An entrepreneur looking to enter the European solar market might naturally look to established manufacturing hubs in Germany or Poland. A closer look at the strategic landscape, however, reveals a compelling alternative.

In 2022, Bosnia and Herzegovina attracted a record €858 million in Foreign Direct Investment (FDI), signaling growing confidence in its potential as a nearshore manufacturing base for the European Union. For investors looking to establish a solar module production facility, this Balkan nation offers a unique combination of financial incentives, strategic market access, and a capable workforce. This guide explores the FDI framework in Bosnia and Herzegovina, detailing the specific benefits available to new investors in the solar manufacturing sector.

Table of Contents

Why Consider Bosnia and Herzegovina for Solar Manufacturing?

Bosnia and Herzegovina (BiH) represents a strategic choice for industrial investors, offering a direct gateway to the European Union with economic policies increasingly geared toward attracting foreign capital.

The country’s strong industrial heritage in sectors like metal processing has fostered a skilled, cost-effective labor force well-suited to the technical demands of solar module assembly. Meanwhile, the government’s focus on the energy sector as an investment pillar, paired with new legislation supporting renewables, creates a highly supportive environment for solar manufacturing. This alignment of industrial capability and policy makes BiH a strong contender for entrepreneurs planning to serve the European market.

Understanding the Legal and Financial Framework for Foreign Investors

The country’s investment policy rests on the Law on the Policy of Foreign Direct Investment of BiH, which guarantees “national treatment” for foreign investors. This principle grants them the same rights, obligations, and legal standing as domestic entities, providing a secure and predictable foundation for business operations.

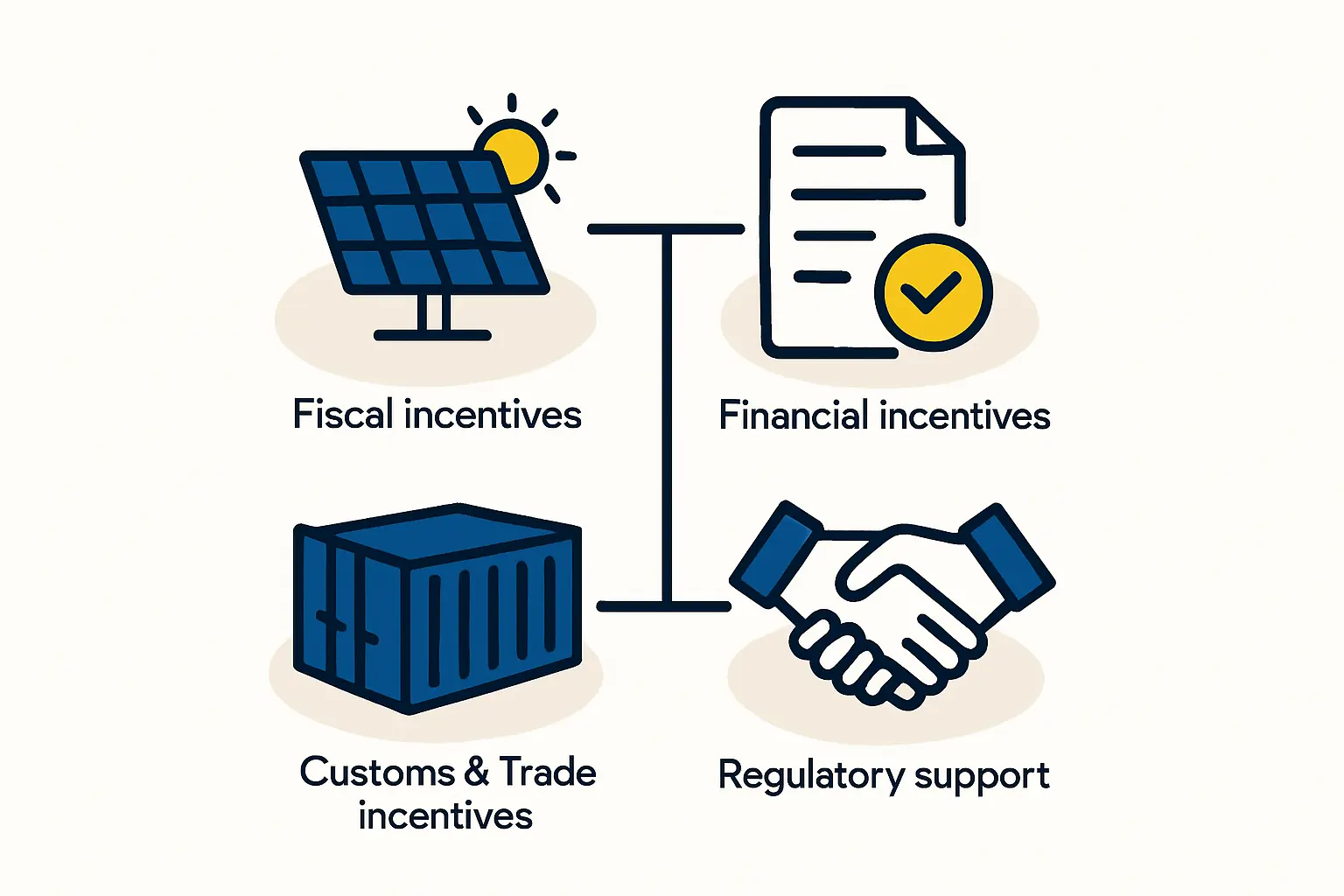

Beyond this legal security, the primary attraction lies in direct financial incentives designed to reduce both initial capital outlays and long-term tax burdens.

Corporate Income Tax (CIT) Incentives

The standard Corporate Income Tax (CIT) rate in the country’s two administrative entities—the Federation of Bosnia and Herzegovina (FBiH) and Republika Srpska (RS)—is 10%, one of the most competitive rates in Europe. However, significant reductions are available for substantial investments:

- In Republika Srpska (RS): An investor who commits more than BAM 10 million (approximately €5 million) over a five-year period is entitled to a 50% reduction in their CIT liability for those five years.

- In the Federation of BiH (FBiH): An investor who commits BAM 20 million (approximately €10 million) and hires at least 50 new employees within a five-year period can receive a 30% reduction in their CIT liability for those five years.

These incentives directly improve a new manufacturing facility’s financial projections, allowing for faster capital recovery and increased profitability during the critical early years of operation.

Value Added Tax (VAT) and Customs Benefits

The country’s VAT system is also structured to encourage investment in production. The standard rate is just 17% and offers several key exemptions that are crucial for a new factory:

- VAT Exemption: Equipment imported specifically for the production process is exempt from VAT.

- Customs Duty Exemption: Imported equipment that represents part of a foreign investor’s share in a local company is exempt from customs duties.

These exemptions translate to substantial savings on major initial costs, such as the machinery for a typical 20-50 MW solar factory or the expense of setting up a turnkey production line.

Strategic Market Access: The European Union Advantage

Perhaps the most significant strategic benefit of manufacturing in Bosnia and Herzegovina is its Free Trade Agreement (FTA) with the European Union. This agreement allows solar modules produced in BiH to be exported to any EU member state without incurring customs duties.

This duty-free access provides a powerful competitive edge. A manufacturer in BiH can offer pricing on par with or better than competitors within the EU, without the tariff barriers faced by producers from Asia or other regions. For an entrepreneur targeting the vast European solar market, this is a decisive advantage that can underpin an entire business model.

Navigating the Application Process: A Step-by-Step Approach

While the administrative structure of Bosnia and Herzegovina can appear complex—comprising the state level, two entities, ten cantons, and the Brčko District—the process for foreign investors is streamlined through a central agency.

The Foreign Investment Promotion Agency (FIPA) serves as the primary point of contact. The agency guides investors through the legal and administrative requirements, from initial inquiry to full operation.

A typical application path involves these key stages:

- Initial Contact and Consultation: Engage with FIPA to discuss the project scope, investment plans, and specific incentive eligibility.

- Company Registration: Formally establish a legal entity within Bosnia and Herzegovina. This is a prerequisite for all subsequent steps.

- Application for Specific Incentives: Submit formal applications to the relevant authorities (entity-level tax administrations, customs offices) to secure CIT reductions and VAT/customs exemptions.

- Securing Permits and Licenses: Obtain the necessary building, environmental, and operational permits, a process where FIPA can provide valuable assistance.

Practical Considerations and Potential Challenges

Investors should be realistic, however. The country’s administrative complexity and political landscape can present hurdles, and navigating the various layers of government requires both patience and local expertise.

These challenges are balanced by significant practical advantages. Skilled labor is available at competitive rates, and the country’s central location in Southeast Europe, with developing transport links, makes it a logical hub for regional distribution. For any international investor, success ultimately depends on pairing a well-researched strategy with the right local support.

Building Your Business Case: An Investor’s Perspective

When these elements are combined, the business case is compelling. Consider an entrepreneur developing a business plan for a solar venture, specifically a 30 MW production facility. The ability to import multi-million-euro production machinery without VAT or customs duties dramatically lowers the initial investment barrier.

A 50% reduction in corporate income tax for the first five years significantly accelerates the path to profitability, while the final product—high-quality solar modules—can enter the lucrative EU market without tariffs. Based on experience from J.v.G. turnkey projects, securing these incentives early in the planning phase can fundamentally improve a project’s financial viability and long-term success.

Frequently Asked Questions (FAQ)

Q: What is the single biggest financial advantage of manufacturing solar modules in BiH?

A: The combination of a low 10% Corporate Income Tax, substantial multi-year tax reductions for large investments, and completely duty-free access to the entire European Union market creates a uniquely powerful financial advantage.

Q: How long does the process to secure incentives typically take?

A: The timeline varies with the project’s complexity, but a proactive approach and close collaboration with FIPA are essential. A well-prepared investment plan can help expedite the process, which typically takes several months from initial application to final approval.

Q: Is a foreign investment legally protected in Bosnia and Herzegovina?

A: Yes. The “national treatment” clause in the FDI law ensures foreign investors have the same legal protections as domestic ones. Bosnia and Herzegovina is also a signatory to over 40 bilateral agreements on the promotion and protection of investments.

Q: Is it necessary to have a local partner to invest in the country?

A: While not legally required, engaging a local partner or experienced consultants can be highly beneficial for navigating the administrative landscape, understanding local business customs, and accelerating the setup process.

Your Next Steps in Exploring Solar Manufacturing in BiH

Bosnia and Herzegovina offers a compelling, though nuanced, opportunity for entrepreneurs in the solar industry. The combination of direct financial incentives, a secure legal framework, and strategic tariff-free access to the EU market warrants serious consideration for any investor looking to establish a competitive manufacturing presence in Europe.

Success lies in thorough preparation and understanding how to leverage the available support structures. With the right guidance, the country’s complexities become manageable, unlocking its significant economic potential.