An entrepreneur in Ouagadougou has arranged financing and secured a suitable building for a new solar module factory. The vision is clear: to produce high-quality solar panels that will power Burkina Faso’s future. However, the project soon runs into a critical reality: its core components—solar cells, specialized glass, and aluminum frames—are not available locally. Every high-value part must be imported, creating a complex logistical chain that stretches from manufacturing hubs in Asia to the factory floor in West Africa.

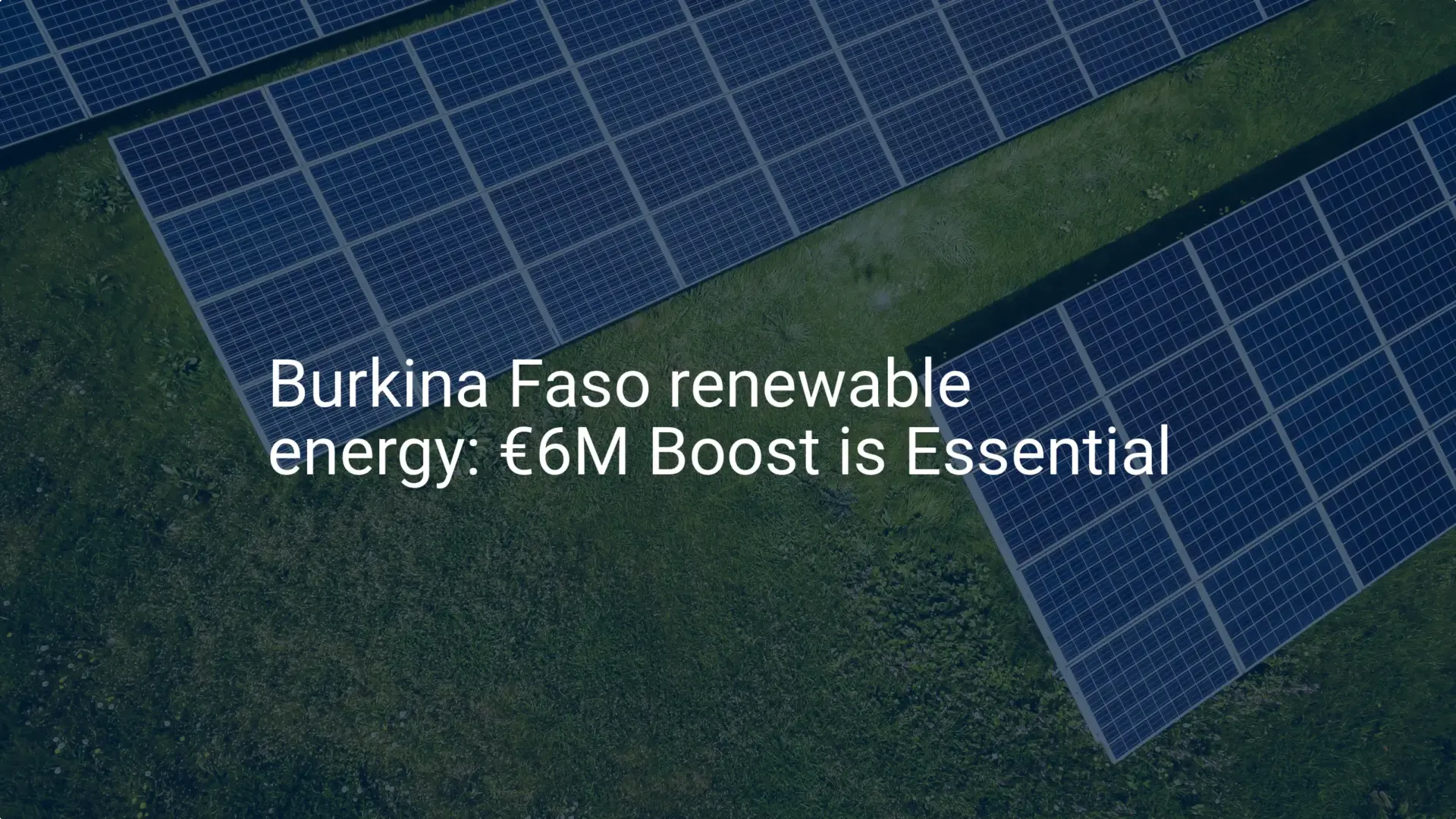

This challenge isn’t unique; it’s a standard hurdle for nearly every new solar module manufacturer in emerging markets. Burkina Faso has one of the highest solar power potentials in the world, with the International Renewable Energy Agency (IRENA) estimating its technical potential at 17,500 TWh per year. Tapping into this potential requires mastering the art and science of global sourcing.

This article provides a strategic framework for managing raw material imports, vetting international suppliers, and mitigating the inherent risks of a global supply chain.

Table of Contents

Understanding the Global Solar Supply Chain

A successful sourcing strategy begins with understanding the global solar manufacturing landscape. The industry is highly concentrated, with a significant portion of production centered in a few key regions.

According to the International Energy Agency (IEA), China currently holds a market share of over 80% across all key manufacturing stages, from polysilicon production to final module assembly. For a new factory in Burkina Faso, this means sourcing key inputs like solar cells, EVA encapsulant, and solar glass will almost certainly involve international trade, primarily with Asian suppliers.

A robust import strategy is therefore more than an administrative task—it’s a core business function. The success of the entire manufacturing operation depends on the reliable and cost-effective flow of these materials. The complete list of components is detailed in the Bill of Materials (BoM), which serves as the “recipe” for the solar panel manufacturing process.

The Essential Imported Components for Your Factory

A standard photovoltaic module is assembled from several specialized components. For a new factory in Burkina Faso, importing the following critical materials is a necessity.

Solar Cells: The Engine of the Panel

These are the most technologically sensitive and highest-value components of a solar panel, converting sunlight directly into electricity. Whether using Passivated Emitter and Rear Cell (PERC) or newer technology like TOPCon, these cells must be sourced from specialized international manufacturers. Their quality directly determines the panel’s final efficiency and performance.

Solar Glass and Encapsulants (EVA/POE)

The front glass must be a highly transparent, low-iron, tempered material that maximizes light transmission while resisting environmental impacts. Encapsulant films, typically Ethylene Vinyl Acetate (EVA), laminate the components and protect the solar cells from moisture and physical damage.

Backsheets and Aluminum Frames

The backsheet is the rearmost layer, providing mechanical protection and electrical insulation. The aluminum frame gives the panel rigidity and a structure for mounting. While aluminum extrusion may be available regionally, the specific alloys and precision required for quality frames often mean they must also be imported, at least initially.

The Logistical Journey: From Supplier to Ouagadougou

Sourcing materials is one challenge; ensuring their timely and safe arrival is another. As a landlocked country, Burkina Faso relies on the ports of neighboring nations, which adds several layers to the logistics process.

The typical journey for a container of solar cells looks like this:

- Factory to Port of Loading: Transport from the supplier’s factory in Asia to a major port like Shanghai or Ningbo.

- Sea Freight: A 45- to 60-day sea voyage to a West African port such as Tema (Ghana), Abidjan (Côte d’Ivoire), or Lomé (Togo).

- Customs and Port Clearance: This is a critical bottleneck. Delays here can last for days or even weeks, incurring significant demurrage fees.

- Overland Transport: The final leg of the journey by truck from the port to the factory in Ouagadougou.

According to World Bank logistics performance data, while regional ports have improved, cross-border clearance and inland infrastructure remain significant hurdles. Effective management requires experienced freight forwarders and customs brokers who specialize in the West African corridor.

A Framework for Vetting and Selecting Suppliers

Choosing the right supplier is arguably the most critical decision in the sourcing process. Partnering with an unreliable one can lead to production stoppages, quality issues, and financial losses. A systematic vetting process is therefore essential.

Step 1: Initial Qualification and Communication

Begin by identifying established suppliers with a proven track record of exporting to international markets, particularly Africa. Clear communication is vital, ensuring they fully understand your technical specifications and quality requirements.

Step 2: Sample Testing and Specification Alignment

Never place a large order without first testing samples. Crucially, these samples must be tested on your manufacturing equipment to confirm compatibility and performance. A small deviation in cell size or ribbon thickness can cause major issues on an automated production line.

Step 3: The Importance of a Factory Audit

If possible, a physical or third-party virtual audit of the supplier’s factory is invaluable. This provides insight into their quality control systems, production capacity, and overall professionalism.

Step 4: Negotiating Contracts and Payment Terms

The final contract should clearly define all specifications, delivery terms (Incoterms), quality standards, and payment schedules. This legally binding document is your primary protection.

Based on experience from J.v.G. turnkey projects, having a technical partner with an established network can significantly de-risk this process. A partner providing a turnkey factory solution typically manages this entire vetting process, leveraging established relationships with pre-qualified suppliers.

Managing Financial and Inventory Risks

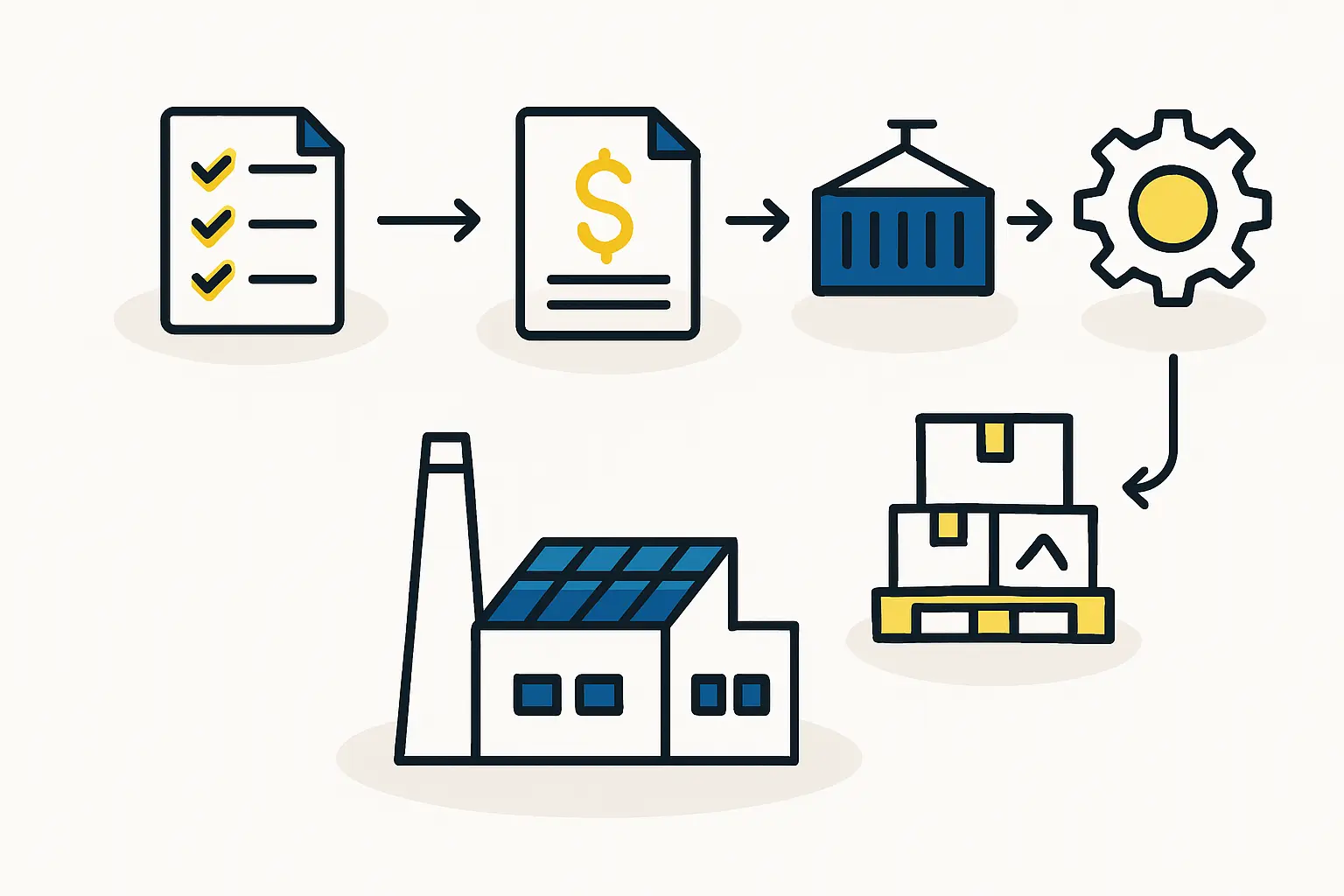

A steady flow of materials requires sound financial planning and strategic inventory management.

Financing Imports

In international trade, the Letter of Credit (LC) is a standard financial instrument that mitigates risk for both buyer and seller. Issued by a bank, an LC guarantees that the supplier will be paid once the terms of the agreement—such as providing shipping documents—are met. This builds trust, especially in new business relationships. Entrepreneurs must also account for currency risk, as materials are typically priced in USD while local revenues are in West African CFA francs (XOF).

Strategic Inventory Management

Given the long lead times (60–90 days from order to delivery) and potential for logistical delays, a factory cannot operate on a just-in-time basis. Holding a safety stock of key components is essential. A common benchmark for a new factory is to have enough raw materials on hand for two to three months of continuous production. This ties up working capital but provides a crucial buffer against supply chain disruptions, ensuring customer orders can be fulfilled without interruption.

Frequently Asked Questions (FAQ)

Q: Can I source any materials locally in Burkina Faso or West Africa?

A: Sourcing locally is challenging, at least initially. While low-value items like packaging materials (cardboard boxes, corner pieces) can often be found nearby, high-technology components like solar cells and specialized glass are not yet produced in the region. In the medium term, aluminum extrusion for frames may become a viable regional option.

Q: How do I handle quality control for an order from thousands of kilometers away?

A: Hiring a third-party inspection service is common practice. These agencies can visit the supplier’s factory or the port of loading to verify that the goods match the quality and quantity specifications in your purchase order before they are shipped.

Q: What are the typical payment terms for a first-time buyer?

A: For new relationships, suppliers often request a down payment of 30% with the order and the remaining 70% upon presentation of shipping documents. As trust is established over time, more favorable terms may be negotiated. A Letter of Credit is a recommended alternative.

Q: How much working capital is needed for raw materials?

A: This depends entirely on your planned production capacity. As a general rule, you should budget enough working capital to cover the cost of an initial two- to three-month safety stock, plus the value of the next shipment in transit.

Conclusion: Building a Resilient Supply Chain

For an entrepreneur in Burkina Faso, starting a solar module factory is a formidable but achievable goal. Success hinges on recognizing that the business is not just about manufacturing but about managing a complex global supply chain. By taking a strategic approach to sourcing, rigorously vetting suppliers, and carefully managing logistical and financial risks, a new factory can establish a resilient flow of materials. This well-planned supply chain is the backbone that will transform Burkina Faso’s immense solar potential into tangible, locally produced energy solutions.