Ghana’s Renewable Energy Master Plan sets an ambitious target: increasing the share of renewable energy in the national generation mix to 10% by 2030.

For the discerning entrepreneur, this policy is more than a government objective—it signals a significant market opportunity. The journey, however, from vision to a fully operational solar module manufacturing plant hinges on one critical challenge: securing long-term, structured financing.

Institutions like Development Bank Ghana (DBG) and international climate funds are ready to invest in the nation’s green transition, but they fund meticulously planned, de-risked projects, not ideas alone. A standard business plan is insufficient. What’s required is a bankable proposal—a comprehensive document that demonstrates technical viability, financial robustness, and a clear mitigation strategy for every potential risk. This article offers a strategic blueprint for developing such a proposal, tailored to the specific requirements of development finance institutions.

Understanding the Financing Landscape in Ghana

Securing capital for a manufacturing project requires engaging with specific types of financial institutions, each with its own mandate and criteria. Understanding their roles is the first step in building a successful financing strategy.

Development Bank Ghana (DBG)

The DBG was established to provide long-term, patient capital for key economic sectors, with manufacturing and technology as primary areas of focus. Unlike commercial banks that often prefer short-term lending, the DBG’s mandate aligns perfectly with the multi-year timeline of establishing and scaling a factory. A proposal to the DBG must therefore emphasize the project’s contribution to national development, such as job creation, technology transfer, and alignment with Ghana’s local content policies.

International Climate Funds

Organizations like the Green Climate Fund (GCF) and the African Development Bank (AfDB) have substantial capital earmarked for projects that deliver a measurable climate impact. Their evaluation process goes beyond financial returns, placing heavy emphasis on Environmental, Social, and Governance (ESG) criteria. A proposal for these funds must quantify the project’s environmental benefits, such as CO2 emissions reduction, and its social impact, like the creation of new skilled jobs.

Commercial Banks

While often hesitant to be the primary lender on a new industrial project due to perceived risk, local commercial banks play a crucial role in providing working capital and other financial services once long-term financing is secured. A development bank’s involvement can often de-risk the project sufficiently to attract commercial co-financing.

The Blueprint for a Bankable Proposal

A proposal that attracts development finance rests on a foundation of solid data and strategic foresight. It must anticipate and answer every question a lender’s risk committee might raise. The following steps offer a structured approach.

Step 1: Establish a Robust Financial Model

The financial section of your proposal must demonstrate a clear path to profitability and loan repayment under various conditions.

- Go Beyond Basic ROI: Your projections should include a sensitivity analysis. This models the project’s performance against potential economic shocks, such as fluctuations in the Cedi-to-USD exchange rate, changes in interest rates, or volatility in the price of raw materials. It shows you have planned for reality, not just the best-case scenario.

- Detailed Cash Flow Projections: Provide monthly or quarterly cash flow statements for at least the first three to five years. This demonstrates a deep understanding of the operational funding required to manage inventory, payroll, and other expenses before revenue stabilizes.

- Structure the Debt Request: Clearly outline the proposed loan structure, including the requested tenor (loan period), a potential grace period on principal repayment during the factory setup and commissioning phase, and the intended use of funds. This shows you have thought through the entire capital lifecycle.

A detailed financial model is the core of your solar module manufacturing business plan.

Ready to make big Profits?

The solar Industry is Booming

WE HELP NEWCOMERS to the solar industry start their own solar module production line. Customers can make BIG PROFITS by selling modules and finding investors, without wasting money and time on things they don't need!

Step 2: De-Risk the Project at Every Level

For a financier, risk is the primary concern. Your proposal must systematically identify and mitigate every potential risk category.

- Execution and Technical Risk: For an entrepreneur without a background in photovoltaics, the risk of technical failure or budget overruns during plant construction is high. This can be addressed by partnering with an experienced engineering firm. A turnkey solar module manufacturing line from a reputable provider like J.v.G. Technology GmbH, with a history of successful installations worldwide, provides financiers with a crucial guarantee of quality, timeline adherence, and performance.

- Operational Risk: Once the factory is built, can it produce modules to international standards consistently? A well-documented solar panel manufacturing process, complete with quality control protocols and staff training programs, is essential. Drawing on the experience of J.v.G. turnkey projects, a comprehensive training schedule for local engineers and operators is a powerful way to mitigate this risk.

- Market Risk: Who will buy your solar modules? Securing letters of intent (LOIs) or memorandums of understanding (MOUs) from potential large-scale customers—such as local solar installers, real estate developers, or government agencies—is a direct way to demonstrate market demand.

Technology as a Cornerstone of Bankability: The DESERT+ Advantage

In a climate like Ghana’s, characterized by high temperatures and humidity, not all solar technology is equal. Standard solar modules can suffer from accelerated degradation, leading to lower-than-projected energy output over the asset’s lifetime. This performance risk translates directly to financial risk for an investor.

Your proposal can turn this environmental challenge into a strategic advantage by specifying technology engineered for local conditions.

J.v.G. Technology’s DESERT+ modules are specifically designed to perform reliably in harsh climatic conditions. Key features, such as specialized cell coatings and advanced encapsulation materials, ensure higher energy yields and a longer operational lifespan in high-temperature environments.

For a financier, specifying DESERT+ technology is not merely a technical detail; it is a critical risk mitigation tool. It substantiates the revenue projections in your financial model, proving the primary income-generating asset is built to withstand local environmental stresses and perform reliably for decades.

Aligning with ESG and National Impact Goals

Development finance institutions have a dual mandate: to achieve a financial return and to foster sustainable development. Your proposal must speak to both.

- Environmental: Quantify the positive climate impact. Calculate the estimated annual reduction in CO2 emissions your factory’s output will enable.

- Social: Frame the project as a catalyst for economic growth. Detail the number of direct and indirect jobs that will be created, from factory floor operators to logistics and sales staff. Emphasize the transfer of advanced manufacturing technology and skills to the local workforce.

- Governance: Highlight the project’s management structure. Partnering with an established German engineering firm demonstrates a commitment to transparency, high standards, and proven project management methodologies, giving financiers confidence in the project’s execution.

Frequently Asked Questions (FAQ) for Aspiring Solar Entrepreneurs in Ghana

What is the typical initial investment for a small-scale factory?

The initial investment for a 20–50 MW semi-automated production line typically ranges from a few million to several million US dollars, depending on the level of automation and the scope of included services. A detailed business plan is necessary to determine the precise figure.

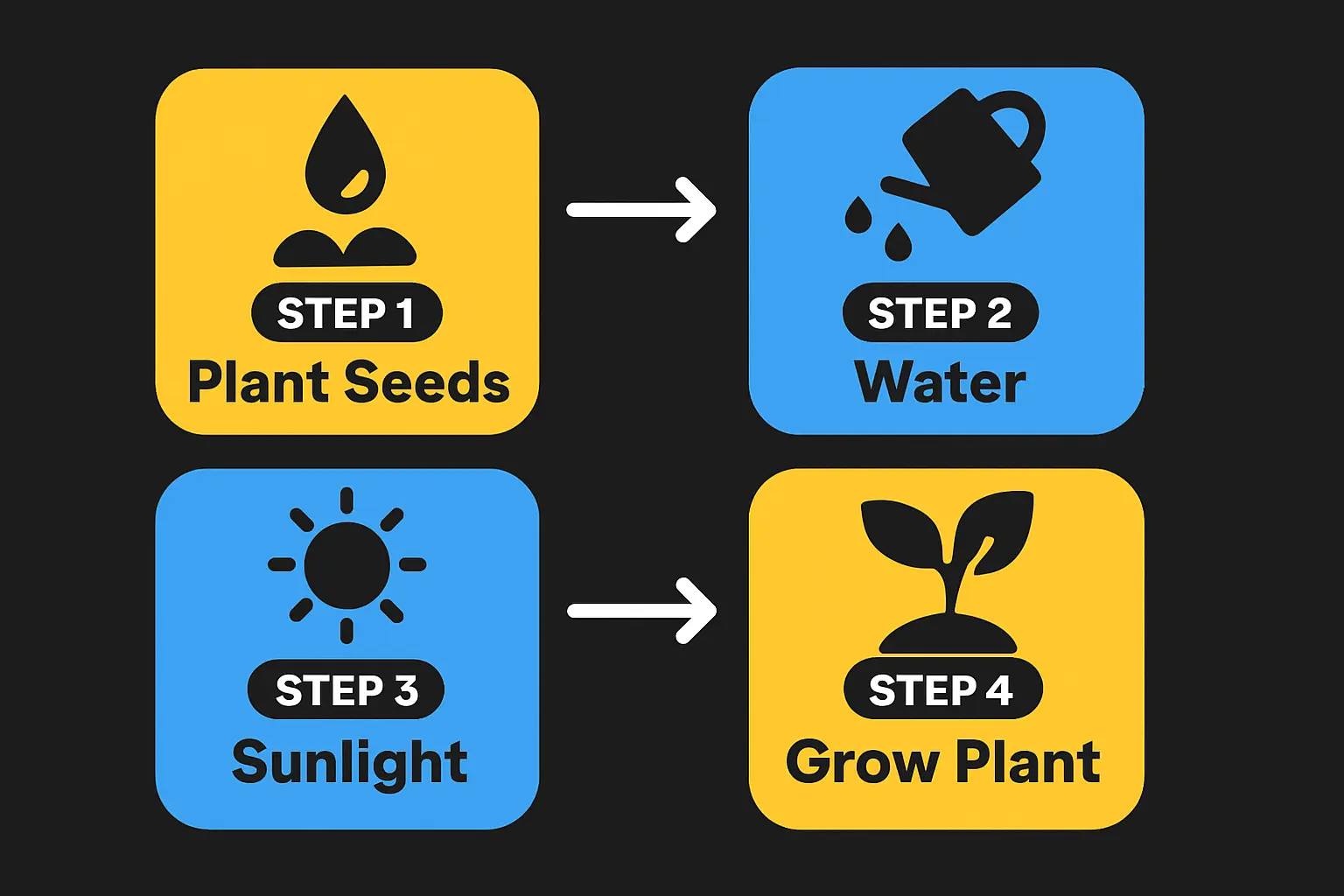

How long does it take to get a factory operational?

With a structured turnkey approach, a solar module manufacturing line can be fully operational in under 12 months from the signing of the contract. This includes planning, machine delivery, installation, and staff training.

Do I need a technical background to start this business?

No. While technical curiosity is helpful, a strong business background is more critical. The key is to partner with technical experts who provide the engineering, process knowledge, and training. pvknowhow.com was founded on the principle that entrepreneurs need a reliable guide, not an engineering degree, to succeed in this industry.

What role does the government play beyond policy?

The Ghanaian government and its agencies can be crucial partners. They may act as a key customer for state-funded projects, facilitate land acquisition, or provide investment incentives. Engaging with agencies like the Ghana Investment Promotion Centre (GIPC) early in the process is highly recommended.

Securing financing from development banks and climate funds is a meticulous process that demands more than a compelling vision. It requires a proposal that is financially sound, technically verified, and strategically de-risked. By building a robust financial model, mitigating risks with proven partners and technology, and aligning the project with national development goals, an entrepreneur in Ghana can present an investment opportunity that is not just attractive, but truly bankable.