The United Arab Emirates (UAE) is rapidly becoming a global powerhouse for renewable energy, with ambitious plans to adopt clean energy and establish itself as a significant hub for solar technology manufacturing.

For entrepreneurs, established companies, and investors looking to capitalize on this green revolution, understanding the landscape of government support is crucial. Government incentives are pivotal for de-risking investments, enhancing financial viability, and accelerating the establishment of local solar panel production lines.

This guide provides a detailed roadmap for understanding and accessing the diverse range of UAE government incentives designed to foster solar panel manufacturing. Whether you’re in the initial stages of exploring opportunities or developing a detailed business plan, this information will be invaluable.

Table of Contents

Why Invest in UAE Solar Manufacturing? The Big Picture

Solar Manufacturing Success: A Comprehensive Guide to UAE Government Incentives” class=”wp-image-33613″ srcset=”https://www.pvknowhow.com/wp-content/uploads/2025/06/Unlocking-Solar-Manufacturing-Success-A-Comprehensive-Guide-to-UAE-Government-Incentives-3.webp 1536w, https://www.pvknowhow.com/wp-content/uploads/2025/06/Unlocking-Solar-Manufacturing-Success-A-Comprehensive-Guide-to-UAE-Government-Incentives-3-500×333.webp 500w, https://www.pvknowhow.com/wp-content/uploads/2025/06/Unlocking-Solar-Manufacturing-Success-A-Comprehensive-Guide-to-UAE-Government-Incentives-3-1024×683.webp 1024w, https://www.pvknowhow.com/wp-content/uploads/2025/06/Unlocking-Solar-Manufacturing-Success-A-Comprehensive-Guide-to-UAE-Government-Incentives-3-768×512.webp 768w, https://www.pvknowhow.com/wp-content/uploads/2025/06/Unlocking-Solar-Manufacturing-Success-A-Comprehensive-Guide-to-UAE-Government-Incentives-3-600×400.webp 600w” sizes=”auto, (max-width: 1536px) 100vw, 1536px” />

Solar Manufacturing Success: A Comprehensive Guide to UAE Government Incentives” class=”wp-image-33613″ srcset=”https://www.pvknowhow.com/wp-content/uploads/2025/06/Unlocking-Solar-Manufacturing-Success-A-Comprehensive-Guide-to-UAE-Government-Incentives-3.webp 1536w, https://www.pvknowhow.com/wp-content/uploads/2025/06/Unlocking-Solar-Manufacturing-Success-A-Comprehensive-Guide-to-UAE-Government-Incentives-3-500×333.webp 500w, https://www.pvknowhow.com/wp-content/uploads/2025/06/Unlocking-Solar-Manufacturing-Success-A-Comprehensive-Guide-to-UAE-Government-Incentives-3-1024×683.webp 1024w, https://www.pvknowhow.com/wp-content/uploads/2025/06/Unlocking-Solar-Manufacturing-Success-A-Comprehensive-Guide-to-UAE-Government-Incentives-3-768×512.webp 768w, https://www.pvknowhow.com/wp-content/uploads/2025/06/Unlocking-Solar-Manufacturing-Success-A-Comprehensive-Guide-to-UAE-Government-Incentives-3-600×400.webp 600w” sizes=”auto, (max-width: 1536px) 100vw, 1536px” />The UAE’s unwavering commitment to a sustainable future creates fertile ground for solar manufacturing investments. Several factors converge, making the nation an attractive destination:

- National Renewable Energy Goals: The UAE’s Energy Strategy 2050 aims for 50% of its energy mix to come from clean sources. Furthermore, the UAE Net Zero by 2050 strategic initiative underscores the long-term commitment to decarbonization. These goals require substantial growth in solar energy capacity, driving demand for locally manufactured components. Significant investments, estimated between USD 45-54 billion, are planned by 2030 to triple the share of renewable energy.

- Rapidly Growing Demand: The UAE’s solar energy market is expanding rapidly. Valued at 11.0 TWh in 2024, it is projected to reach 73.5 TWh by 2033, reflecting a compound annual growth rate (CAGR) of 22.33%. Installed solar capacity is also set to soar from 7.90 GW in 2024 to an anticipated 36.06 GW by 2029 (CAGR 35.48%). This surge is exemplified by mega-projects like the Mohammed bin Rashid Al Maktoum Solar Park and the Al Dhafra Solar PV plant.

- Strategic Location and Logistics: Situated at the crossroads of global trade, the UAE offers unparalleled logistical advantages, with world-class ports, airports, and infrastructure that facilitate both the import of raw materials and the export of finished solar modules to regional and international markets.

- “Tariff Haven” Status: For manufacturers eyeing export markets, particularly the United States, the MENA region, including the UAE, presents a significant advantage. It’s considered a “tariff haven” with a relatively low basic tariff (around 10%) on modules exported to the US, compared to much higher duties imposed on products from other regions. This can provide a substantial competitive edge.

- Falling Cost of Solar: The cost of solar energy in the UAE has dramatically decreased, reaching as low as 1.69 cents/kWh in 2024, down from 11 cents/kWh a decade ago. This makes solar power increasingly competitive and boosts its adoption.

Unlock your solar potential!

Visit our Premium Course or explore our services. Together, we’ll make your solar journey smooth and successful.

Federal Level Incentives & Support Programs

The UAE federal government offers a framework of incentives and support mechanisms designed to attract and cultivate investment in the solar manufacturing sector.

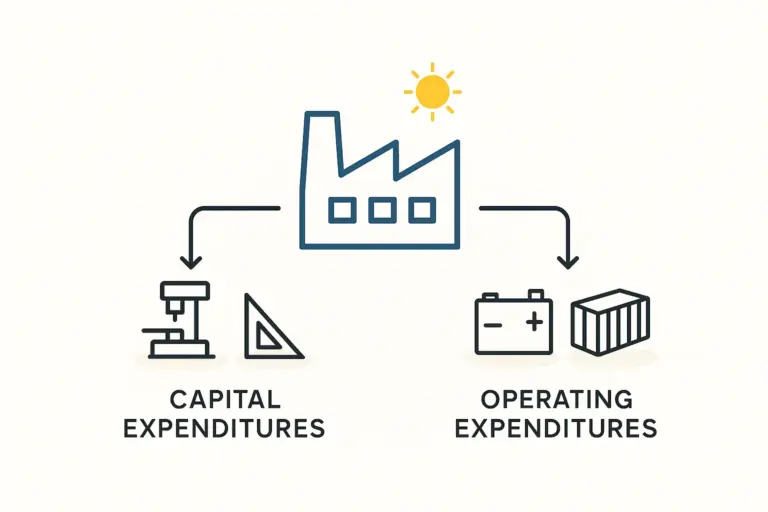

Financial Incentives

- Tax Exemptions and Rebates: While the UAE introduced a federal corporate tax, the regime includes provisions and potential exemptions that can benefit strategic sectors like renewable energy manufacturing. Notably, equipment and materials for solar power generation can be eligible for tax and duty-free advantages within the first ten years of certification. Furthermore, a zero-rated Value Added Tax (VAT) often applies to the supply of solar power generation equipment and materials, reducing the cost burden for manufacturers. Specific tax rebates may also be available, subject to guidelines from the Ministry of Finance.

- Customs Duty Waivers: To lower the initial capital expenditure for setting up manufacturing facilities, customs duty exemptions are often available for imported machinery, equipment, and raw materials essential for solar panel production.

- Potential for Production-Linked Incentives (PLIs): Globally, PLI schemes are becoming a popular tool to boost domestic manufacturing. While specific PLI schemes exclusively for solar manufacturing in the UAE are evolving, the government’s proactive stance on industrial development suggests a supportive environment for such initiatives. Investors should monitor announcements from relevant ministries for potential future programs.

- Grants and Subsidized Funding: Various federal entities may offer grants or subsidized funding for projects aligned with national strategic objectives, including renewable energy manufacturing.

Financing Support

- Emirates Development Bank (EDB): The EDB is a key player in financing industrial projects that contribute to economic diversification and sustainability. A key initiative is the AED 100 million Solar Energy Finance Program, specifically designed to support businesses, including mSMEs, in solar energy projects. This program can offer attractive terms, such as loans with up to an 8-year tenor, up to 100% loan-to-value (LTV) ratio, and grace periods of up to six months. The EDB also offers various other financing solutions applicable to solar manufacturers.

- Other National Financial Institutions: Several other national banks and financial institutions are increasingly aligning their lending portfolios with the UAE’s green agenda, potentially offering favorable financing terms for solar manufacturing ventures.

Non-Financial Support

- Support for R&D and Technology Adoption: The UAE government encourages innovation and the adoption of advanced technologies. Support may be available through research grants, partnerships with universities and research institutions, and initiatives promoting technology transfer.

- Streamlined Regulatory and Licensing Processes: The government is continuously simplifying business setup, licensing, and approval processes, reducing bureaucratic hurdles for investors.

Emirate-Level Incentives: Tailored Opportunities

Beyond federal support, individual emirates offer their own incentives and support programs, often tailored to their specific economic development plans and industrial strengths.

Abu Dhabi

- Key Entities: The Abu Dhabi Department of Energy (DoE) and industrial zones like Khalifa Industrial Zone Abu Dhabi (KIZAD) are pivotal in driving the emirate’s renewable energy manufacturing ambitions.

- Incentives: Investors may find attractive land lease rates, benefits on utility connections and tariffs in designated industrial zones, and support for infrastructure development.

- Masdar: Masdar, Abu Dhabi’s renewable energy company, often plays a role in fostering the clean energy ecosystem, which can create collaborative opportunities for manufacturers.

Dubai

- Key Entities: The Dubai Electricity and Water Authority (DEWA), Dubai Industrial City, and Jebel Ali Free Zone (JAFZA) are central to Dubai’s solar strategy.

- Incentives: Dubai offers excellent infrastructure in its industrial parks. While programs like Shams Dubai (promoting rooftop solar installation) and Net Metering policies primarily target solar adoption, they significantly boost local demand. This makes it easier for projects to source and buy solar panels in Dubai from local producers, creating a sustainable market for manufacturers.

- Dubai Industrial City and JAFZA offer specific advantages related to industrial land, warehousing, and logistics.

Sharjah & Northern Emirates

- Key Entities: The Sharjah Electricity, Water and Gas Authority (SEWA) and free zones such as Sharjah Airport International Free Zone (SAIF Zone) and Hamriyah Free Zone Authority (HFZA) are active in promoting industrial growth.

- Incentives: These emirates provide competitive setup costs, access to skilled labor, and strategic locations, along with various incentives offered through their respective free zones and industrial areas.

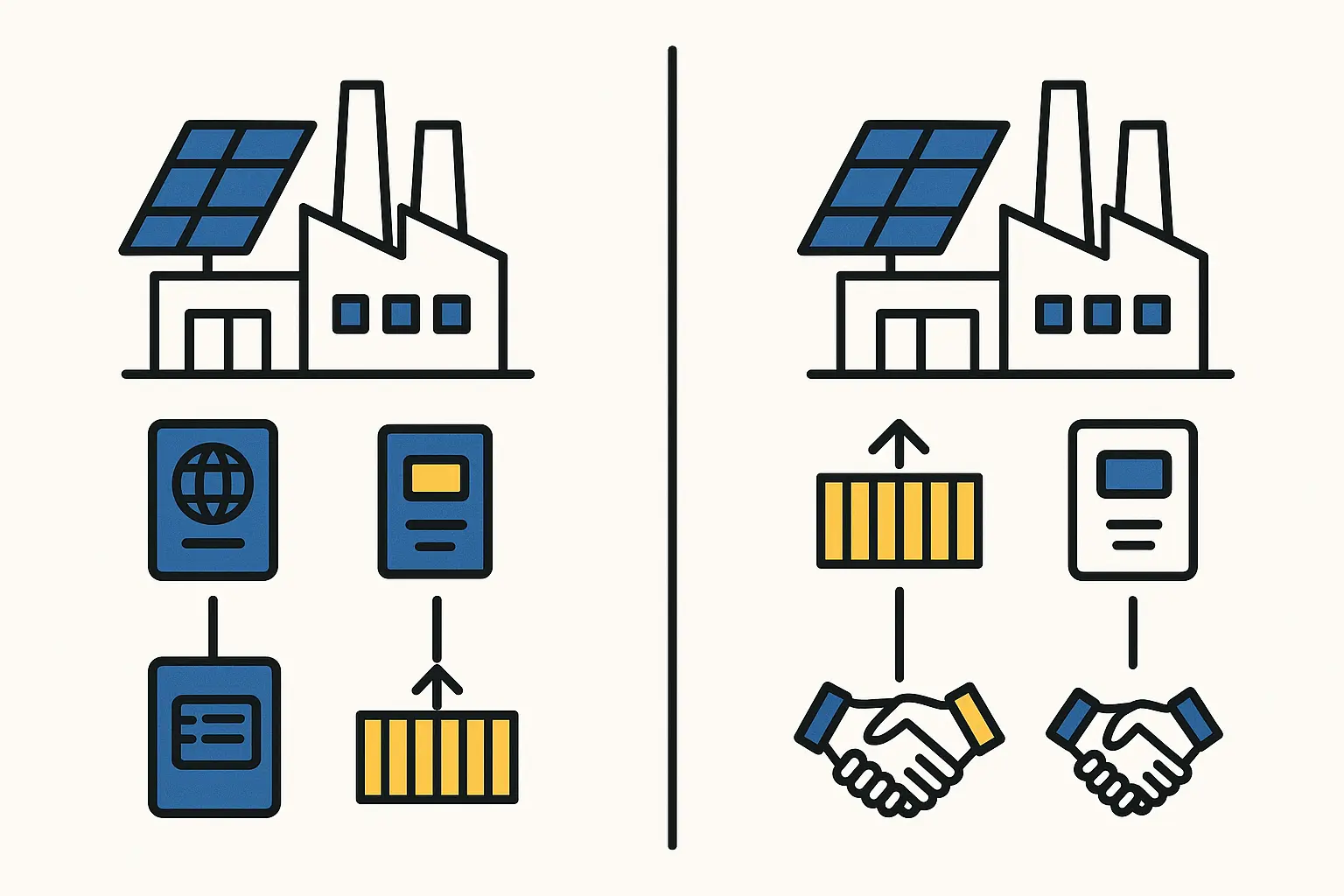

Special Economic Zones (SEZs) & Free Zones: The Manufacturer’s Edge

The UAE’s numerous Special Economic Zones (SEZs) and Free Zones are a cornerstone of its business-friendly environment and offer substantial advantages for solar manufacturers.

- Key Benefits:

- 100% foreign ownership.

- Full repatriation of profits and capital.

- Exemption from corporate taxes (often for extended periods, subject to zone regulations).

- Exemption from import and export duties.

- Access to world-class infrastructure and logistics.

- Streamlined administrative and legal procedures.

- Key SEZs/Free Zones for Solar Manufacturing:

- KIZAD (Abu Dhabi): Offers large industrial plots, excellent connectivity, and an environment conducive to heavy manufacturing.

- Dubai Industrial City (DIC): A dedicated industrial hub with specialized zones and infrastructure for manufacturing.

- Jebel Ali Free Zone (JAFZA – Dubai): One of the world’s largest free zones, offering exceptional logistics and access to Jebel Ali Port.

- SAIF Zone & Hamriyah Free Zone (Sharjah): Provide cost-effective solutions and strategic locations.

These zones often provide “one-stop-shop” services, simplifying processes like licensing and company formation, making the entire business setup efficient for foreign investors.

Navigating the Application Process: A Practical Guide

Accessing government incentives requires a clear understanding of the application procedures. While specifics vary by program and emirate, here’s a general approach:

- Thorough Research: Identify the most relevant incentives for your specific manufacturing project based on scale, technology, and location.

- Eligibility Check: Carefully review the eligibility criteria for each targeted program.

- Business Plan Preparation: A comprehensive business plan is essential. This should include detailed financial projections, market analysis, technology overview, job creation estimates, and an explanation of how the project aligns with the UAE’s strategic goals.

- Documentation: Prepare all necessary documentation, which typically includes company registration documents, financial statements, project proposals, technical specifications, and land/facility plans.

- Identify Key Authorities: Determine the specific government departments, agencies, or free zone authorities responsible for administering the incentives.

- Initial Consultation: An initial consultation with the relevant authorities is often advisable to understand the nuances of the application process and ensure your proposal aligns with their objectives.

- Formal Application: Submit the formal application along with all supporting documents.

- Follow-Up: Maintain communication with the authorities and be prepared to provide additional information or clarifications if requested.

- Local Partnerships and Consultancy: Engaging with local business consultants or legal advisors with experience in the UAE market can be highly beneficial for navigating the regulatory landscape and application processes. PVknowhow.com, for instance, offers extensive experience in business planning and technical consulting for solar factory setups.

Understanding Eligibility Criteria

Eligibility for incentives depends on several factors, including:

- Business Registration: Proper legal registration of the business entity in the UAE.

- Investment Size: Minimum investment thresholds may apply for certain programs.

- Technology Type: Emphasis may be placed on advanced, efficient, or innovative solar technologies.

- Job Creation Potential: The number of local jobs the project is expected to create.

- Local Content Contribution: The extent to which the project will use local resources and services, and potentially contribute to developing a local supply chain. This is increasingly important with the implementation of Local Content Requirements (LCRs).

- Export Potential: For some incentives, the project’s capacity to export and contribute to the UAE’s trade balance might be a factor.

- Sustainability and Environmental Standards: Adherence to environmental regulations and contribution to sustainability goals.

Challenges and Considerations

While the UAE offers a highly attractive environment, investors should also be aware of certain considerations:

- Local Content Requirements (LCRs): The UAE is implementing LCRs to boost domestic value addition. Manufacturers need to understand these requirements and plan their sourcing and operations accordingly.

- Skilled Labor and Raw Materials: While the UAE has a diverse workforce, securing highly specialized technical skills for solar manufacturing might require targeted recruitment and training programs. Similarly, establishing reliable supply chains for specific raw materials is a key planning aspect, although the UAE’s excellent logistics help mitigate this.

- Navigating Regulatory Updates: The regulatory landscape is dynamic and progressive. Staying updated on the latest policies and incentive programs is crucial.

The Future of Solar Manufacturing in the UAE

The outlook for solar manufacturing in the UAE is exceptionally bright. The government’s steadfast commitment to its renewable energy targets, coupled with ongoing investments in infrastructure and a pro-business environment, signals continued support for the sector. Projections indicate that MENA’s solar module manufacturing capacity, with the UAE playing a leading role, could exceed 3 GW by the end of 2024 and is on a trajectory to reach an impressive 44 GW by 2029. The region is even forecasted to achieve self-sufficiency in module production by 2026.

Significant international interest, including partnerships with leading Chinese solar technology firms (expected to account for over 85% of MENA’s solar module manufacturing capacity by 2028), further validates the UAE’s position as a burgeoning manufacturing hub. For investors and entrepreneurs, this translates into substantial opportunities for growth and contribution to a cleaner energy future.

Conclusion

The UAE government has laid out a compelling array of incentives and support mechanisms to encourage investment in solar panel manufacturing. From federal tax benefits and customs waivers to tailored emirate-level programs and the strategic advantages of Free Zones, the ecosystem is designed to foster success. By understanding these opportunities and strategically navigating the application processes, businesses can significantly enhance the viability and profitability of their solar manufacturing ventures in the UAE.

The journey from concept to an operational solar factory requires meticulous planning and expert guidance. We encourage you to conduct further in-depth research and engage with the relevant UAE authorities and experienced partners like PVknowhow.com to explore how these incentives can unlock your project’s full potential. The UAE is not just investing in solar energy; it’s investing in becoming a global leader in its production, and the opportunities for forward-thinking manufacturers are immense.

Frequently Asked Questions (FAQs)

What are the primary goals of UAE’s solar manufacturing incentives?

The primary goals include diversifying the UAE’s economy, achieving its ambitious renewable energy targets (like the UAE Energy Strategy 2050), creating skilled jobs, fostering technological innovation, reducing reliance on imported solar panels, and positioning the UAE as a regional and global hub for solar technology manufacturing and export.

Are these incentives only for large corporations?

No, many incentives are designed to support a range of businesses, including Small and Medium-sized Enterprises (SMEs). For instance, the Emirates Development Bank (EDB) has specific financing programs, like the AED 100 million Solar Energy Finance Program, aimed at supporting mSMEs in the solar energy sector, including manufacturing.

How do Free Zones in the UAE specifically support solar manufacturing?

Free Zones offer a suite of benefits crucial for manufacturing, such as 100% foreign ownership, exemption from corporate and income taxes (often for extended periods), exemption from import/export duties on raw materials and equipment, state-of-the-art infrastructure, streamlined customs procedures, and easier recruitment of international talent. Zones like KIZAD and Dubai Industrial City are particularly well-suited for industrial and manufacturing activities.

What kind of tax benefits can solar manufacturers expect in the UAE?

Solar manufacturers can potentially benefit from corporate tax exemptions or preferential rates (especially within Free Zones), zero-rated VAT on the supply of solar power generation equipment and materials, and customs duty exemptions on imported machinery and raw materials necessary for production, particularly within the first ten years of certification. Specifics can vary, so consulting with tax advisors is recommended.

Where can I find the most up-to-date information on these incentives?

The most current information can typically be found on the official websites of relevant federal ministries (e.g., Ministry of Economy, Ministry of Industry and Advanced Technology, Ministry of Finance), the Emirates Development Bank (EDB), specific emirate-level economic development departments (e.g., Abu Dhabi Department of Economic Development, Dubai Economy and Tourism), and the authorities managing major Free Zones (e.g., KIZAD, JAFZA, Dubai Industrial City). Engaging with specialized consultants can also provide consolidated and current insights.