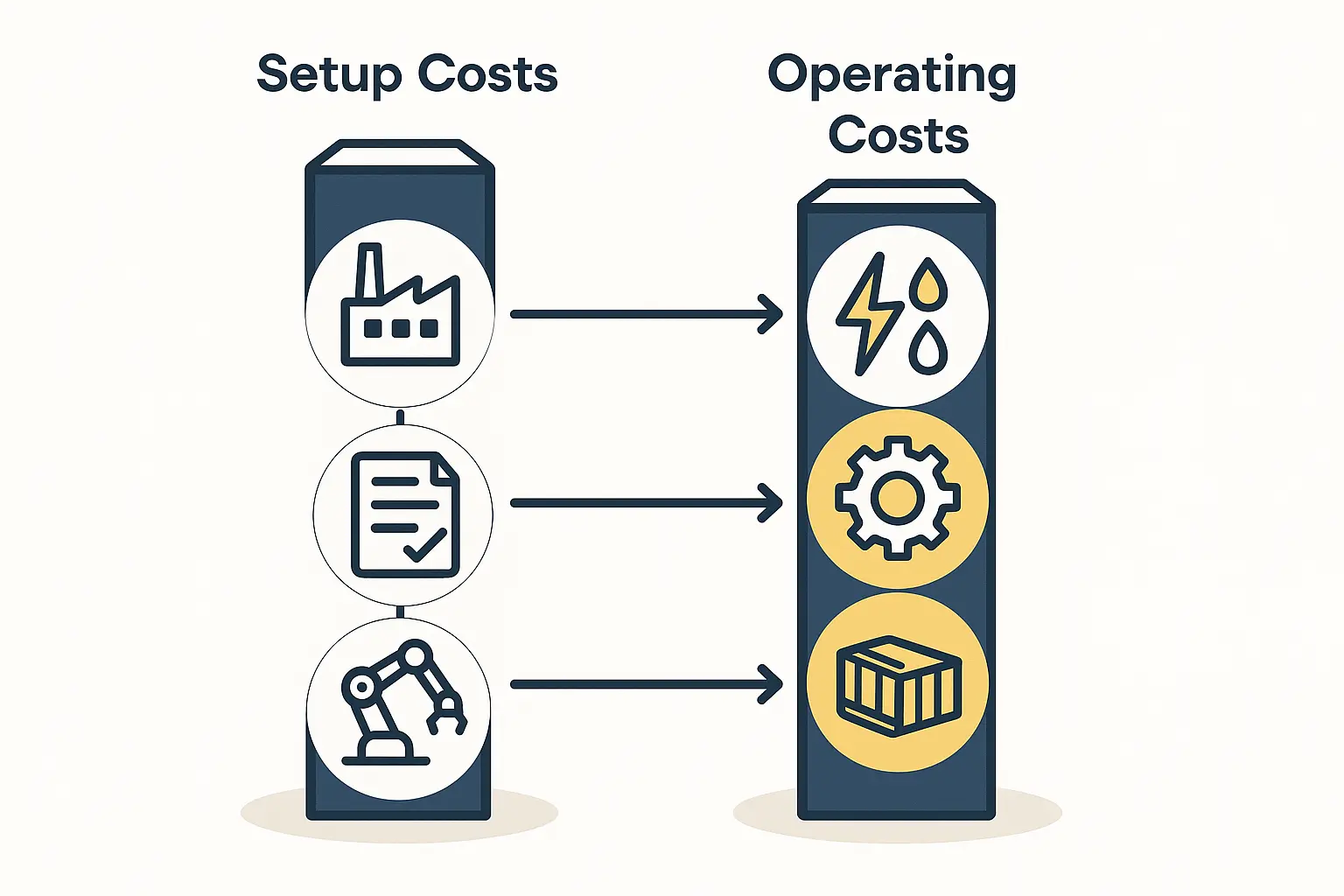

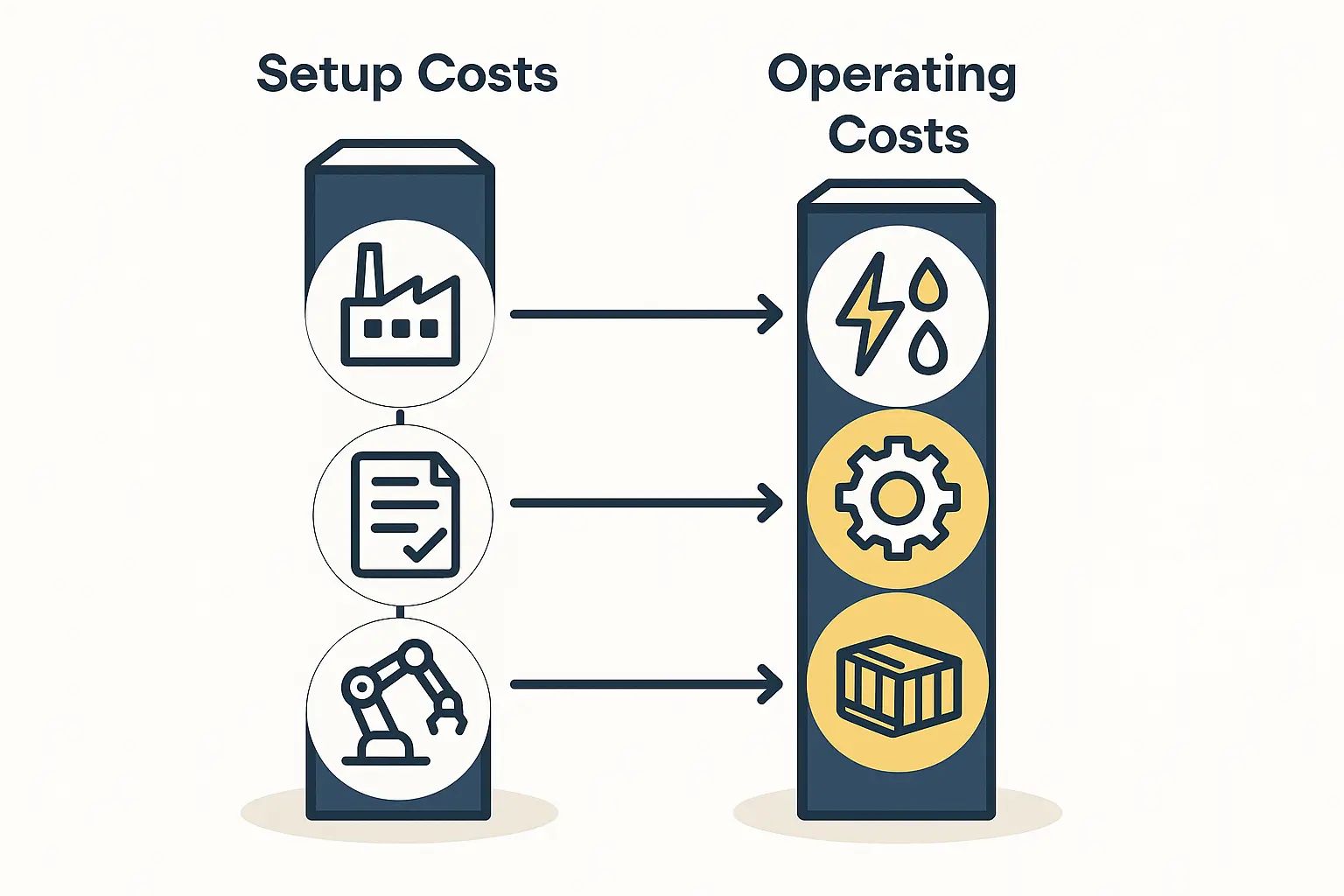

Understanding the Two Pillars of Cost: CAPEX and OPEX

Any financial forecast for a manufacturing business rests on two fundamental pillars:

-

Capital Expenditures (CAPEX): These are the one-time, upfront investments needed to get the factory operational, including the building, machinery, and initial setup.

-

Operating Expenditures (OPEX): These are the recurring costs of running the factory and producing solar modules, such as raw materials, labor, and utilities.

A common oversight for new investors is focusing heavily on the initial CAPEX (the price of the machines) while underestimating the ongoing OPEX, which ultimately determines long-term profitability and cash flow.

I. Capital Expenditures (CAPEX): The Initial Investment

The upfront investment sets the foundation for your entire operation. In the UAE, these costs are influenced by factors like your choice of emirate and whether you operate in a free zone or on the mainland.

Machinery and Equipment

This is usually the largest single component of your initial investment. For a new entrant, a semi-automated production line offers a balanced approach between investment cost, output, and labor requirements.

Based on numerous J.v.G. Technology GmbH projects, a typical 50 MW semi-automated turnkey solar production line represents an investment of approximately €1.5 million to €2.5 million. This budget generally covers the core equipment needed for the complete solar panel manufacturing process, from cell stringing to final testing.

A detailed list of solar panel manufacturing machines includes:

- Solar Cell Tester and Sorter

- Automatic Stringer Machine

- Layup Station

- EL Tester (pre-lamination)

- Laminator

- Framing Machine

- Junction Box Application Unit

- Final EL Tester and Sun Simulator

Choosing an integrated turnkey solution from a single supplier helps mitigate compatibility risks and streamlines the installation and training process.

Building and Infrastructure

You have two primary options in the UAE: leasing a pre-built warehouse or constructing a new facility. For most new ventures, leasing is the more capital-efficient choice.

-

Facility Size: A 50 MW line requires approximately 2,000 to 3,000 square meters. This space accommodates the production line, raw material storage, finished goods warehousing, and offices.

-

Leasing Costs: Annual lease rates for industrial warehouses in UAE free zones like Jebel Ali Free Zone (JAFZA) or Khalifa Industrial Zone Abu Dhabi (KIZAD) can range from AED 250 to AED 400 per square meter, translating to an annual rent of AED 500,000 to AED 1,200,000.

-

Key Considerations: The facility must meet specific criteria: a minimum ceiling height of 6-8 meters, a reinforced floor capable of handling heavy machinery, and an adequate, stable power supply (typically 300-400 kVA).

Licensing, Permits, and Initial Setup

Operating in the UAE requires specific trade and industrial licenses. Costs vary between emirates and free zones, but an entrepreneur should budget for:

- Company Registration and Trade License Fees

- Initial Visa Allocations for Key Staff

- Utility Connection Fees (DEWA, SEWA, etc.)

- Initial Raw Material Stock (to cover the first 1-2 months of production)

Collectively, these setup costs can range from €100,000 to €200,000, depending on the scale and specific administrative zone.

II. Operating Expenditures (OPEX): The Ongoing Costs

While CAPEX is a one-time event, OPEX is a continuous reality. Efficiently managing these costs is the key to achieving a competitive cost-per-watt and ensuring profitability.

Raw Materials (Bill of Materials – BOM)

The BOM is the single largest component of your operating costs, typically accounting for 75-85% of the production cost of a single module. The primary materials include:

- Solar Cells: The most expensive component (50-60% of BOM). Sourcing high-efficiency cells is crucial for performance.

- Glass: Typically 3.2mm tempered solar glass (10-15% of BOM).

- Aluminum Frames: The UAE’s strong aluminum industry can be a local sourcing advantage (8-12% of BOM).

- Encapsulant (EVA/POE): (6-8% of BOM)

- Backsheet/Rear Glass: (4-6% of BOM)

- Junction Box & Cables: (2-4% of BOM)

For a 50 MW factory operating at full capacity, the annual budget for raw materials could range from €15 million to €20 million, though this figure fluctuates with global market prices for silicon and other commodities.

Labor

The UAE has a readily available workforce, though skilled technicians for specialized machinery will likely require training.

-

Staffing Requirement: A 50 MW semi-automated line typically requires 25 to 30 employees per shift, including line operators, quality control technicians, maintenance staff, and supervisors.

-

Labor Costs: Factoring in average salaries, allowances, and visa costs, the total annual labor cost for a single-shift operation would likely fall between AED 1.5 million and AED 2.5 million.

A well-structured training program, often included in a turnkey line package, is essential for ensuring operational efficiency and minimizing production errors.

Utilities

The UAE offers relatively competitive industrial electricity rates, a significant advantage for an energy-intensive process like lamination.

-

Electricity: The laminator is the most power-hungry machine. A 50 MW factory’s monthly electricity bill might range from AED 30,000 to AED 50,000, depending on production volume and local utility tariffs.

-

Water: Water consumption is relatively low, used primarily for cleaning and sanitation.

Other Operating Costs

- Logistics and Shipping: The UAE’s world-class port infrastructure (e.g., Jebel Ali Port) is a major asset for both importing raw materials and exporting finished goods.

- Maintenance and Spares: It’s prudent to budget 1-2% of the machinery cost annually for maintenance and spare parts.

- Rent: As detailed in the CAPEX section, this is a significant recurring cost.

- Insurance, marketing, and administrative overheads.

Financial Summary: A High-Level View

The following table offers a simplified summary of the potential costs for a 50 MW solar module factory in the UAE. These figures are illustrative and serve as a starting point for a detailed financial model.

| Cost Category | Type | Estimated Range (EUR) | Notes |

|---|---|---|---|

| Machinery & Equipment | CAPEX | €1,500,000 – €2,500,000 | Core investment for a 50 MW line. |

| Building & Infrastructure | CAPEX/OPEX | €120,000 – €300,000 (Annual Lease) | Based on a 2,500 sqm facility in a free zone. |

| Setup & Licensing | CAPEX | €100,000 – €200,000 | One-time administrative costs. |

| Raw Materials (BOM) | OPEX | €15,000,000 – €20,000,000 (Annual) | At full capacity; subject to market prices. |

| Labor | OPEX | €375,000 – €625,000 (Annual) | For approx. 30 employees on a single shift. |

| Utilities | OPEX | €90,000 – €150,000 (Annual) | Primarily electricity costs. |

Frequently Asked Questions (FAQ)

Q1: What are the main benefits of setting up a solar factory in a UAE free zone?

Free zones like JAFZA, KIZAD, or Dubai Silicon Oasis offer significant advantages, including 100% foreign ownership, 0% corporate and personal income taxes, streamlined customs procedures (crucial for importing materials and exporting modules), and access to world-class infrastructure.

Q2: How much working capital is needed beyond the initial CAPEX investment?

A common rule of thumb is to secure enough working capital to cover 3-6 months of operating expenses (OPEX). Based on the estimates above, this translates to an additional €1.5 million to €3 million in liquid funds to cover raw materials, salaries, and rent before revenue stabilizes.

Q3: Are there specific government incentives for solar manufacturing in the UAE?

While direct subsidies may vary, the primary incentive is the government’s strategic commitment to renewable energy, which creates a stable, long-term domestic market. Operating in a free zone provides substantial tax incentives. Furthermore, initiatives like “Make it in the Emirates” aim to support local manufacturers, potentially offering access to favorable financing or procurement policies in the future.

Q4: How long does it take to become operational?

From signing the machinery contract to producing the first certified module, a realistic timeline is 9 to 12 months. This includes approximately 4-6 months for machine manufacturing and shipping, followed by 3-6 months for facility preparation, installation, commissioning, and staff training.

Next Steps: Building a Viable UAE Solar Business Plan

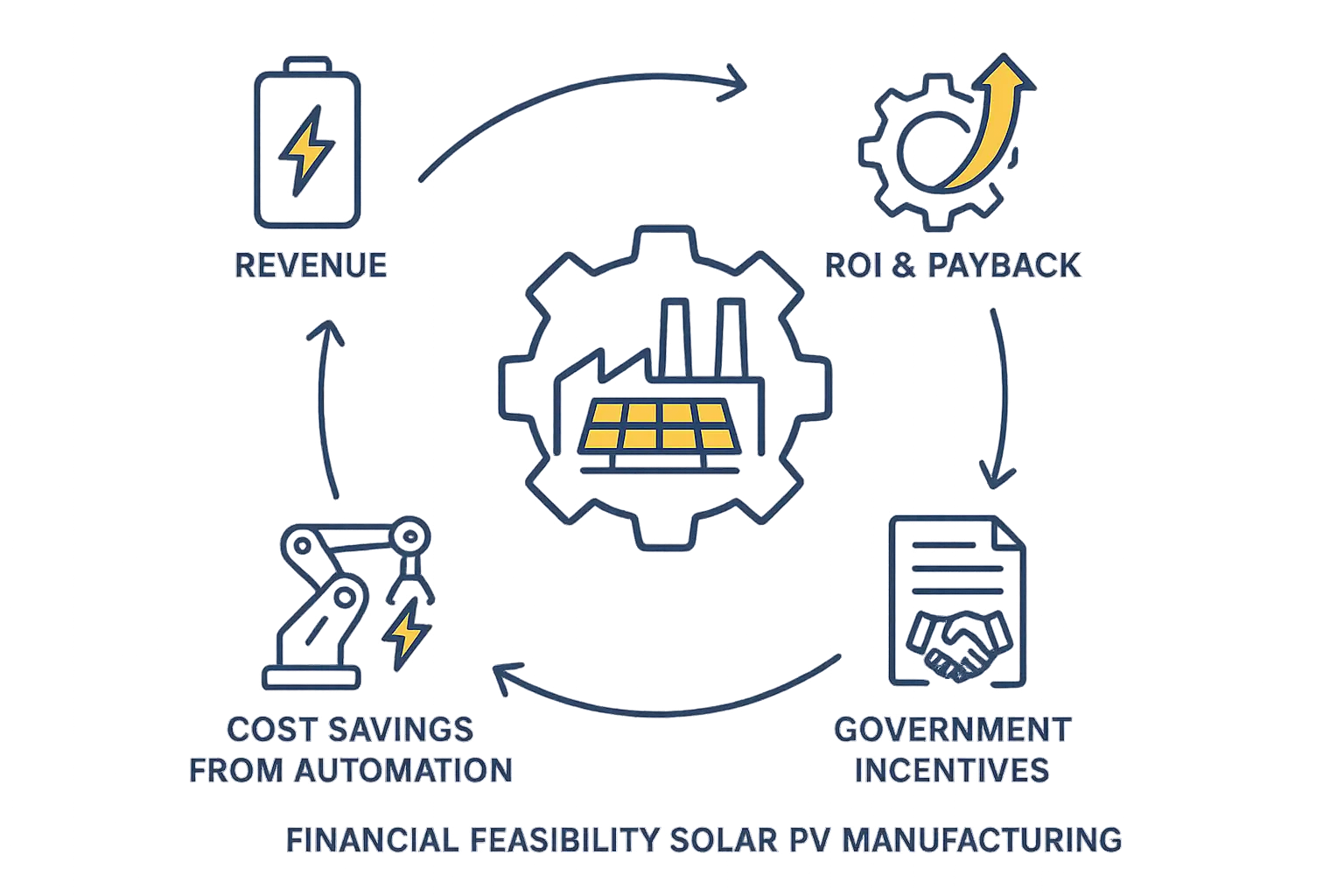

Calculating the setup and operating costs is the crucial first step in determining the financial feasibility of a solar module factory in the UAE. The region presents a unique combination of strategic advantages: a strong domestic market, excellent logistics, a favorable tax environment, and competitive energy costs.

However, capitalizing on these advantages requires meticulous financial planning. While these figures provide a framework, a successful venture demands a comprehensive financial model tailored to your specific project scale, technology, and sourcing strategy.

For entrepreneurs ready to turn this vision into a profitable reality, the crucial next step is to develop a business plan built upon a detailed financial forecast. This document is foundational for securing financing and guiding strategic decisions.