Many entrepreneurs exploring the solar manufacturing sector assume the primary challenge is technical, from understanding cell efficiencies to lamination processes. Experience shows, however, that the most critical hurdle is often securing the right financing. Even a technically sound project can fail without a financial strategy that aligns with the expectations of local and regional lenders.

This is especially true in a market like Barbados. Despite the nation’s ambitious renewable energy goals and a stable financial system, success hinges on understanding the local banking landscape and the mindset of its capital providers.

This guide outlines the key financing channels available for a prospective solar module factory in Barbados and explains how to prepare a proposal that inspires confidence.

Table of Contents

Understanding the Financial Environment in Barbados

Before approaching potential financiers, it’s crucial to understand the context in which they operate. The Barbadian financial sector has several key characteristics that will directly impact any application for industrial project financing.

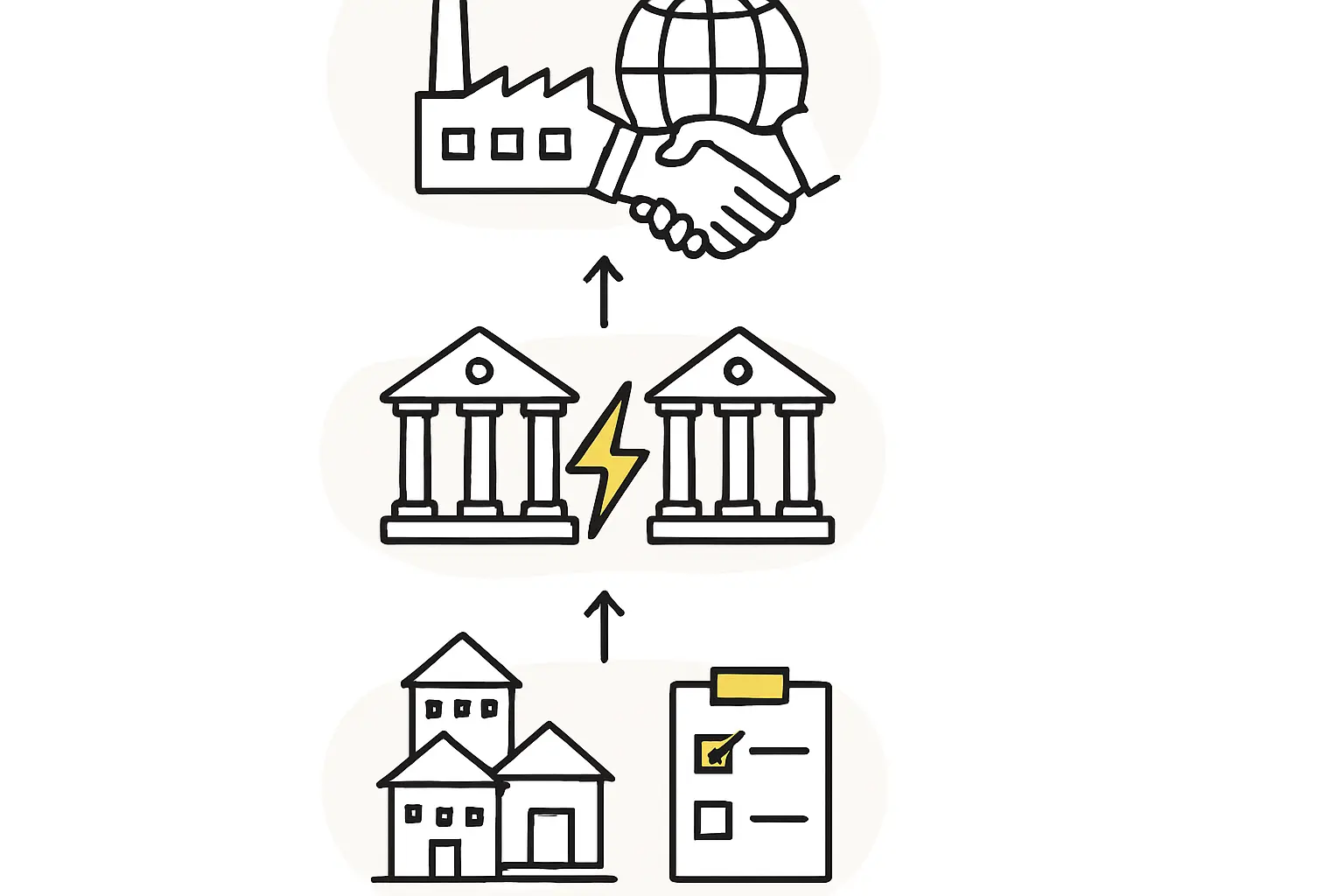

The banking system, for instance, is mature and highly liquid, meaning local commercial banks have substantial capital available to lend. This liquidity, however, is balanced by a traditionally conservative approach to risk. Lenders here are meticulous, prioritizing projects with clear, predictable revenue streams and manageable risks.

At the same time, the Government of Barbados has established one of the most ambitious climate targets in the world: 100% renewable energy generation and carbon neutrality by 2030. This national mandate creates a highly favorable environment for renewable energy projects, as financiers know that these ventures align with public policy, which de-risks an investment from a regulatory perspective.

The challenge for an entrepreneur, then, isn’t a lack of capital or political will. It’s presenting a solar module manufacturing project in a language that conservative bankers understand and trust—transforming a novel industrial venture into a bankable asset.

Key Financing Channels for Your Project

A robust financing strategy for a solar factory in Barbados will likely blend capital from different sources. Each channel has its own priorities, application processes, and benefits.

1. Local Commercial Banks

The primary commercial banks operating in Barbados—such as CIBC FirstCaribbean International Bank, Scotiabank, and RBC Royal Bank—represent the most direct source of debt financing.

Opportunity: These institutions have deep local knowledge and are the most accessible for Barbadian-based enterprises. They are familiar with financing commercial real estate and asset-backed loans.

Challenge: While these banks have experience with rooftop solar installations, financing a full-scale manufacturing plant is less common. Their risk assessment will focus heavily on the business plan, the management team’s experience, and potential off-take agreements for the finished modules. Your proposal must be exceptionally clear and detailed.

2. Regional Development Banks

For a project of this scale and strategic importance, regional development banks are a critical part of the financing mix.

Caribbean Development Bank (CDB): Headquartered in Barbados, the CDB’s mandate is to support economic growth and regional integration. A solar module factory aligns perfectly with its goals of promoting sustainable energy, creating skilled employment, and reducing import dependency. The CDB can provide loans, grants, and technical assistance. It often acts as an anchor investor, giving local commercial banks the confidence to participate.

Inter-American Development Bank (IDB): The IDB Group actively finances private sector projects that contribute to development in Latin America and the Caribbean. Its focus on infrastructure, climate action, and industrial competitiveness makes it a natural partner for a solar manufacturing venture.

3. International Climate Finance Mechanisms

Given the project’s direct contribution to climate goals, international funds can be a valuable source of concessional financing—loans with more favorable terms than standard market rates.

Green Climate Fund (GCF): The GCF is the world’s largest dedicated climate fund. While it does not typically fund private entities directly, it works through accredited institutions like the CDB. A project that aligns with CDB’s priorities may be able to benefit from GCF co-financing, significantly improving its overall financial viability.

4. Government Incentives and Support

The Barbadian government backs its 2030 commitment with supportive policies. The Fiscal Incentives Act, for example, offers tax holidays and exemptions on import duties for equipment used in approved manufacturing industries. While not direct financing, these incentives reduce the initial capital outlay and improve the project’s long-term profitability, making it more attractive to lenders.

Building a Bankable Business Plan

Securing funding from any of these sources depends entirely on the quality of your project proposal. A lender needs to see more than just an idea; they need to see a meticulously planned business.

A successful proposal must demonstrate a deep understanding of both the technical and commercial aspects of the operation. Your comprehensive business plan is your most important tool, and it must clearly articulate the market demand, projected cash flows, operational plan, risk mitigation strategies, and the full scope of the required investment.

Our experience with turnkey projects at J.v.G. shows that bankers gain confidence when technical risks are clearly managed. Demonstrating that you have a credible technology and implementation partner can significantly reduce their perceived risk and increase the likelihood of securing funds.

Frequently Asked Questions (FAQ)

-

How much initial capital is required to start a small-to-medium solar factory?

The investment depends on the desired capacity and level of automation. A semi-automated 20–50 MW line is a common entry point for new market players. A detailed breakdown of typical investment requirements for a solar factory will provide a clearer picture of the capital required. -

Do I need to be a solar engineer to get financing?

No, you do not need a technical background. However, financiers will expect you to have a credible technical partner. A bank’s primary concern is mitigating risk. Presenting a plan that includes a turnkey factory setup from an experienced engineering firm directly addresses this concern, as it shows the technical execution is in capable hands. -

How long does it typically take to secure financing and build a factory?

The financing stage can take 6–12 months, depending on the complexity of the deal structure and the preparedness of the business plan. Once financing is secured, the procurement, delivery, and installation of a turnkey line can be completed in under a year. -

Will local banks finance the entire project?

It is unlikely. Commercial banks typically prefer to co-finance alongside a development bank like the CDB. They will also expect the entrepreneur to contribute significant equity (typically 20-30% of the total project cost) to ensure all parties are financially committed to the project’s success.

Your Next Steps on the Journey

Understanding the financing landscape is the first step toward transforming your ambitious idea into a tangible asset for Barbados. Your success hinges on a clear strategy, a professionally developed business plan, and knowing what local lenders need to see.

For entrepreneurs ready to move from concept to detailed planning, our free introductory course on solar factory planning provides the essential knowledge to build a compelling case. Prepare thoroughly, and you can confidently engage the financial institutions ready to help build the future of energy in the Caribbean.