For entrepreneurs entering the solar manufacturing sector, choosing a location is a critical decision. While factors like market demand and logistics are paramount, government support can profoundly impact the financial viability of a new venture. The United Arab Emirates, with its ambitious renewable energy targets, presents a particularly compelling case.

Many business leaders see the immense potential of the region’s solar market but are often unaware of the robust framework of incentives designed to attract and nurture industrial investment. This support goes beyond simple grants, representing a strategic alignment between government policy and private enterprise.

Understanding this framework is the first step toward de-risking a significant capital investment and positioning a new factory for long-term success. This guide outlines the key incentives available for investors planning to establish solar panel manufacturing operations in the UAE.

The Strategic Context: Why the UAE Backs Local Solar Manufacturing

The UAE’s support for renewable energy manufacturing isn’t arbitrary—it’s a core component of a long-term national vision. To appreciate the incentives, it’s essential to understand the strategic goals driving them.

The UAE Energy Strategy 2050 aims for a 50% clean energy share in the country’s total energy mix, a goal requiring a massive expansion of solar capacity. This commitment is reinforced by the UAE Net Zero by 2050 initiative, a national drive to achieve net-zero emissions. Together, these policies create immense and sustained domestic demand for solar modules.

However, the government’s objectives extend beyond simply installing panels. The goals are to achieve:

- Economic Diversification: Reducing reliance on hydrocarbons by building a competitive, knowledge-based industrial sector.

- Energy Security: Gaining independence by controlling the supply chain for critical energy infrastructure.

- Technological Leadership: Positioning the UAE as a regional hub for renewable energy technology and manufacturing excellence.

Initiatives like the Dubai Clean Energy Strategy 2050, which targets 75% of the Emirate’s power from clean sources, underscore this commitment at both the federal and Emirate levels. By manufacturing locally, a business directly contributes to these national priorities and, in turn, can access significant support mechanisms.

Key Support Mechanisms for Solar Investors

The UAE government uses a multi-layered approach to incentivize industrial investment. This support extends beyond direct cash subsidies, creating a business environment that fosters growth and profitability.

The “Make it in the Emirates” Initiative

This flagship federal program is designed to attract industrialists, investors, and innovators to the UAE. It serves as an umbrella initiative for many of the available incentives.

By establishing a solar factory under this program, an investor signals alignment with the UAE’s industrial development goals. The program facilitates access to a broader ecosystem of support, from financing to regulatory guidance.

The In-Country Value (ICV) Program

The ICV program is one of the most effective, albeit indirect, incentives. This procurement-led mechanism gives preference in government and semi-government contracts to companies that contribute significantly to the local economy.

A solar factory producing modules within the UAE is well-positioned to achieve a high ICV score. This provides a substantial competitive advantage when bidding on utility-scale solar projects or supplying to government-backed developments. In essence, the government becomes a priority customer for locally manufactured goods. For new manufacturers in the region, securing a high ICV rating is a key strategic objective.

Favorable Financing and Tax Environment

The high initial capital expenditure is a significant hurdle for any new industrial venture. The UAE addresses this through specialized financial institutions and its notably business-friendly tax regime.

-

Emirates Development Bank (EDB): As a key financial institution supporting the UAE’s diversification strategy, the EDB offers competitive, long-term financing for projects in priority sectors, including renewable energy manufacturing. It can provide financing of up to 100% of the project value with grace periods of up to two years.

-

Tax Benefits: The UAE’s corporate tax environment is globally competitive. While a 9% federal corporate tax was introduced in 2023, businesses operating within designated Free Zones can often benefit from a 0% rate on qualifying income, providing a significant boost to profitability.

Securing financing from an institution like the EDB requires careful preparation. A credible, comprehensive feasibility study is essential to demonstrate the project’s viability to financiers, and knowing how to create a bankable business plan for your solar factory is an indispensable part of this process. [Link 2]

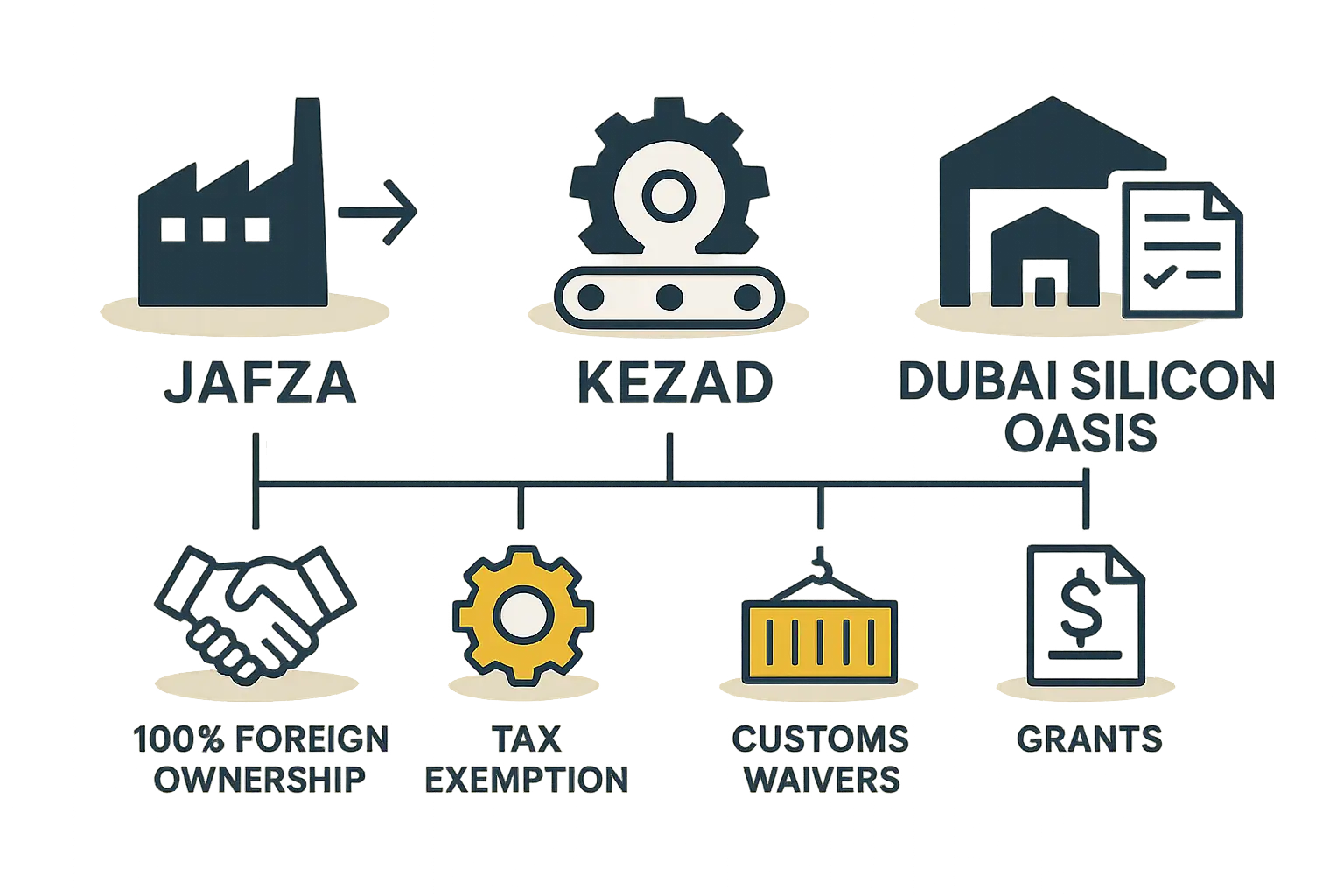

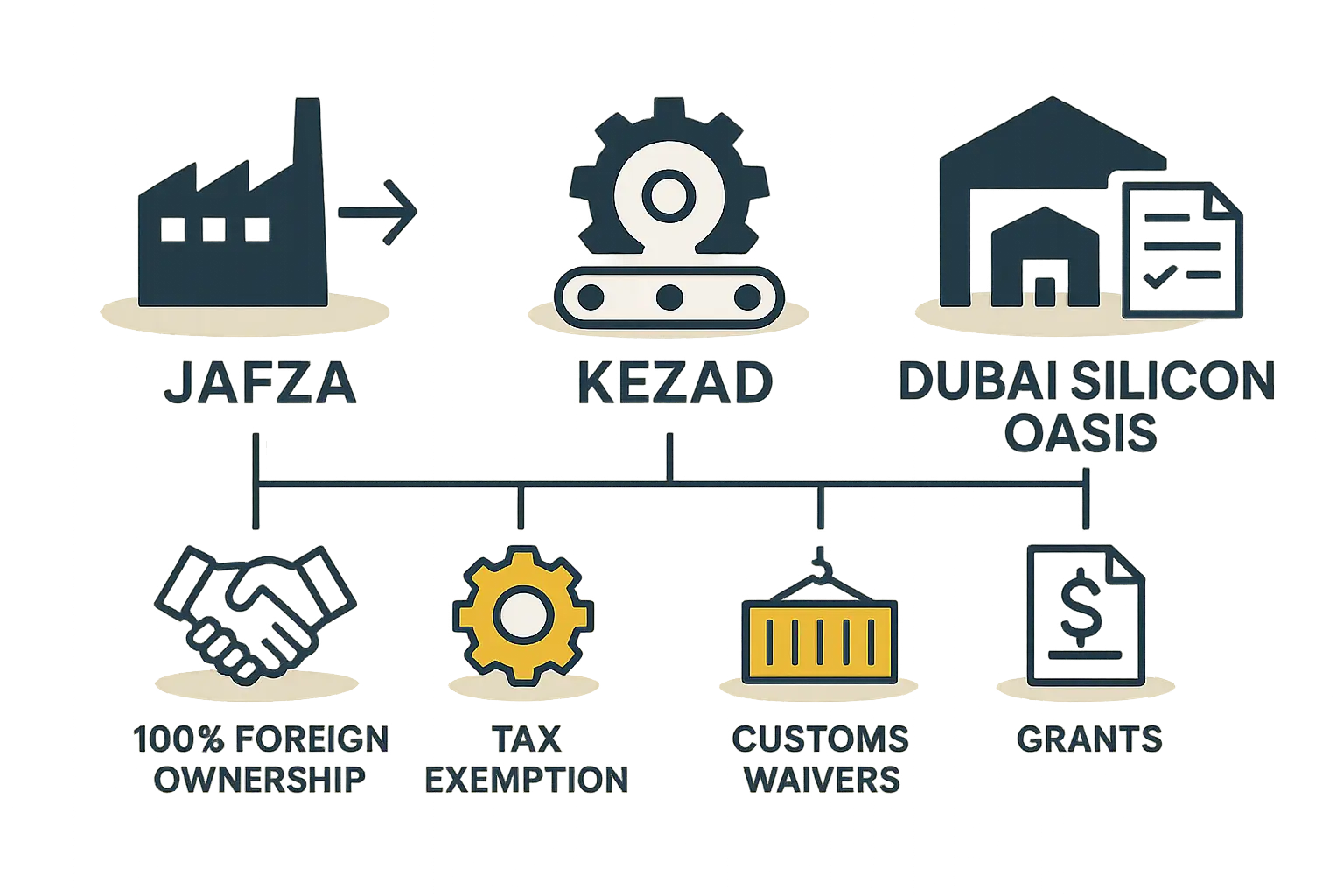

The Strategic Advantage of UAE Free Zones

For international investors, the UAE’s extensive network of Free Zones offers an exceptionally attractive entry point. These designated economic areas provide a range of benefits tailored to foreign-owned businesses.

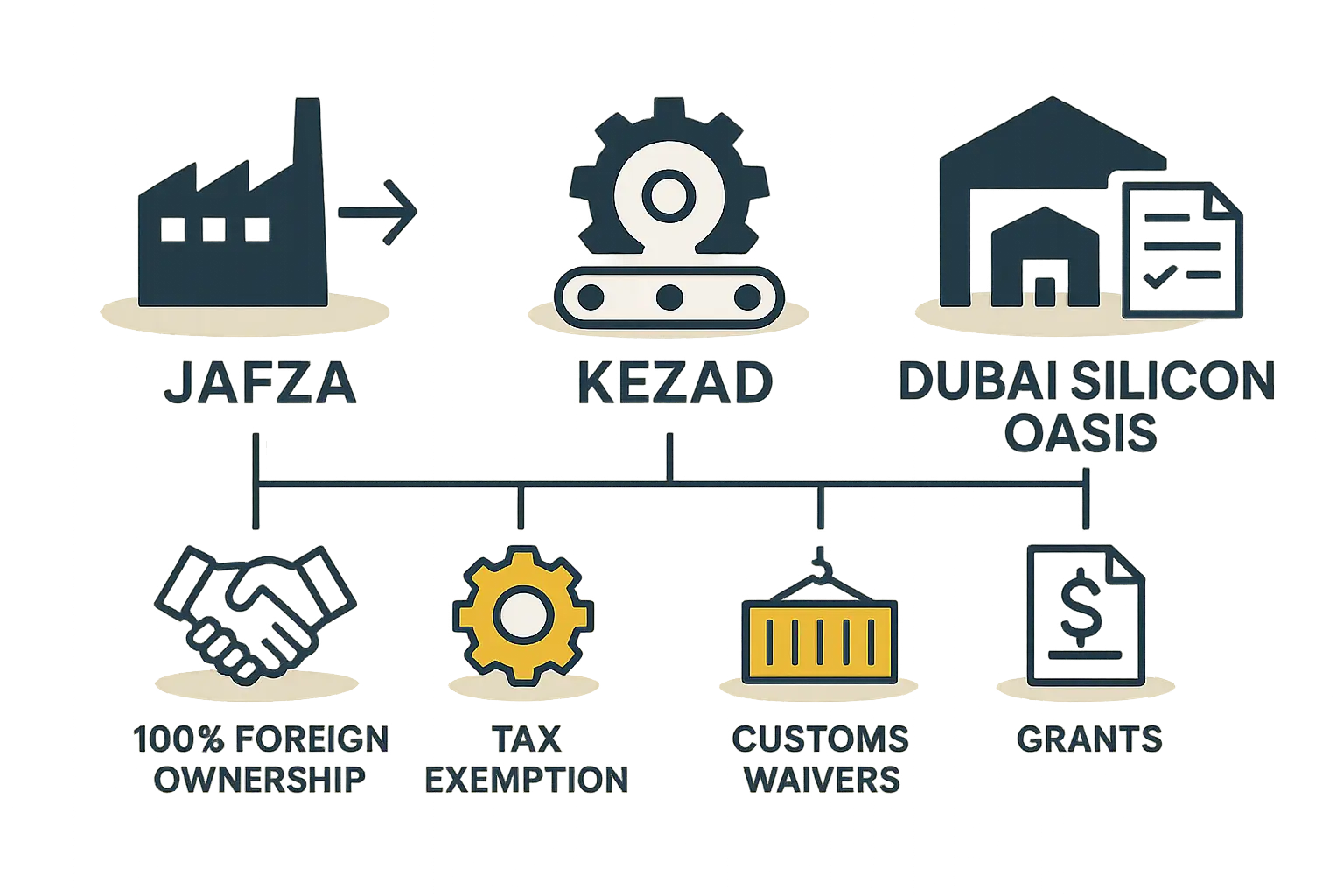

Key advantages of establishing a solar factory in a Free Zone like Jebel Ali Free Zone (JAFZA) in Dubai or Khalifa Industrial Zone Abu Dhabi (KIZAD) include:

- 100% Foreign Ownership: The investor retains full control of the enterprise without the need for a local sponsor.

- Tax Exemptions: Typically include 0% corporate and personal income taxes for a specified number of years.

- Repatriation of Profits: No restrictions on sending capital and profits back to the home country.

- Streamlined Logistics: World-class infrastructure, ports, and customs clearance processes, which are vital for importing raw materials and exporting finished modules.

These zones are more than just plots of land; they are integrated industrial ecosystems designed to minimize bureaucratic hurdles and operational friction for manufacturers.

Navigating the Practical Steps

Accessing these benefits requires a systematic approach, as the support is intended for serious, well-planned ventures that align with the nation’s strategic direction.

A common challenge for entrepreneurs new to the industry is understanding the technical and operational requirements. A turnkey production line, where a single partner manages the design, installation, and commissioning of the entire factory, can be an efficient solution. Understanding what a turnkey solar module production line involves can help investors appreciate how this model simplifies market entry. [Link 1]

The application process for financing and other incentives is rigorous. A business plan that clearly articulates the project’s contribution to job creation, technology transfer, export potential, and the ICV program is most likely to receive favorable consideration.

FAQ: Common Questions on UAE Solar Manufacturing Incentives

-

Do I need a local Emirati partner to set up a factory?

Not necessarily. In a Free Zone, an investor can retain 100% foreign ownership. For a “mainland” company, regulations have been relaxed, but a local agent or partner can still be beneficial for navigating administrative processes. -

Are these incentives only for large, utility-scale factories?

No. While large projects are welcome, programs from the Emirates Development Bank are also designed to support small and medium-sized enterprises (SMEs). The key criterion is the project’s strategic value and commercial viability, not just its size. A 50 MW factory with a solid business plan can be very attractive. -

How long does the approval process for financing and permits typically take?

Timelines vary depending on the project’s complexity and the completeness of the application. A well-prepared project with a bankable business plan that clearly aligns with the “Make it in the Emirates” objectives will generally have a smoother and faster approval process. -

If I manufacture in the UAE, do my solar panels still need international certifications?

Absolutely. Local manufacturing incentives do not replace the need for quality assurance and market access standards. To sell modules to reputable projects locally or to export them, they must meet international standards. For any aspiring manufacturer, understanding solar panel certifications like IEC, UL, and beyond is essential. [Link 3]

Your Next Steps in Exploring the UAE Market

The United Arab Emirates offers a uniquely supportive environment for establishing a solar manufacturing facility. Its combination of strategic government backing, sustained local demand, and world-class business infrastructure creates a strong value proposition.

Success, however, depends on careful planning and a thorough understanding of both the technical requirements of manufacturing and the strategic objectives of the UAE government. By aligning your project with national goals, you can unlock a range of incentives that significantly improve your venture’s profitability and long-term success.