When considering a new venture, an entrepreneur weighs two key factors: a strong market opportunity and a stable, supportive operating environment. While West Africa’s demand for renewable energy is undeniable, the decision to invest millions in a new solar module factory hinges on more than just market potential.

This decision requires a clear understanding of the financial and legal landscape. For investors looking to Burkina Faso, the nation’s Investment Code is a critical document, one that fundamentally shapes the financial viability of such a project.

This guide explains the key provisions of Burkina Faso’s Investment Code, translating its legal articles into tangible business benefits for a new solar manufacturing enterprise. It outlines the specific tax and customs advantages available, details the application process, and clarifies the obligations that accompany these incentives.

Table of Contents

Understanding the Investment Code: A Strategic Framework for Investors

An investment code is a legal framework established by a government to attract and regulate private investment, especially from foreign entities. It acts as a formal agreement, offering clear rules, guarantees, and incentives to businesses that align with a country’s economic development goals.

For a capital-intensive project like a solar panel factory, Burkina Faso’s Investment Code is more than a bureaucratic formality—it is a strategic tool. The code is designed to reduce initial setup costs, improve cash flow during the critical early years, and provide long-term stability for the investor. The country actively encourages investment in renewable energy, making solar manufacturing a priority sector eligible for the most favorable terms.

Key Benefits for Solar Manufacturing Under Burkina Faso’s Regime

The Investment Code offers a privileged status, known as “Regime A,” for new enterprises that meet specific criteria related to investment amount and job creation. For a solar panel manufacturing plant, this status unlocks substantial financial advantages.

Tax Exemptions: A Multi-Year Advantage

Profitability in the early stages of operation is crucial for survival and growth. The Investment Code provides significant relief from major corporate taxes, allowing a new company to reinvest its earnings.

Key exemptions during the “installation phase”—the period of setting up the factory—include:

- Exemption from customs duties and taxes on the importation of equipment and materials needed for construction.

- Exemption from Value Added Tax (VAT) on invoices related to the construction and installation of the production facility.

Once the factory is operational, the benefits continue for five to seven years, depending on the project’s location:

- Exemption from the Tax on Industrial and Commercial Profits (BIC): This is the primary corporate income tax. A full exemption allows the business to retain 100% of its profits during this period.

- Exemption from the Minimum Flat-Rate Tax (IMF): This tax is typically payable even if a company does not generate a profit, so its exemption removes a fixed cost during the early years.

- Exemption from the Employers’ and Apprenticeship Tax (TPA): This reduces the company’s payroll-related tax burden.

These exemptions collectively create a powerful financial cushion, enabling a new venture to achieve stability and scale its operations more rapidly.

Customs Duty Relief: Reducing Initial Capital Expenditure

The largest single cost in establishing a solar factory is often the machinery. A complete turnkey solar panel production line involves importing numerous high-value machines, from cell stringers to laminators and testers.

Under the Investment Code, an approved project receives a total exemption from all customs duties and taxes, including VAT, on the importation of this essential equipment. This provision directly reduces the capital required to launch. For an investment where machinery can account for over 60% of the budget, this relief translates into millions of dollars in upfront savings, improving the project’s return on investment from day one.

Guarantees and Protections for Investors

Beyond fiscal incentives, the code provides legal assurances crucial for foreign investors. These include:

- Freedom of Management: Investors are free to manage their companies as they see fit, within the confines of the law.

- Right to Transfer Capital: The code guarantees the right to transfer profits, dividends, and proceeds from the sale of the business out of the country, subject to foreign exchange regulations.

- Non-Discrimination: The code ensures that foreign investors receive treatment equal to that of national investors, preventing unfair disadvantages.

- Dispute Resolution: It provides for recourse to international arbitration to settle disputes between the investor and the state, offering a neutral and predictable legal process.

The Approval Process: A Step-by-Step Overview

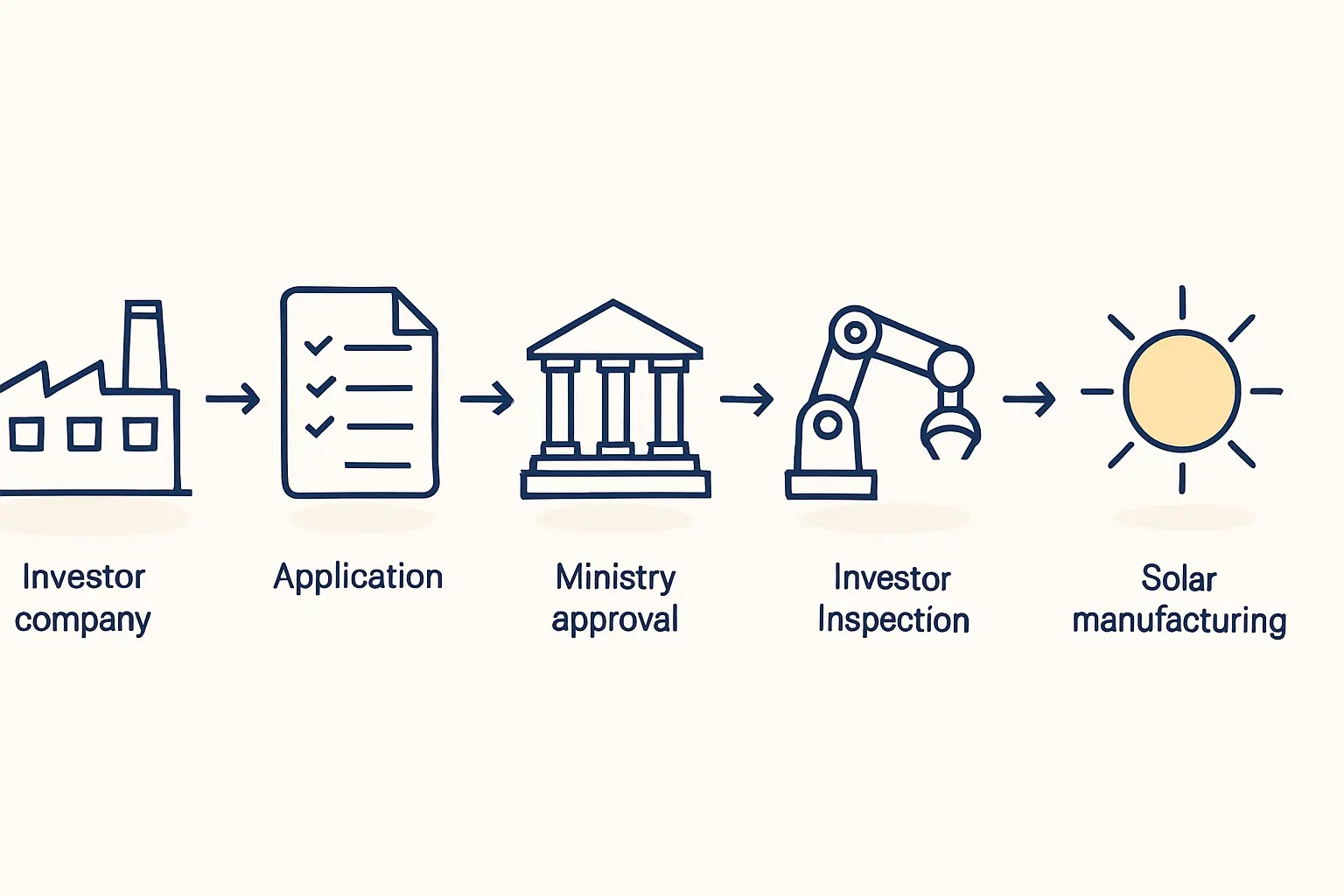

Accessing these benefits requires a formal application and approval process managed by the National Investment Commission. While structured, the process is generally straightforward for a well-prepared applicant.

- Submission of Application: The investor submits a detailed file to the relevant ministry (in this case, likely the Ministry of Industry, Commerce, and Handicrafts). This file must include legal documents, technical specifications, and a comprehensive solar manufacturing business plan.

- Review by the Commission: The National Investment Commission reviews the application to ensure it meets the eligibility criteria laid out in the code. This includes verifying the investment amount, job creation projections, and the project’s alignment with national development priorities.

- Opinion and Decree: The National Investment Commission issues an opinion on the project’s eligibility within 45 days of receiving a complete application file. Based on a favorable opinion, an inter-ministerial decree is then issued, formally granting the project the benefits of the chosen regime.

To ensure a smooth and timely approval, a meticulously prepared business plan and clear technical documentation are essential.

Eligibility and Obligations: What is Required of Your Project?

The incentives offered by the Investment Code are part of a partnership. In return for these benefits, the investor’s project must contribute to Burkina Faso’s economy. The primary obligations include:

- Minimum Investment: The project must meet a minimum investment threshold defined in the code.

- Job Creation: The project is expected to create a specified number of permanent jobs for nationals.

- Reporting: The company must submit annual reports to the authorities detailing its progress in implementing the investment program.

- Compliance: Adherence to all national laws, including labor, environmental, and social security regulations, is mandatory.

Failure to meet these obligations can result in the withdrawal of the approved benefits. Therefore, the initial business plan must contain realistic and achievable projections for investment and job creation.

Frequently Asked Questions (FAQ)

Q: What is the minimum investment required to qualify for Regime A?

A: The Investment Code specifies different thresholds. For a new company, the minimum investment is typically 100 million FCFA (approx. €152,000) with the creation of at least 20 permanent jobs for nationals. A solar manufacturing plant would comfortably exceed this threshold.

Q: Can these benefits be combined with other incentives?

A: The code generally states that the benefits provided are exclusive of other specific incentive schemes unless explicitly allowed. It is crucial to clarify this during the application phase.

Q: What happens if my project timeline changes?

A: The approval is granted based on the timeline presented in the business plan. Any significant delays or changes must be formally communicated to the relevant authorities to request an extension and avoid non-compliance.

Q: Is a local partner mandatory for foreign investors?

A: No, the Investment Code allows for 100% foreign-owned enterprises. However, partnering with a local entity can sometimes facilitate administrative processes and provide valuable market insights.

Q: How are disputes handled under the Investment Code?

A: The code encourages amicable settlement first. If that fails, it provides for resolution through national courts or, for foreign investors, through international arbitration bodies like the International Centre for Settlement of Investment Disputes (ICSID).

Conclusion: A Foundation for Long-Term Success

Burkina Faso’s Investment Code makes a clear, compelling case for establishing a solar manufacturing plant in the country. It provides a structured pathway to significantly reduce capital outlay and operational costs during a business’s most vulnerable early years.

The combination of tax holidays, customs exemptions, and legal guarantees creates a competitive advantage and a lower-risk environment for investors. For any entrepreneur or company exploring this opportunity, a thorough understanding of the code is not just advisable—it is fundamental to the due diligence process. A project’s financial model and long-term viability are directly shaped by the powerful incentives this framework offers. Properly navigating its requirements is the first step toward building a successful and sustainable manufacturing enterprise in one of Africa’s most promising solar markets.