When entrepreneurs explore global opportunities, their search for the right investment location often focuses on market size or labor costs. A less obvious—but often more powerful—factor is a country’s legal and financial framework.

Imagine a stable, strategically located economy that not only welcomes foreign investment but has also created a transparent, point-based system for granting significant, long-term tax exemptions to projects aligned with its national development goals. This is the opportunity Uruguay offers through its Investment Promotion Law, commonly known as COMAP.

For business professionals considering entry into the renewable energy sector, particularly in setting up a new solar module factory, this framework presents a compelling financial case. Understanding how this system works is the first step toward tapping into one of Latin America’s most investor-friendly environments.

What is Uruguay’s Investment Promotion Framework?

At the heart of Uruguay’s investment strategy is Law 16.906, which declares the promotion and protection of both national and foreign investment to be in the national interest. This law establishes a framework of equal treatment for all investors and provides a set of general incentives.

Its operational body is the Application Commission for the Investment Law (COMAP). The commission evaluates specific investment projects submitted by companies and, based on a predefined scoring matrix, recommends which should receive enhanced tax benefits. The goal is to attract and foster investments that contribute to key national objectives, such as job creation, technological innovation, and regional development.

For entrepreneurs planning to establish a solar module manufacturing facility, the COMAP framework provides a clear and predictable path to securing substantial financial advantages.

The COMAP Scoring System: A Path to Tax Benefits

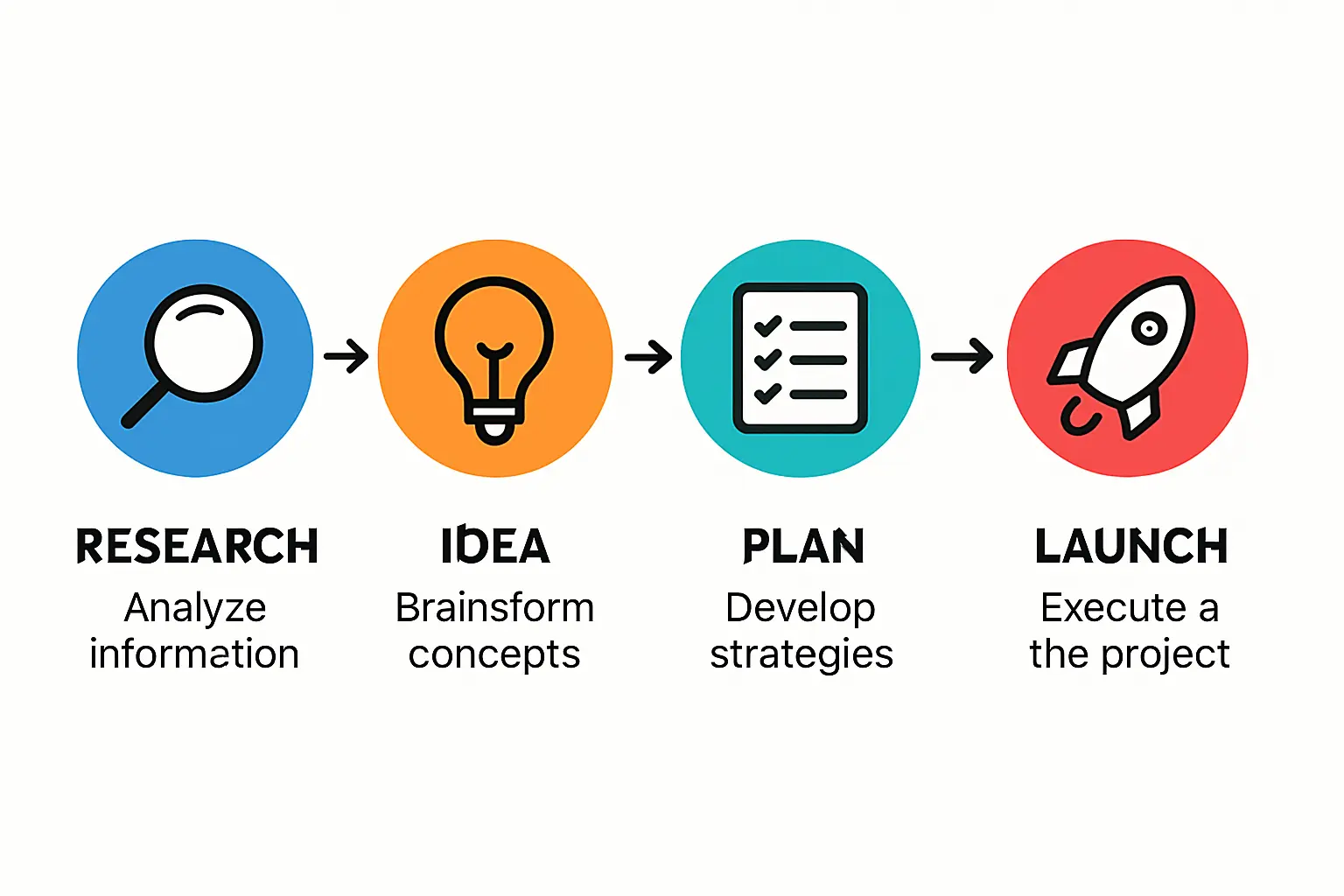

The COMAP system isn’t arbitrary; it’s a quantitative process where an investment project earns points based on its contribution to key indicators. The total score directly determines the scale and duration of tax benefits, with a higher score translating into more significant and longer-lasting exemptions.

While the matrix includes several factors, a few are particularly relevant for a new solar manufacturing enterprise.

Key Indicators for a Solar Manufacturing Project

Job Creation

Job creation is a primary indicator. The system evaluates not just the number of new jobs but also their quality, considering factors like required training and salary levels. A small to medium-sized solar factory employing 30 to 50 skilled and semi-skilled workers can generate a significant score in this category.

Decentralization

The Uruguayan government actively encourages economic development outside its capital, Montevideo. Projects located in the country’s interior departments receive a higher score. This incentive not only contributes to regional development but also often aligns with lower operational costs for land and facilities. For investors, this presents a strategic choice that yields both logistical and financial rewards.

Technology and Clean Production

This indicator favors projects that incorporate technological innovation, research and development, and clean technologies. A modern solar module factory is well-positioned to excel in this category. Establishing a new turnkey solar module line involves sophisticated automation and advanced manufacturing processes. Furthermore, because the end product directly contributes to clean energy generation, such projects are viewed very favorably.

Sectoral Indicator

The government periodically defines strategic sectors that are crucial for national development. Projects within these sectors, which often include renewable energy and its value chain, can receive a substantial number of points automatically. This effectively signals that solar manufacturing is a high-priority industry for the country.

Translating COMAP Scores into Financial Advantages

The points accumulated through the COMAP evaluation translate directly into tangible tax benefits. The most significant of these is the exemption from Corporate Income Tax (IRAE), which is levied at a standard rate of 25%.

The project’s score determines two things:

- The percentage of the IRAE exemption: The portion of the company’s net taxable income that will be tax-exempt.

- The duration of the exemption: The number of years the exemption can be applied.

A higher score allows a company to exempt a larger percentage of its profits over a longer period, significantly improving the project’s return on investment.

Beyond the IRAE exemption, projects approved by COMAP typically receive a suite of other powerful benefits:

-

Wealth Tax (IP) Exemption: Exemption from wealth tax on the assets included in the investment.

-

VAT Refund: A refund of the Value Added Tax (VAT) paid on the purchase of materials and services for civil works.

-

Tax-Free Imports: Exemption from all taxes, including customs duties, on the import of capital goods (machinery and equipment) that do not have a competitive domestic equivalent. This is a critical benefit that lowers the initial investment for a solar factory.

Based on J.v.G. Technology’s experience with international projects, these combined incentives can reduce the initial capital expenditure and accelerate the timeline to profitability by several years.

Frequently Asked Questions (FAQ)

What types of companies can apply for COMAP benefits?

Any company that is a taxpayer of the Corporate Income Tax (IRAE) in Uruguay can submit an investment project for evaluation, regardless of its size or ownership.

Is the application process complicated?

While the process requires careful preparation, the criteria are transparent. For entrepreneurs preparing the technical and operational aspects of a proposal, platforms like pvknowhow.com can provide foundational knowledge.

How long does the approval process typically take?

The evaluation and approval process by COMAP generally takes a few months from the submission of a complete project file.

Are the benefits guaranteed once the project is approved?

Yes. Once the Executive Power approves the project and issues a resolution, the tax benefits are secured. This guarantee is contingent on the company complying with the commitments made in its proposal, such as job creation and investment targets.

Can foreign investors fully own a project in Uruguay?

Yes, Uruguay’s legal framework allows for 100% foreign ownership of companies and provides strong protections for foreign investors, treating them equally to domestic investors.

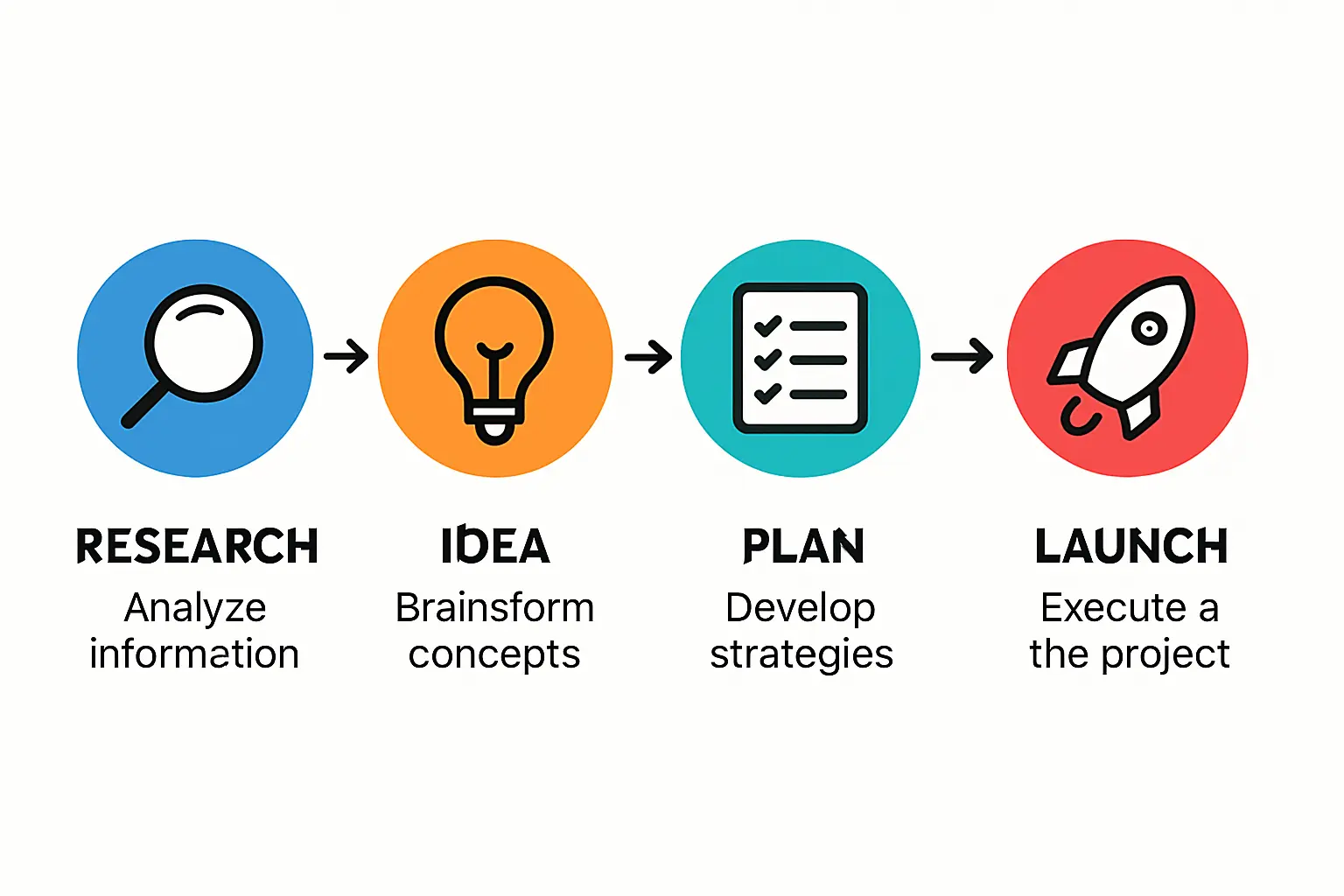

Strategic Planning for Investment in Uruguay

Uruguay’s COMAP framework offers a clear, stable, and highly advantageous environment for establishing a solar module manufacturing facility. It transforms a standard investment decision into a strategic partnership with a nation committed to fostering high-value industries. The system rewards projects that bring tangible benefits—new jobs, technological advancement, and regional growth—with significant, long-term financial incentives.

For the international entrepreneur, this means the financial model for a new solar factory in Uruguay looks fundamentally different from one in a country without such a structured program. Success, however, depends on a meticulously planned project that aligns with COMAP’s objectives from the outset. A thorough understanding of the technical, operational, and financial requirements is the foundation for a successful application.