For international entrepreneurs, entering the West African solar market can be a formidable challenge. Tariffs, logistical hurdles, and varying cross-border regulations often complicate market entry and erode profits.

Ghana, however, offers a strategic solution for investors looking to serve this growing region: establishing operations within a Free Zone. This framework, governed by the Free Zones Act (Act 504), is designed to attract export-oriented businesses by providing a compelling mix of tax incentives, customs relief, and streamlined access to regional markets.

This guide explains how investors can leverage the program to build a successful, tax-efficient solar module manufacturing plant focused on export.

Ghana’s Strategic Position as an Export Gateway

Ghana’s geographic location, political stability, and well-developed port infrastructure in Tema and Takoradi make it a natural hub for West African trade. Establishing a manufacturing base here puts a business in a prime position to serve the entire Economic Community of West African States (ECOWAS), a market of nearly 400 million people.

The Free Zones Act amplifies these inherent advantages, transforming an already good location into a powerful business platform. This strategic positioning allows manufacturers to import raw materials and components from global markets, assemble high-value products like solar modules in Ghana, and then export them duty-free to neighboring countries. This creates a competitive edge that is difficult to replicate.

The Ghana Free Zones Act (Act 504): A Framework for Growth

Enacted in 1995, the Free Zones Act has a clear objective: to promote economic development through export-oriented manufacturing and processing. The Ghana Free Zones Authority (GFZA), the governing body responsible for implementing this policy, serves as a one-stop shop for investors seeking licenses and establishing operations.

The core principle is simple: create a business-friendly environment that removes typical barriers to trade and investment. For a solar module manufacturer, this means predictable costs, simplified logistics, and significant financial benefits. Experience from J.v.G. turnkey projects in emerging markets shows that a clear legal framework like Act 504 significantly reduces risk during the initial setup phase.

Key Financial Incentives for Solar Module Manufacturers

The financial incentives offered under the Free Zones Act are substantial and directly target the primary costs of a manufacturing business. These benefits can dramatically improve the financial viability and long-term profitability of a project.

Corporate Tax Holiday and Reduced Rates

Perhaps the most significant incentive is the complete exemption from corporate income tax for the first ten years of operation. For a new venture facing high startup costs and working toward profitability, this decade-long tax holiday is a critical advantage. After this period, the corporate tax rate is permanently capped at a maximum of 15%, which is considerably lower than standard corporate tax rates in the region.

Exemption from Import Duties and Levies

A solar module assembly line requires importing specialized machinery and a steady supply of raw materials, such as solar cells, EVA film, backsheets, and aluminum frames. Under the Free Zones Act, all machinery, equipment, and raw materials intended for the production process are 100% exempt from customs duties and levies. This removes a major layer of cost and complexity from the supply chain, directly reducing the capital required to start and operate the factory.

Unrestricted Profit Repatriation

For foreign investors, the ability to move capital is paramount. The act guarantees a 100% exemption from withholding taxes on dividends and allows for the unrestricted repatriation of profits and dividends. It also permits Free Zone enterprises to operate foreign currency accounts, providing stability and flexibility in financial management. These provisions assure investors that they can manage their returns without restrictive capital controls.

Operational Requirements and Market Access

While the benefits are significant, operating within a Free Zone comes with specific requirements designed to ensure the program’s export focus is maintained.

The 70/30 Export-to-Local Sales Rule

The foundational rule for any Free Zone enterprise is that at least 70% of its annual production must be exported. This requirement ensures the program meets its primary goal of boosting Ghana’s export economy.

The remaining 30% of production can be sold on the domestic Ghanaian market, providing a valuable opportunity to serve local demand for solar energy while still benefiting from the program’s incentives. Crucially, products sold locally are subject to standard Ghanaian import duties and taxes, ensuring a level playing field with other importers.

Unlocking the ECOWAS Market

For a solar module manufacturer in Ghana, the greatest opportunity lies in duty-free and quota-free access to the ECOWAS market. This means modules assembled in a Ghanaian Free Zone can be sold in Nigeria, Côte d’Ivoire, Senegal, and other member states without incurring the import tariffs that would apply to modules shipped from Asia or Europe. This access creates a decisive price and logistics advantage, enabling a Ghanaian-based manufacturer to compete effectively across West Africa.

The Path to Establishing Your Free Zone Enterprise

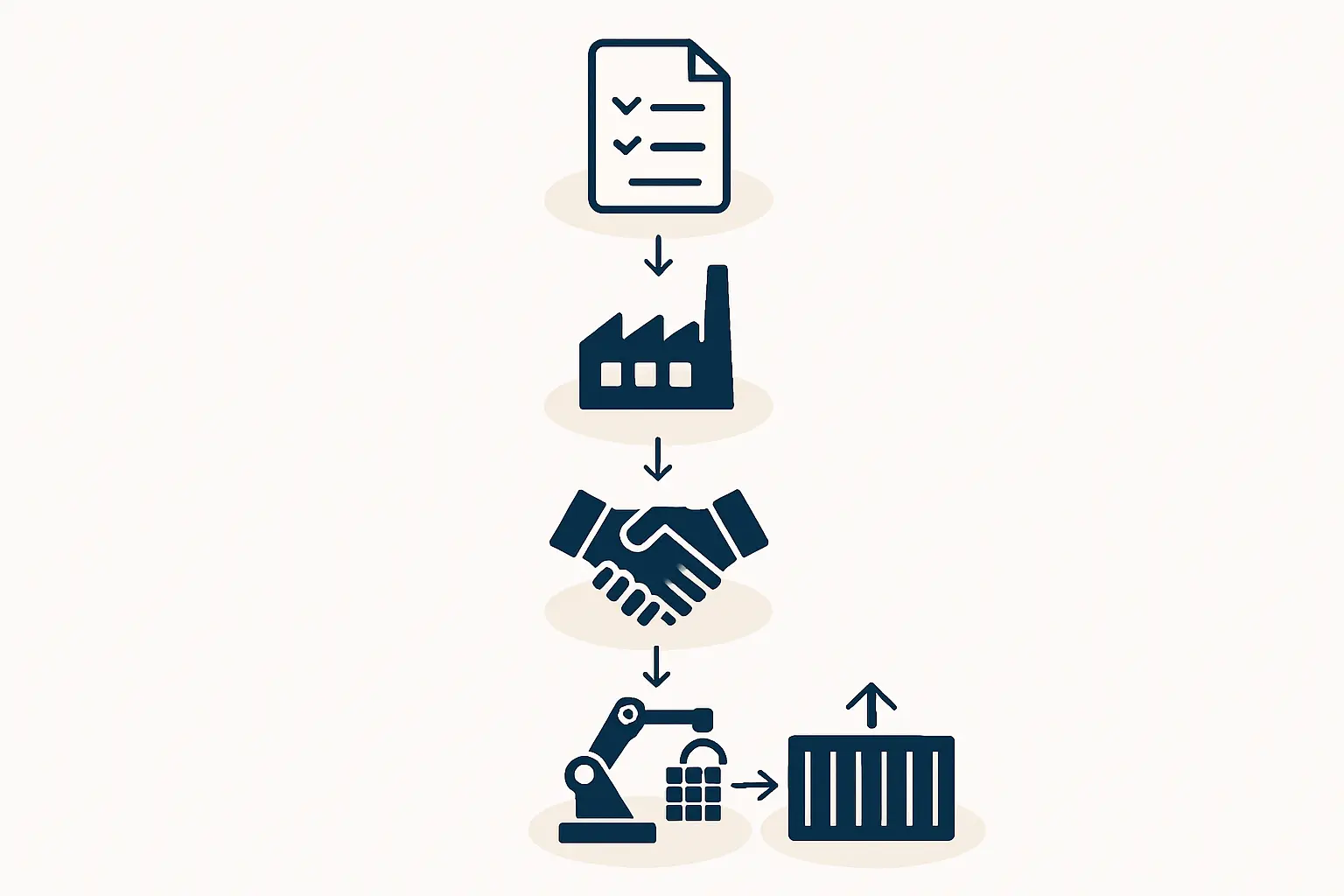

The process of setting up a Free Zone company is structured and managed by the GFZA. While it requires thorough preparation, the path is clear for serious investors.

The Application and Licensing Process

The first step is to submit a formal application to the GFZA. A critical component of this application is a comprehensive business plan for a solar factory. This document must detail the project’s scope, production capacity, financial projections, employment plan, and market strategy. The GFZA reviews this plan to ensure the project is viable and aligns with the goals of the Free Zones program.

Once the application is approved, the investor incorporates the company in Ghana and obtains the necessary permits from the Environmental Protection Agency (EPA).

Setting Up Your Facility

Investors have two main options for their physical location:

-

Lease a serviced plot within a designated export processing zone (e.g., in Tema), which offers pre-developed infrastructure.

-

Declare a single-factory zone at a location of their choice, provided it meets the GFZA’s requirements.

Regardless of the location, designing and implementing an efficient production facility is essential. A well-planned turnkey production line ensures that the factory can meet its production targets, quality standards, and operational budgets from day one.

Frequently Asked Questions (FAQ)

-

Can a non-Ghanaian investor own 100% of a Free Zone company?

Yes. The Free Zones Act permits 100% foreign ownership, providing complete control and security for international investors. -

Is there a minimum investment requirement to qualify for Free Zone status?

There is no statutory minimum investment figure. However, the project’s viability and scale must be convincingly demonstrated in the business plan. The overall investment requirements will depend on the target production capacity of the solar module factory. -

How long does the licensing process typically take?

While timelines can vary, a well-prepared application can often be processed and approved by the GFZA within a few months. The overall project timeline, including factory construction and commissioning, typically ranges from 12 to 18 months. -

What happens if a company fails to meet the 70% export requirement?

The GFZA monitors compliance closely. Companies that consistently fail to meet the export threshold may face penalties or risk having their Free Zone license revoked. A robust export strategy is therefore crucial from the outset.

A Strategic Entry Point into West African Solar

For entrepreneurs and companies aiming to manufacture solar modules for the West African market, Ghana’s Free Zones Act offers an exceptionally compelling framework. The combination of a 10-year tax holiday, duty-free importation of machinery and materials, and unrestricted access to the vast ECOWAS market creates a solid foundation for a profitable and sustainable business.

While the opportunity is significant, success requires diligent planning, a robust business case, and expert execution. By understanding the framework of Act 504, investors can confidently take the first steps toward building a leading solar manufacturing operation in the heart of West Africa.