Unlocking Austria’s Full Spectrum of Incentives for Solar Panel Manufacturers: A 2025 Guide

Austria is accelerating its renewable energy ambitions, creating significant opportunities for solar panel manufacturers. For any company considering establishing or expanding solar production in Europe, understanding the Austrian government’s comprehensive support system is crucial. This guide details the available incentives and the latest Austria energy subsidy news to help you make informed investment decisions for 2025.

Table of Contents

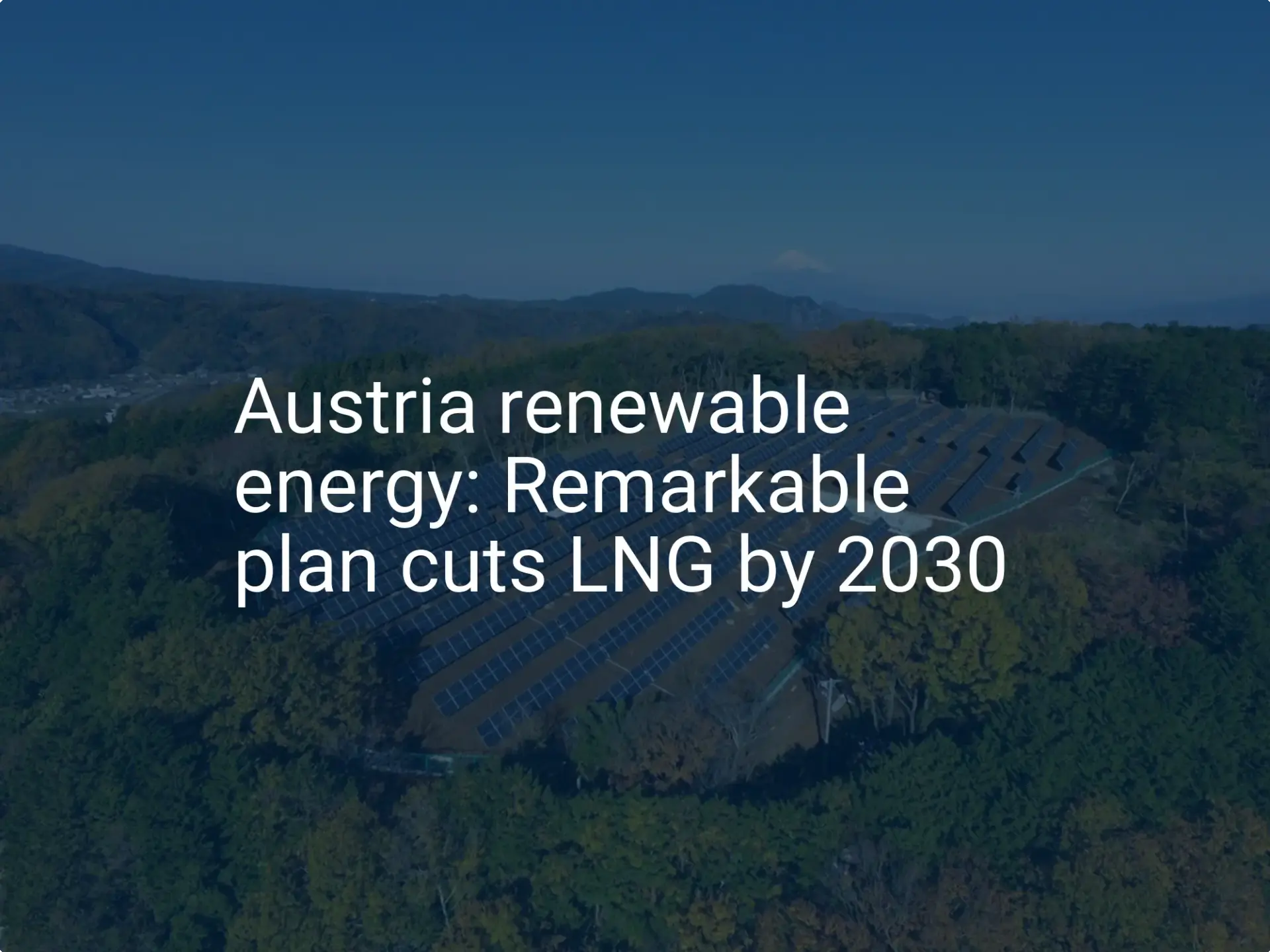

Austria’s Vision for a Domestic Solar Manufacturing Sector

Austria has set ambitious goals for its energy future, aiming for 100% renewable electricity by 2030 and targeting 11 TWh of solar power generation by the same year. Achieving these targets hinges on building a robust domestic solar manufacturing sector.

This commitment is not only about energy independence but also about fostering green jobs, enhancing technological leadership, and contributing to the European Union’s broader green industrial policy. The Austrian government recognizes that localizing the solar supply chain is key to resilience and long-term sustainability.

Your Solar Success Starts Here

Ready to launch your solar manufacturing venture?

Gain foundational knowledge from our free e-course, or let our expert services provide the hands-on support you need. We’ll make your solar venture smooth, profitable, and stress-free.

Deep Dive: Financial Incentives & Grants for Solar Manufacturers

Austria offers a range of financial incentives designed to attract investment in solar module production. These programs aim to reduce initial capital outlay and support the growth of manufacturing operations.

The “Made in Europe” Bonus Scheme

A cornerstone of Austria’s support is the “Made in Europe” bonus. This scheme is designed to bolster European manufacturing capabilities and strengthen supply chain resilience.

- What it offers: This initiative provides a significant financial incentive, potentially a bonus of up to 20%, for solar and storage projects that use components manufactured within Europe.

- Eligibility for manufacturers: While the bonus is often associated with project developers, it directly benefits manufacturers by creating strong demand for locally produced modules and components. To qualify, your products must meet specific origin criteria.

- Application and Timelines: The funding call for this bonus is anticipated around June 23, 2025. It’s essential to monitor announcements from relevant Austrian authorities, such as the Ministry for Climate Action, Environment, Energy, Mobility, Innovation and Technology (BMK).

- Strategic Benefit: This bonus creates a preferential market for solar modules produced in Austria and the wider European Union, giving local producers a competitive edge.

Renewable Energy Expansion Act (EAG) Funding

The Renewable Energy Expansion Act (Erneuerbaren-Ausbau-Gesetz, EAG) is a pivotal law underpinning Austria’s energy transition, allocating substantial funds for renewable energy projects, including solar.

- Relevance to Manufacturing: While much of the EAG funding targets project deployment, manufacturers benefit indirectly through increased demand. For 2025, Austria has allocated €70 million for renewables, with €60 million specifically for solar PV and storage projects.

- Tapping into Funding: Manufacturers can leverage this by partnering with developers who are applying for EAG subsidies, ensuring their modules are specified in grant applications.

- Focus on System Integration: EAG funding increasingly prioritizes projects that enhance grid stability and efficiency, including an emphasis on co-located storage. For instance, starting in Q4 2025, subsidies are expected to be available only for PV systems with co-located storage. Manufacturers developing integrated solutions or modules optimized for such systems will have a distinct advantage.

Investment Subsidies for Production Facilities

Austria also offers direct investment grants or subsidies aimed at reducing the capital expenditure (CAPEX) for establishing new solar manufacturing plants or expanding existing ones. These can cover a portion of costs related to machinery, equipment, and building construction. Details on specific programs, eligibility criteria, and responsible agencies are typically available through Austria Wirtschaftsservice GmbH (AWS), the federal promotional bank, or regional development agencies.

Support for Power Purchase Agreements (PPAs)

Recent policy updates in Austria have made Power Purchase Agreements (PPAs) more attractive. New guidelines for 2025 allow PV projects to receive subsidies even if they have a PPA; previously, for systems over 1MW, it was often an either/or choice. This change is expected to stimulate more large-scale solar projects, thereby increasing demand for solar modules from local manufacturers.

Navigating Tax Benefits for Solar Manufacturing in Austria

Beyond direct grants, Austria offers several tax advantages that can strengthen the financial case for solar manufacturing ventures.

Corporate Income Tax

Austria’s standard corporate income tax rate is 23% (as of 2024). While specific tax holidays for green industries are less common than direct subsidies, manufacturers should explore all available deductions. Austria also offers a research premium of 14% for eligible R&D expenditures, which can significantly reduce the tax burden for innovative companies.

Value Added Tax (VAT)

The VAT landscape requires careful attention.

- Manufacturing Inputs: For B2B transactions, such as purchasing machinery and raw materials, standard VAT rules generally apply. Businesses can typically reclaim input VAT.

- End-Products/Installations: Recent discussions have changed the VAT on the sale and installation of small PV systems (e.g., up to 35 kWp) for end-consumers. While a temporary 0% VAT rate was introduced, there are indications of a potential reversion to the standard rate or a modified system. These changes primarily affect installers and end-users, but they also indirectly influence market demand—a key consideration for manufacturers. Manufacturers should consult local tax advisors for the most current regulations applicable to their operations.

Property Tax and Other Levies

Municipalities may offer reductions or exemptions on property taxes for new industrial projects, particularly in designated development zones. Interested companies should contact local authorities in their prospective investment region.

Accelerated Depreciation

Austrian tax law allows for accelerated depreciation on certain assets, including machinery and equipment. This enables businesses to deduct a larger portion of their capital investments sooner, improving cash flow in the early years of operation. Businesses should verify specific rates and conditions with tax professionals.

Fueling Innovation: R&D Grants and Support Programs

Austria strongly supports research and development in green technologies, offering various programs that can benefit solar manufacturers.

Austrian Research Promotion Agency (FFG) Programs

The FFG is Austria’s national funding agency for industrial research, development, and innovation. It offers a wide array of grant programs, loans, and advisory services relevant to solar manufacturers, often covering stages from basic research to prototype development and market launch.

Specific Calls for Energy Transition and Green Tech

Funding calls at both the national and EU level focused on energy transition, circular economy, and green technologies are frequently launched. Austrian entities, including solar manufacturers, are often eligible to apply, making it wise to monitor platforms like those of the FFG and EU funding portals. The “Made in Europe” bonus itself underscores a focus on advanced technologies, with Austrian expertise noted in inverters and battery storage systems.

Collaboration with Universities and Research Institutes

Austria boasts a strong network of universities and research institutions specializing in materials science, engineering, and renewable energy. FFG and other bodies often promote and co-fund collaborative R&D projects between industry and academia. Such partnerships can provide access to cutting-edge research, skilled personnel, and specialized facilities.

Beyond Finance: Additional Support Structures

The Austrian support ecosystem extends beyond direct financial aid and tax benefits.

Infrastructure and Site Development Assistance

Regional development agencies often assist investors in:

- Finding suitable locations

- Navigating zoning regulations

- Accessing necessary infrastructure such as utilities and transport links

Some regions may offer pre-developed industrial parks.

Skilled Workforce Development and Training Initiatives

Austria places a high value on vocational training and skilled labor. Various programs, often in collaboration with industry, support the training and upskilling of the workforce. Manufacturers can partner with local technical schools or participate in government-backed training schemes to ensure a supply of qualified personnel.

Access to Market and Export Promotion

Organizations like the Austrian Federal Economic Chamber (WKO) and its international arm, Advantage Austria, provide support for:

- Market access

- Export promotion

- Establishing international business contacts

This can be valuable for manufacturers looking to serve both domestic and international markets.

How to Apply: A Practical Approach

Navigating the incentive landscape requires a systematic approach:

- Identify Relevant Programs: Based on your specific project (new factory, expansion, R&D focus), pinpoint the most applicable federal and regional incentives.

- Consult Key Agencies: Engage early with relevant bodies such as the Austrian Business Agency (ABA – Invest in Austria) for initial guidance, FFG for R&D, AWS for certain financial grants, and regional development agencies.

- Thoroughly Review Eligibility Criteria: Each program has detailed requirements covering company size, project scope, investment volume, job creation, and technological focus.

- Prepare Comprehensive Documentation: Applications typically require a detailed business plan, financial projections, technical specifications, and information on the project’s economic and environmental impact.

- Seek Expert Advice: Consider engaging local consultants or legal and tax advisors specializing in Austrian business incentives to ensure compliance and maximize your chances of success.

The Future Outlook for Solar Manufacturing Incentives in Austria

Austria’s commitment to its renewable energy targets and the broader European push for strategic autonomy in key industries like solar suggest a continued supportive environment for domestic manufacturers. The latest **Austria solar news** indicates that while specific programs may evolve, the underlying policy direction favors strengthening local production capabilities. Future incentives are likely to remain focused on:

- Innovation

- Efficiency

- Contributions to grid stability

- Circular economy principles

Investing in solar module manufacturing in Austria presents a compelling opportunity, supported by a government keen on fostering a resilient and technologically advanced domestic industry. By carefully exploring and leveraging the available incentives, you can significantly improve the outlook for your solar manufacturing venture.

FAQs for Solar Manufacturers Eyeing Austria

What is the single most significant recent incentive for solar manufacturers in Austria?

The “Made in Europe” bonus is highly significant, as it creates preferential market conditions for components and modules produced within Europe, including Austria. This directly boosts demand for locally manufactured solar products.

Are there direct grants specifically for setting up a new solar panel factory?

Yes, Austria, through agencies like Austria Wirtschaftsservice GmbH (AWS) and regional development bodies, may offer investment subsidies or grants for capital expenditures related to establishing or expanding production facilities. The specifics vary by program and region.

How does Austria support R&D in solar manufacturing?

Support primarily comes through the Austrian Research Promotion Agency (FFG), which offers various grants and loans for innovation. Additionally, a 14% R&D tax premium is available for eligible expenditures, and there are opportunities for collaboration with universities.

Do these incentives only apply to solar module assembly, or also to upstream components?

Many incentives, particularly R&D grants and investment support, can apply to various stages of the solar value chain, including component manufacturing, provided the project meets the eligibility criteria and aligns with Austria’s strategic goals. The “Made in Europe” bonus emphasizes the origin of components.

Where can I find the most up-to-date information on Austrian solar incentives?

Key resources include the Austrian Business Agency (ABA – Invest in Austria), the Ministry for Climate Action, Environment, Energy, Mobility, Innovation and Technology (BMK), the Austrian Research Promotion Agency (FFG), Austria Wirtschaftsservice GmbH (AWS), and the websites of regional (Bundesländer) economic development agencies.