Many entrepreneurs look at Mongolia’s vast, sun-drenched landscapes and see immense potential for renewable energy. The ‘Land of the Blue Sky’ averages over 250 sunny days per year, making it an ideal location for solar power. But transforming this natural advantage into a profitable solar manufacturing business takes more than sunlight—it demands a robust financial strategy.

While the Mongolian government offers a framework of incentives to attract investment, many potential business owners find the application process opaque and complex. This guide provides a step-by-step walkthrough of the financial incentive landscape in Mongolia. It moves beyond a simple list of benefits to explain the practical application process, outlining what government bodies look for and how to prepare a successful submission. This information is critical for developing a realistic and bankable [internal link: solar factory business plan].

Understanding Mongolia’s Renewable Energy Framework

Before applying for incentives, it’s essential to understand the legal and regulatory foundation. Mongolia’s commitment to renewables is outlined in its Law on Renewable Energy, first passed in 2007 and updated since. This legislation sets the national strategy for reducing dependence on fossil fuels and encouraging private sector investment in clean energy.

Two key government bodies oversee this framework:

-

The Ministry of Energy (MOE): As the primary policymaking body, the MOE is the first point of contact for new manufacturing projects. It reviews and approves major investment proposals and incentive applications.

-

The Energy Regulatory Commission (ERC): The ERC is the independent regulatory authority. While its main role is to set tariffs and license energy producers, its policies directly influence market demand for locally manufactured solar modules. Understanding the ERC’s tariff structure is vital for projecting your future customers’ purchasing power.

Experience from J.v.G. turnkey projects shows that entrepreneurs who take the time to understand the objectives of these institutions are better positioned to align their business proposals with national energy goals, significantly improving their chances of approval.

Key Financial Incentives for Solar Panel Manufacturers

While policies can evolve, several core incentives form the backbone of Mongolia’s support for the renewable sector. These are designed to reduce both initial capital expenditure and the long-term operational tax burden.

Tax Exemptions on Imported Equipment

One of the most significant financial hurdles is the [internal link: investment for a solar factory], particularly the cost of specialized machinery. To address this, the Mongolian government offers:

-

Value Added Tax (VAT) Exemption: Imported machinery, technology, and components essential for a solar module production line are often exempt from the standard VAT.

-

Customs Duty Exemption: Similarly, these goods may be exempt from import tariffs.

Together, these exemptions can lower the initial equipment investment by 10–15%, a substantial saving for a 20–50 MW production line.

Corporate Income Tax Holidays

To improve the long-term profitability and cash flow of new manufacturing ventures, the government provides significant corporate income tax (CIT) relief. Qualifying renewable energy projects are typically offered a structure that includes:

-

100% CIT Exemption for the first five years of operation.

-

50% CIT Exemption for the subsequent five years.

This 10-year period of reduced taxation allows a new factory to reinvest its earnings into expansion, quality control, and workforce training.

Feed-in Tariffs (FiTs) and Market Stability

While Feed-in Tariffs are paid to power producers, not manufacturers, they are a critical indirect incentive. The ERC sets stable, long-term prices for solar energy fed into the grid. This policy creates a predictable and profitable market for solar farm developers—who are the primary customers for your locally manufactured modules. A stable FiT regime translates directly into reliable demand for your products.

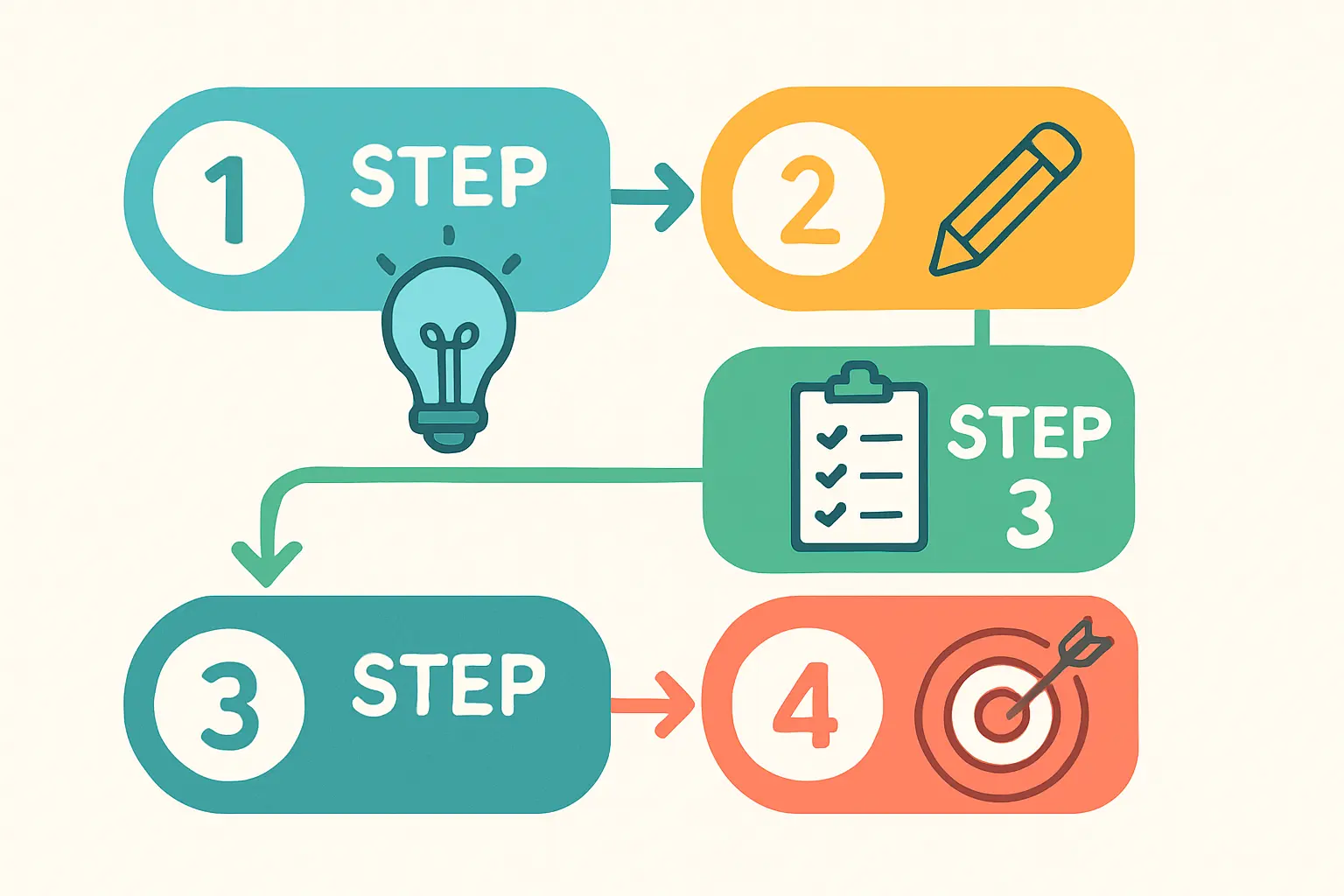

A Step-by-Step Guide to the Application Process

Navigating the bureaucracy is often the most challenging part for entrepreneurs. The following four-step process provides a clear roadmap.

Step 1: Preliminary Assessment and Eligibility Check

Before drafting any documents, confirm your project’s eligibility by reviewing the latest version of the Law on Renewable Energy and any recent decrees from the Ministry of Energy. We also advise scheduling a preliminary, informal meeting with a representative from the MOE to introduce your project and understand their current priorities.

Step 2: Assembling the Application Dossier

This is the most critical phase. Your submission must be professional, comprehensive, and convincing. While specific requirements may vary, a standard dossier includes:

-

Official Application Form: Obtained from the Ministry of Energy.

-

Detailed Business Plan: This must include a market analysis, technical specifications of your proposed factory, a list of [internal link: essential machines for a solar panel production line], and multi-year financial projections.

-

Company Registration Documents: Proof of your legal entity in Mongolia.

-

Proof of Financial Capability: Evidence that you have the necessary capital or financing commitments to execute the project.

-

Technical Partnership Details: If you are working with an external consultant or technology provider, like J.v.G. Technology GmbH, including this information can strengthen your application by demonstrating technical competence.

Step 3: Formal Submission and Initial Review

Submit the complete dossier to the Ministry of Energy. The ministry will then conduct an initial review to ensure all required documents are present. If the package is incomplete, it will likely be returned, causing significant delays.

Step 4: The Technical and Financial Review

Once the submission is accepted, it undergoes a detailed review by a committee of experts. They will assess the project’s:

-

Technical Viability: Is the proposed technology reliable and suitable for Mongolia’s climate?

-

Financial Soundness: Are the revenue and cost projections realistic?

-

Economic Benefit: How many local jobs will be created? Does the project contribute to energy independence?

This stage can take several months and may involve requests for additional information. A positive outcome results in an official agreement outlining the specific incentives granted to your project.

Common Challenges and How to Prepare

From consulting with numerous entrepreneurs entering the solar sector, several common pitfalls emerge:

-

Incomplete Documentation: A common reason for rejection or delay is an incomplete application. Use a checklist to ensure every required document is included and correctly formatted.

-

Unrealistic Projections: Overly optimistic financial forecasts can damage credibility. Projections should be based on conservative market assumptions and benchmarked against industry data.

-

Ignoring Local Context: A proposal that works in Europe may not be suitable for Mongolia. Your plan should address local challenges, such as logistical complexities and the need for a resilient supply chain. This is where demonstrating [internal link: localization awareness in your factory planning] is key.

Frequently Asked Questions (FAQ)

-

Are these incentives available to foreign investors?

Yes, Mongolia’s legal framework is designed to encourage foreign direct investment. Foreign-owned or joint-venture companies are generally eligible for the same incentives as domestic ones, provided they are legally registered in Mongolia. -

How long does the entire application and approval process take?

Assuming a complete and well-prepared application, the process typically takes 6 to 12 months from formal submission to final approval. Delays are common, so be sure to factor this timeline into your project plan. -

Do I need a local partner to succeed?

While not legally required, having a reputable local partner offers a significant advantage. They can provide invaluable assistance in navigating the administrative process, understanding the business culture, and building relationships with government stakeholders. -

What is the difference between a tax credit and a tax exemption?

A tax exemption means you are not required to pay a specific tax in the first place (e.g., VAT on imported goods). A tax credit is a dollar-for-dollar reduction of the income tax you owe. The incentives in Mongolia primarily focus on exemptions and multi-year tax holidays.

The Path Forward

Securing government incentives is a critical step in de-risking your investment and establishing a competitive solar module factory in Mongolia. The process requires diligence, professionalism, and a thorough understanding of the government’s objectives. By following a structured approach and preparing a comprehensive application, you can significantly increase your chances of success.

For those in the early stages of this journey, the logical next step is to understand the fundamentals of setting up a manufacturing facility. Our comprehensive overview of [internal link: how to start a solar module factory] provides the broader context needed to build a compelling case for your project.